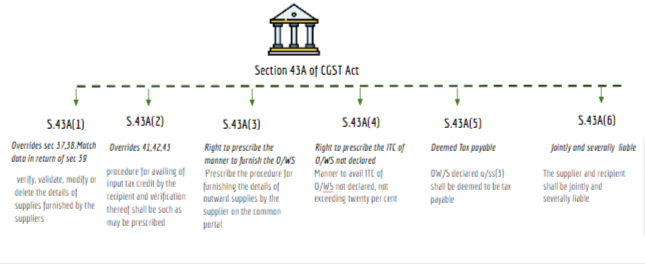

Section 43A of CGST Act :Procedure for furnishing return and availing input tax credit(Updated Till July 2024)

Section 43A of the CGST Act as amended by the Finance Act 2023

Note: Section 40 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

Text On Section Section 43A of the CGST Act:

(1) Notwithstanding anything contained in sub-section (2) of section 16, section 37 or section 38, every registered person shall in the returns furnished under sub-section (1) of section 39 verify, validate, modify

or delete the details of supplies furnished by the suppliers.

(2) Notwithstanding anything contained in section 41, section 42 or section 43, the procedure for availing of input tax credit by the recipient and verification thereof shall be such as may be prescribed.

(3) The procedure for furnishing the details of outward supplies by the supplier on the common portal, for the purposes of availing input tax credit by the recipient shall be such as may be prescribed.

(4) The procedure for availing input tax credit in respect of outward supplies not furnished under sub -section (3) shall be such as may be prescribed and such procedure may include the maximum amount of the input tax credit which can be so availed, not exceeding twenty per cent. of the input tax credit available, on the basis of details furnished by the suppliers under the said sub-section.

(5) The amount of tax specified in the outward supplies for which the details have been furnished by the

supplier under sub-section (3) shall be deemed to be the tax payable by him under the provisions of the

Act.

(6) The supplier and the recipient of a supply shall be jointly and severally liable to pay tax or to pay the input tax credit availed, as the case may be, in relation to outward supplies for which the details have been furnished under sub-section (3) or sub-section (4) but return thereof has not been furnished.

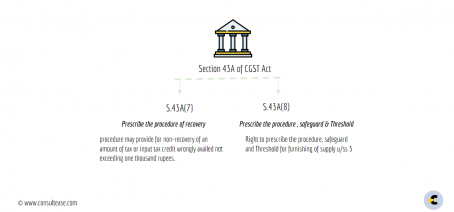

(7) For the purposes of sub-section (6), the recovery shall be made in such manner as may be prescribed

and such procedure may provide for non-recovery of an amount of tax or input tax credit wrongly availed

not exceeding one thousand rupees.

(8) The procedure, safeguards and threshold of the tax amount in relation to outward supplies, the details of which can be furnished under sub-section (3) by a registered person,-

(i) within six months of taking registration;

(ii) who has defaulted in payment of tax and where such default has continued for more than two months

from the due date of payment of such defaulted amount, shall be such as may be prescribed.

Chart of the Section :

Prem

Prem

designer

Adilabad, India

gst taxation