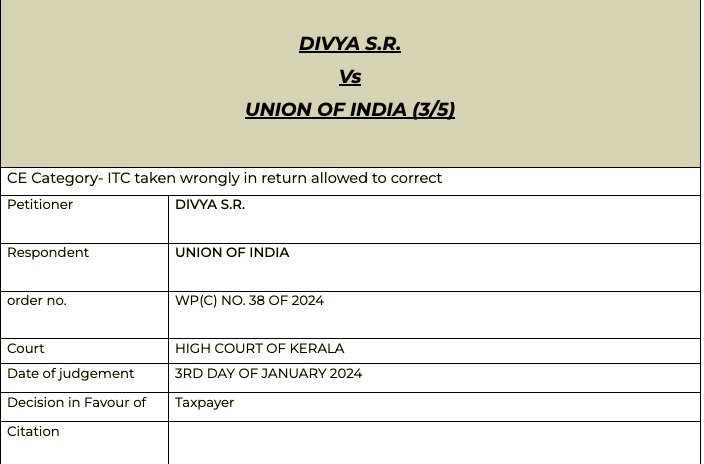

ITC taken in wrong hear in 3b, Court allowed to correct even for 2017-18

Table of Contents

ITC taken in wrong head allowed by the court.

It was one of the very common issue in the initial period. People were not allowed to amend the return. But the ITC taken in wrong head should have been allowed to be corrected. This was allowed via portal.

In this vital judgement the honourable court allowed the taxpayer to claim the correct ITC. Read the wordings in the end of article. The copy of order is also attached here.

Pleading

The petitioner, an assessee under the provisions of the Central Goods and Services Tax Act/State Goods and Services Tax Act, 2017, has approached this Court in the present writ petition seeking a writ of mandamus directing the 6th respondent to set off input tax credit of IGST to the tune of Rs.1,14,957/-, which was wrongly claimed under CGST and SGST for the period July, 2017 to March, 2018 against the output tax liability of the petitioner for the said period.

FactsThe financial year is of 2017-18. The petitioner had received IGST tax credit through inter state inward supply of goods. The total amount of IGST Credit as reflected in GSTR 2A was Rs.1,14,957/-. The petitioner while preferring monthly return in GSTR 3B for July, 2017, by mistake claimed the entire input tax credit of Rs.1,14,957/- under the heads of CGST and SGST, instead of claiming it under the head IGST. This mistake had resulted in passing the assessment order in Ext.P1. Learned counsel for the petitioner further submits that the petitioner has filed a rectification application in GST RFD-01 on 21.12.2023 as provided under Rule 89(1)(A) of the Goods and Services Tax Rules, 2017. However, no decision has been taken on the said rectification application, Ext.P4, till date. He, therefore, submits that the 6th respondent may be directed to consider Ext.P4 application and pass necessary orders thereon, in accordance with law, and till a decision is taken on the said application as above, no coercive measure be taken against the petitioner for realisation of the tax assessed in Ext.P1 assessment order.

Observations

Considering the aforesaid submissions, and the facts of the case, the present writ petition is disposed of with direction to the 6th respondent to consider Ext.P4 application filed by the petitioner/assessee and pass necessary orders thereon expeditiously, in accordance with law. Needless to say that the petitioner could be afforded an opportunity of hearing before final order is passed on Ext.P4 application. Until final order is passed on Ext.P4 application as above, no coercive measures shall be taken against the petitioner for realisation of the tax amount assessed in Ext.P1 order.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.