No appeal against the order of Commissioner /AC – Uttaranchal HC

Appeal against the order of commissioner/AC

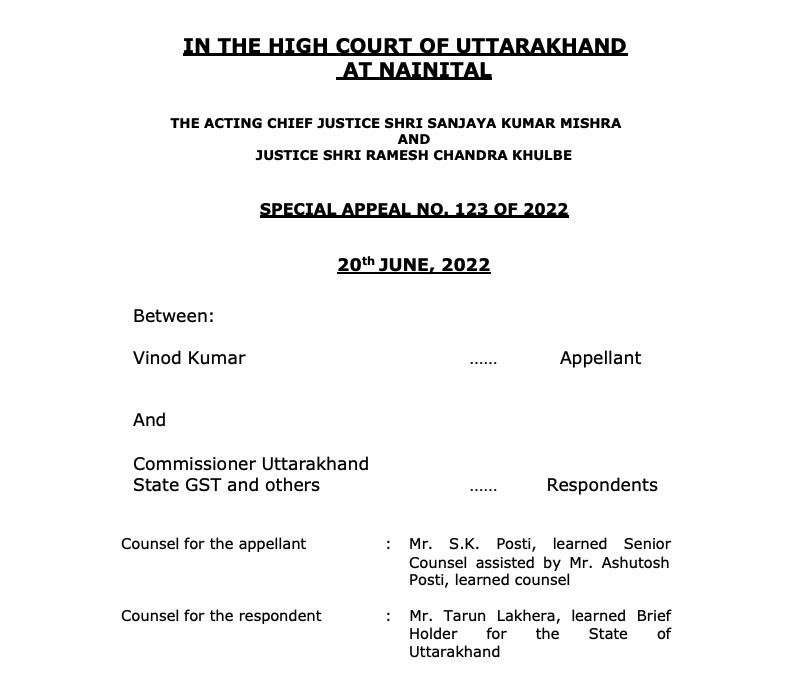

In a recent judgment the Uttaranchal High court has restricted the appeals against the orders of commissioner and AC.The issue under the consideration of the cancellation of a registration by the assistant commissioner.In this case the taxpayer is a masonary/Painter.

He had applied for GST registration, and was allotted GST Registration No. GSTIN 05AGMPK8182B3ZC. It is apparent from the records that the petitioner/appellant failed to file his return for a continuous period of six months, which was mandatory under the Uttarakhand Act. Hence, his registration was cancelled on 21.09.2019. He preferred an appeal before the First Appellate Authority, but the same was dismissed on the ground of delay. Thereafter, the petitioner/appellant filed a writ petition before the Court, as stated above, which was also dismissed as not maintainable.

Here the court held that the orders of Commissioner or AC are not appealable orders. In this case alternate remedy was not available and thus the writ petition should have been accepted. The judgement of Radha Krishna enterprises was also considered by the honourable court.

But this judgment in itself created a lot of issues. Now the appeal mechanism in Uttranchal has stopped as authority is not taking up the appeals against the orders or C/AC.

Author can be reached at shaifaly.ca@gmail.com

Read (download) judgement-

Vinod kumar Vs Commissioner Uttrakhand state

Vinod kumar Vs Commissioner Uttrakhand state

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.