GST & Accounting Entries in GST ERA

GST & Accounting Entries in GST ERA – ALSO ITS EFFECT ON GSTR 3B RETURN

Let’s understand this with the help of Example. In the given Example Mr. x has the following transaction of Sale, Purchase, & some expenses like Repairs & Advocate Fees.

| Question. Mr. X has following transactions in Month of March 18. Please pass Accounting entries & show its effect on GSTR 3b. Please show all Accounting entries in his books of account. | ||||||||

| Accouting entry No | sales to | BASIC | CGST | SGST | IGST | TOTAL | ||

| sales | 1 | MR. A | ₹ 3,000 | ₹ 270 | ₹ 270 | ₹ 3,540 | ||

| 2 transactions in March | 2 | MR. B | ₹ 2,000 | ₹ 360 | ₹ 2,360 | |||

| Purchase from | BASIC | CGST | SGST | IGST | TOTAL | |||

| Purchase | 3 | MR. C | ₹ 1,700 | ₹ 306 | ₹ 2,006 | |||

| 2 Transactions in March | 4 | MR. D | ₹ 1,600 | ₹ 144 | ₹ 144 | ₹ 1,888 | ||

| Frieght paid | paid to | BASIC | CGST | SGST | IGST | TOTAL | ||

| 1 Transaction in March | 6 | MR. E | ₹ 500 | ₹ 500 | ||||

| PAY RCM @ 5% | ||||||||

| Advocate Fees | Paid to | BASIC | CGST | SGST | IGST | TOTAL | ||

| 1 Transaction in March | 7 | MR. F | ₹ 100 | ₹ 100 | ||||

| PAY RCM @18% | ||||||||

| Expensses with GST lavied | paid to | BASIC | CGST | SGST | IGST | TOTAL | ||

| For E.g Repair Exp. | 8 | MR. G | ₹ 600 | ₹ 54 | ₹ 54 | ₹ 708 | ||

| ( Party is registered ) | ||||||||

| Expensses without GST | Paid to | BASIC | CGST | SGST | IGST | TOTAL | ||

| For E.g Repair exp | 9 | MR. H | ₹ 400 | NA | NA | NA | ₹ 400 | |

| ( party is not registerd) | ||||||||

ACCOUNTING ENTRIES in Books of Mr. X

| Accouting Entry for Sales to Mr.A | 1. | Mr. A | Dr. | 3540 | |||

| to sales a/c | 3000 | ||||||

| to CGST payable | 270 | ||||||

| to SGST payable | 270 | ||||||

| Accounting Entry for Sales to Mr. B | 2. | Mr. B Dr. | 2360 | ||||

| to sales a/c | 2000 | ||||||

| to IGST payable | 360 | ||||||

| Accouting Entry for Purchase made from Mr. C | 3. | Purchase A/c | dr. | 1700 | |||

| IGST receivable | dr. | 306 | |||||

| to Mr. C | 2006 | ||||||

| Accouting Entry for Purchases Made from Mr. D | 4. | Purchase A/c | Dr. | 1600 | |||

| CGST receivable | dr. | 144 | |||||

| SGST receivable | dr. | 144 | |||||

| to Mr. D | 1888 | ||||||

| Frieght paid to Mr.E | 5. | Frieght exp. Dr. | 500 | ||||

| to Mr. E | 500 | ||||||

| RCM on Freight need to be discharged by Mr. x in Cash/ Bank |

RCM – CGST dr. | 12.5 | |||||

| RCM – SGST dr. | 12.5 | ||||||

| to Cash/ Bank | 25 | ||||||

| (payment of RCM) |

| Advocate Fees paid to Mr. F | 6. | Adv. Fee. Dr. | 100 | ||||

| to Mr. F | 100 | ||||||

| RCM on Advocate fees need to be discharged by Mr. x in Cash/ Bank |

RCM – CGST dr. | 9 | |||||

| RCM – SGST dr. | 9 | ||||||

| to Cash/ Bank | 18 | ||||||

| (payment of RCM) |

| Accounting Entry for Repair exp. Since invoice from Mr. G is GST levied. So we have taken ITC. |

7. Repair Exp. Dr. | 600 | |||||

| CGST receivable dr. | 54 | ||||||

| SGST receivable dr. | 54 | ||||||

| to Mr. G | 708 | ||||||

| Repair exp paid to Mr. H . Since Mr. H is unregistered so He has not levied GST | 8. Repair exp. Dr. | 400 | |||||

| to Mr. H | 400 | ||||||

| Final payment of CGST & SGST & IGST | 9 FINAL ADJUSTMENT | ||||||

| SGST payable dr. | 270 | ||||||

| to SGST receivable | 198 | ||||||

| to Cash/ Bank | 72 | ||||||

| IGST payable dr. | 360 | ||||||

| to IGST receivable | 306 | ||||||

| to Cash/ Bank | 54 | ||||||

| CGST payable dr. | 270 | ||||||

| to CGST receivable | 198 | ||||||

| to Cash/ Bank | 72 | ||||||

RCM CGST A/C & RCM SGST A/C WILL HAVE DEBIT BALANCE ON ASSET SIDE. This will be Cash/ Bank Balance & it will be available to use against outward liability of next month.

CA HARSHIL SHETH | H A SHETH & ASSOCIATES | 9879831157 | CA.HARSHILSHETH@GMAIL.COM

FORM GSTR – 3B

Let’s find out how GSTR 3b of March for Mr. X will look like

| Year | 2018 | MONTH | MARCH | |||

3.1 DETAILS OF OUTWARD SUPPLIES AND INWARD SUPPLIES LIABLE TO REVERSE CHARGE

| NATURE OF SUPPLIES | TOTAL TAXABLE VALUE |

INTEGRATED TAX | CENTRALTAX | STATE/UT TAX | CESS | |||||||

| 1 | 2 | 3 | 4 | 5 | 6 | |||||||

| (A) OUTW ARD TAXABLE SUPPLIES (OTHER THAN ZERO RATED , NIL RATED AND EXEMPTED) |

5000.00 | 360.00 | 270.00 | 270.00 | ||||||||

| (B) OUTW ARDTAXABLE SUPPLIES (ZERO RATED) | ||||||||||||

| (C) OTHER OUTW ARD SUPPLIES (NIL RATED,EXEMPTED) | ||||||||||||

| (D) INW ARD SUPPLIES(LIABLE TO REVERSE CHARGE) | 600.00 | 21.50 | 21.50 | |||||||||

| (E) NON-GST OUTW ARD SUPPLIES | ||||||||||||

4. ELIGIBLE ITC

| DETAILS | INTEGRATED TAX | CENTRAL TAX | STATE/UT TAX | CESS | ||||

| 1 | 2 | 3 | 4 | 5 | ||||

| (A) ITC AVAILABLE (WHETHER IN FULL OR PART) | ||||||||

| (1) IMPORT OF GOODS | ||||||||

| (2) IMPORT OF SERVICES | ||||||||

| (3) INW ARD SUPPLIES LIABLE TO REVERSE CHARGE(OTHER THAN 1 & 2 ABOVE) |

21.50 | 21.50 | ||||||

| (4) INW ARD SUPPLIES FROM ISD | ||||||||

| (5) ALL OTHER ITC | 306.00 | 198.00 | 198.00 | |||||

| (B) ITC REVERSED | ||||||||

| (1) AS PER RULE 42 &43 OF CGST RULE | ||||||||

| (2) OTHERS | ||||||||

| (C) NET ITC AVAILABLE (A) – (B) | 306.00 | 219.50 | 219.50 | |||||

| (D) INELIGIBLE ITC | ||||||||

| (1) AS PER SECTION 17(5) | ||||||||

| (2) OTHERS | ||||||||

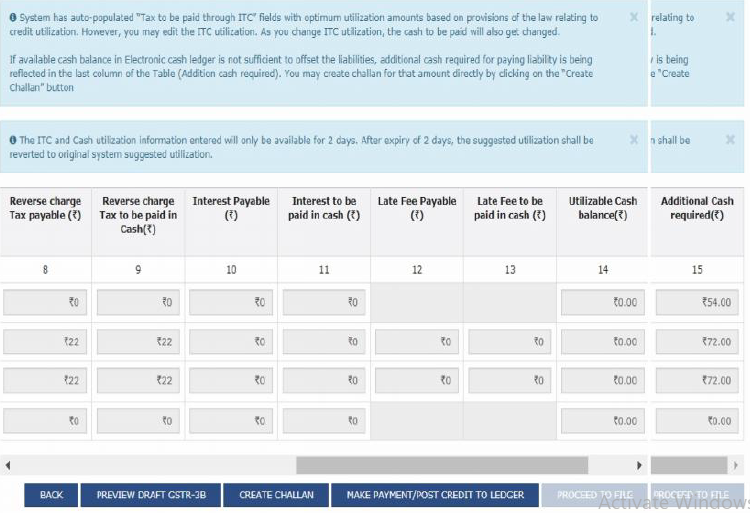

Please check net payable is

IGST Rs. 54

CGST Rs. 72

SGST Rs. 72

And same accounting entries we have passed.