Updates that Matter: Income Tax,DVAT, DGFT, Customs,Company’s Law

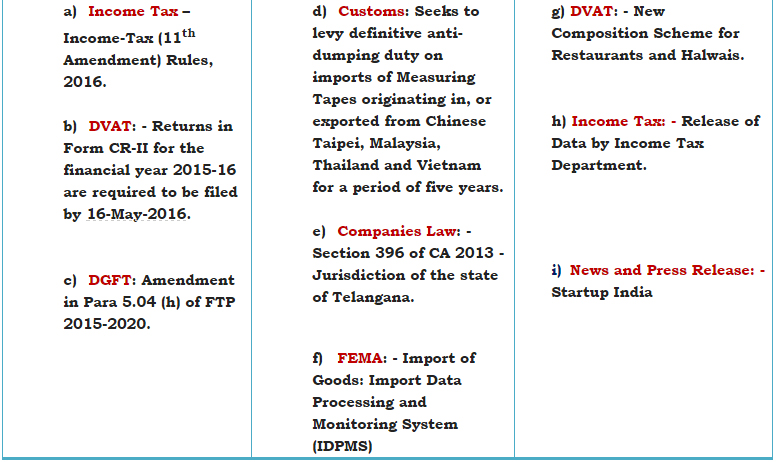

a) Income Tax – Income-Tax (11th Amendment) Rules, 2016.

In the Income-Tax Rules, 1962, after rule 26B, there shall be inserted Rule 26C “Furnishing of evidence of claims by employee for deduction of tax under section 192.”

There is Amendment in Rule 30, Rule 31A for sub-rule (2), Rule 37CA of Income Tax Rules, 1962.

In said rules, in Appendix II- Insertion of Form 12BB after Form 12BA and amendment in Form No. 24G, Form No. 24Q, Form No. 26Q, Form No. 27Q.

Notification No. 30/2016 Dated 29-04-2016.

b) DVAT: – Returns in Form CR-II for the financial year 2015-16 are required to be filed by 16-May-2016.

In exercise of the powers under Section 27 of Delhi Value Added Tax Act, 2004 and in partial modification to the notification No.F.3(628)/Policy/VAT/2016/

Notification No. No.F.3(628)/Policy/VAT/2016/

c) DGFT: Amendment in Para 5.04 (h) of FTP 2015-2020.

The Central Government hereby makes the following amendments in the Foreign Trade Policy (FTP) 2015-2020 with immediate effect:

After amendment the amended Para 5.04 (h) of FTP 2015-2020 shall read as under:

”5.04 Export Obligation (EO)

(h) Payment received in rupee terms for such Services as notified in Appendix 5D shall also be counted towards discharge of export obligation under the EPCG scheme.”

Effect of this Notification: A new Appendix 5D is being notified containing list of services, payments for which are received in Rupee terms and which are to be counted for fulfilment of Export Obligation under EPCG scheme.

Notification No. 6/2015-2020 Dated: 3-5-2016

d) Customs: Seeks to levy definitive anti-dumping duty on imports of Measuring Tapes originating in, or exported from Chinese Taipei, Malaysia, Thailand and Vietnam for a period of five years.

In exercise of the powers conferred by sub-section (1) and subsection (5) of section 9A of the Customs Tariff Act, read with rules 18 and 20 of the Customs Tariff (Identification, Assessment and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995, the Central Government, on the basis of the final findings of the designated authority, hereby imposes on the Measuring Tapes, specification of which is mentioned, falling under tariff item of the First Schedule to the Customs Tariff Act as specified, originating in the countries as specified, exported from the countries as specified, produced by the producers as specified, exported by the exporters as specified and imported into India, an anti-dumping duty at the rate equal to the amount as specified in the currency as specified in and as per unit of measurement as specified.

Notification No. 16/2016 ADD Dated: 2-5-2016

e) Companies Law: – Section 396 of CA 2013 – Jurisdiction of the state of Telangana.

The Central Government notified the jurisdictions of Regional Directors vide notification number G.S.R 832(E) dated 03.11.2015 to discharge the functions under sub-section (1) of section 396 of the said Act.

In the said notification in serial number (7), in column (2), for the words “States of Karnataka and Andhra Pradesh” the words “States of Karnataka, Andhra Pradesh and Telangana” shall be substituted and shall be deemed to have been substituted with effect from 3rd November, 2015.

Notification No. G.S.R 832(E) Dated: 26-4-2016

f) FEMA:-Import of Goods: Import Data Processing and Monitoring System (IDPMS)

Reserve Bank of India had constituted a Working Group comprising of representatives from Customs, Directorate General of Foreign Trade (DGFT), Special Economic Zone (SEZ), Foreign Exchange Dealers Association of India (FEDAI) and select Authorised Dealer banks (AD banks), to suggest putting in place a comprehensive IT- based system to facilitate efficient processing of all import transactions and effective monitoring thereof. The Working Group had recommended development of a robust and effective IT- based system “Import Data Processing and Monitoring System “(IDPMS) on the lines of “Export Data Processing and Monitoring System” (EDPMS) in consultation with the Customs authorities and other stakeholders.

Circular No. 65 Dated: – 28-4-2016

g) DVAT: – New Composition Scheme for Restaurants and Halwais.

A new composition scheme has been recently notified by the Government vide notification dated 18/03/2016 in exercise of powers conferred in section 16 (12), wherein the registered dealers whose annual turnover is upto 50 Lakhs and who makes sales of cooked food, snacks, sweets, savouries, juices, aerated drinks, tea and coffee etc. have an option to pay composition tax @ 5%.

It is further clarified that the applications in respect of the new composition scheme are to be filed manually in respective wards or at reception counter of the Department, till the time an order specifically requiring online filing of forms is issued by the Commissioner, VAT in exercise of powers conferred in the notification.

Circular No. 1/2016-17 Dated: – 27-4-2016.

h) Income Tax: – Release of Data by Income Tax Department.

Income Tax Department has released Time Series Data for Financial Year 2000-01 to 2014-15 based on internal reporting/ MIS of the Income Tax Department or figures reported by Controller General of Accounts or data published by other Government agencies along with PAN Allotment Statistics pertaining to Financial Year 2013-14 and Income Tax Return Statistics for Assessment Year 2012-13 (FY 2011-12).

The objective of publishing this statistics is to encourage wider use and analysis of Income tax data by Departmental personnel as well as various stakeholders including economists, scholars, students, researchers and academicians for purposes of tax policy formulation and revenue forecasting.

Circular No. PRESS RELEASE Dated: – 29-4-2016

i) News and Press Release: – Startup India

- An Action Plan for Startup India to build a strong eco-system to nurture innovation and Startups in the country was launched on 16th January 2016. Salient features of the scheme are as follow:

- Simplification and Handholding

- Funding support and Incentives

- Industry-Academia Partnership and Incubation

ii. Credit Guarantee Fund

Dated 3rd May, 2016.

CA Ankit Gulgulia

CA Ankit Gulgulia

Chartered Account and Financial Services Provider

New Delhi, India