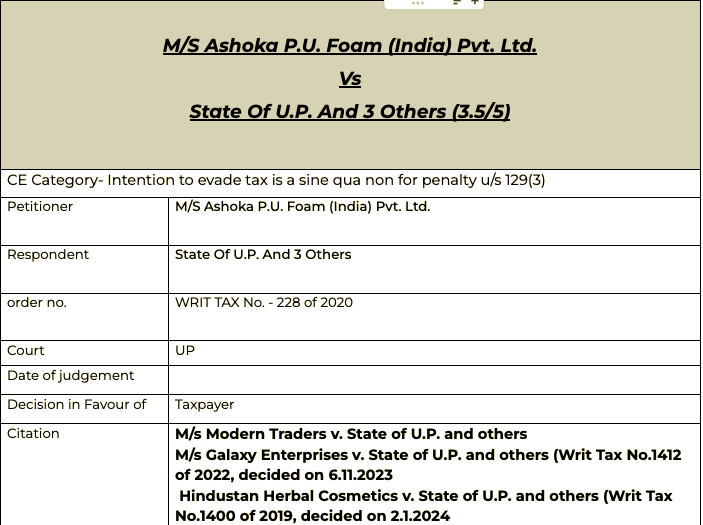

Intention to evade tax is a sine quo non for penalty u/s 129(3)- HC

Intention to evade tax is essential for penalty

The most litigated issue. Good are moving and are held by the authorities. In many cases the court has put an emphasis that intention to evade tax is important. Penalty cant be levied merely on a clerical error. But still on the ground vehicle are detained for small issues.

let have a look at this important decision of honourable UP HC.

Citations-

M/s Modern Traders v. State of U.P. and others

M/s Galaxy Enterprises v. State of U.P. and others (Writ Tax No.1412 of 2022, decided on 6.11.2023

Hindustan Herbal Cosmetics v. State of U.P. and others (Writ Tax No.1400 of 2019, decided on 2.1.2024

Pleading

This is a writ petition under Article 226 of the Constitution of India wherein the petitioner is aggrieved by the penalty order dated September 13, 2018 passed by the respondent No.4/Assistant Commissioner, State Goods and Services Tax, Agra and the order dated October 3, 2019 passed in appeal by the respondent No.3/Additional Commissioner Grade-2 (Appeal)-III, State Goods and Services Tax, Agra.

Facts

The petitioner had explained that the date on which the breakdown had taken place, there was Bharat Band and due to the same, the driver of the vehicle could not update the e-way bill. The factual position is that the goods were accompanied by invoice and e-way bill

reflecting earlier vehicle number. Furthermore, it is to be noted that the revised eway bill was produced before the authorities prior to the passing of the seizure order.

The appellate authority, while passing the order in appeal, has made categorical finding that even if the documents are accompanied with the goods but there is a technical error, the same would amount to violation of provisions of Section 129 the Uttar Pradesh Goods and Services Tax Act, 2017 read with Rule 138 of the Uttar Pradesh Goods and Service Tax Rules, 2017, even though there is no intention to evade tax

Observation

In a catena of judgments, this Court has held that presence of mens rea for evasion of tax is a sine qua non for imposition of penalty and mere technical error would not lead to imposition of penalty [see M/s Modern Traders v. State of U.P. and others (Writ Tax No.763 of 2018, decided on 9.5.2018), M/s Galaxy Enterprises v. State of U.P. and others (Writ Tax No.1412 of 2022, decided on 6.11.2023 and Hindustan Herbal Cosmetics v. State of U.P. and others (Writ Tax No.1400 of 2019, decided on 2.1.2024]

The imposition of penalties within the realm of tax laws should not be based solely on insignificant technical errors devoid of any financial consequences. The foundational principle guiding this approach is the commitment to maintain a tax system that is characterized by fairness and justice, where the severity of penalties corresponds to the gravity of the offense committed. While penalties serve a pivotal role in ensuring compliance with tax laws, legal frameworks stress the importance of establishing the actual intent to evade taxes as a prerequisite for their just imposition.

In light of the above, I am of the view that the orders impugned in this writ petition are not sustainable in law wherein the authorities have exceeded their jurisdiction and have not acted in accordance with the provisions of the statutes. Accordingly, the order September 13, 2018 and October 3, 2019 are quashed and set-aside. The amount deposited by the petitioner be refunded within a period of four weeks from date. Other consequential reliefs to follow.

Read and download the copy of judgment-

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.