Reporting of GST in Tax Audit

Reporting of GST in Tax Audit

The time period of the filing of the income tax return is near. So, the tax audit is also be done in this time period. While doing the Tax Audit, we require to fill the information regarding the GST. So, following are the notes regarding the reporting of GST in Tax Audit.

Questions asked

Whether the assessee is liable to pay indirect tax like excise duty, service tax, sales tax, customs duty, etc. if yes, please furnish the registration number or any other identification number allotted for the same.

What to Report

- State wise GSTIN, even ISD GSTIN

- Registration Numbers of past applicable laws

Tax Auditor is not however expected to venture into an investigation as to whether an assessee was required to obtain GST registration in some State or not. As an auditor under the Income Tax, he is only required to report the facts

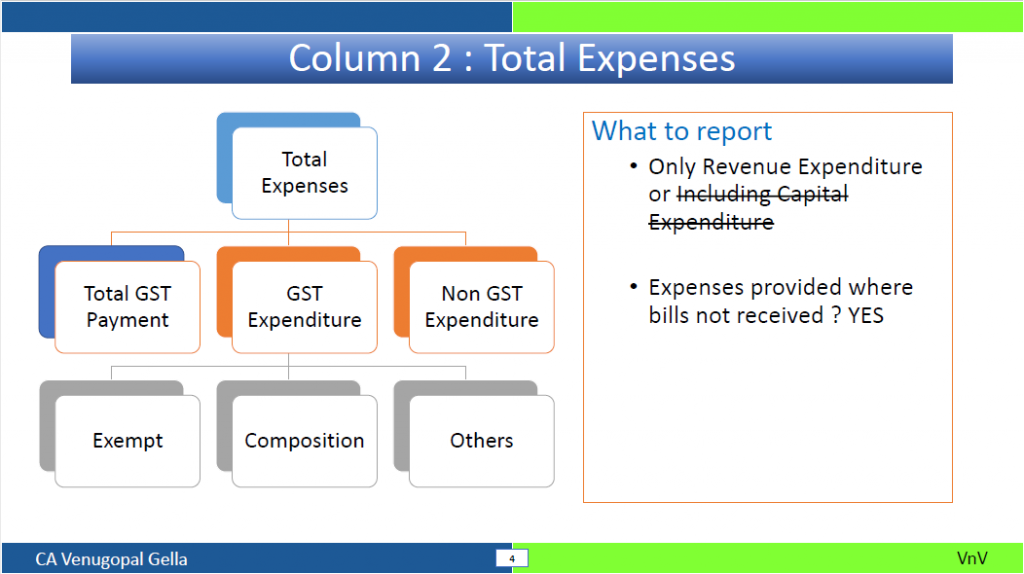

Clause 44: Expenditure Breakup

Break-up of the total expenditure of entities registered or not registered under the GST:

| Sl. No. | Total amount of expenditure incurred during the year | Expenditure in respect of entities registered under GST | Expenditure to entities not registered under GST | |||

| Relating to goods or services exempt from GST | Relating to entities falling under Composition Scheme | Relating to other registered entities | Total Payment to registered entities | |||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) |

Download the full ppt on Reporting of GST in Tax Audit by Clicking the below image:

Points to Note

1. Period of Reporting

• 9 months Data(on or after 01.07.2017) of GST Period of , entities registered or not registered under the GST

2. Line Item Expense Wise or Consolidated Amount

• One Total Value

3. Does Comparison with 3B / 2A required?

• Not required for reconciliation

4. Does Expense not reported in 3B (Salary ,Depreciation, Provision etc) should it be also reported?

• Yes, To be added to column 7

5. Details of total expenditure incurred with entities registered or not registered under the GST on or after 01.07.2017

6. Total amount of Expenditure during the year means :

Aggregate of expenditure reported at items 6, 8 to 35, 37 & 38 of Part-A-P&L

Exceptions / NON Reporting

7. Duties and taxes, paid or payable, in respect of goods and services purchased

36. Rates and taxes, paid or payable to Government or any local body

39. Bad Debts

40. Provision for bad and doubtful debts

41. Other provisions

43. Interest

44. Depreciation and amortization

46. Provision for current tax

Validations

Column2 would be compared :

- 9 months aggregate of expenditure reported at items 6, 8 to 35, 37 & 38 of Part-A-P&L / P&L – Ind AS)

- Though not 100% matching check for reasonability

% of Non GST Purchases

- GST _ Not Registered Entities / Total Amount

Totals Validation

- Amongst the Column Totals there is NO validation

- Data cannot be NULL

If you already have a premium membership, Sign In.

CA Venu Gopal Gella

CA Venu Gopal Gella

Keep learning

Banglore, India

GST