43rd GST Council Meeting Things You Must Know!

Table of Contents

Overview

No. of GSTC Meetings

- 18 Meetings→ Pre–GST(Before 01.07.17)

- 8 Meetings→ 2018–2019

- 3 Meetings → 2020–2021

- 2017–2018→ 8 Meetings

- 2019–2020→ 5 Meetings

Reducing Frequency?

40th Meeting→ 12th June 2020 After 89 days

41st Meeting→ 27th August 2020 After 75 days

42nd Meeting→ 5th October 2020 After 38 days

43rd Meeting→ 28th May 2021 After 234 days

Why Such Delay?

Assembly elections held in 5 States

On-going COVID-19 pandemic

Proposed Changes In 43rd GSTC Meeting

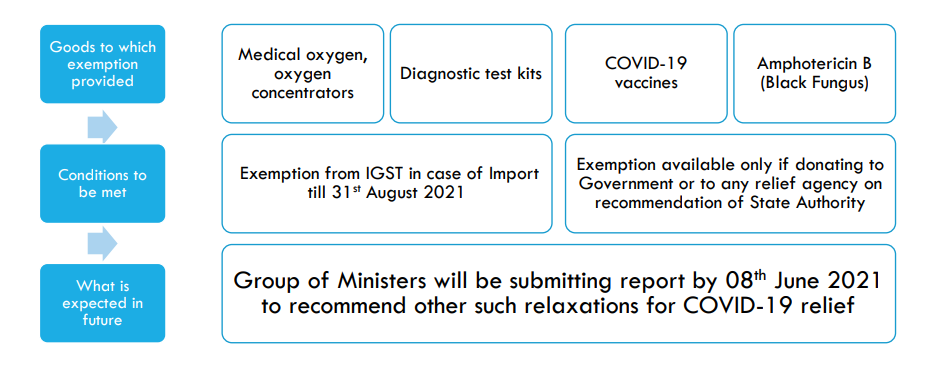

Exemptions

Covid-19 And Black Fungus Relief

Exemption For Serving Food

- Entities like Akshay Patra Foundation provide free meals in schools to lakhs of students

- Such meals may get funded through Corporate Donations to cover their costs

- Typically, in such cases, the fundamental question is who is the service recipient – such corporates or educational institutions

- In this regard, likely clarification that Such services of providing food including mid-day meal to an educational institution and Anganwadi would be exempt from GST irrespective of the funding received from Corporates

Exemption For Education

- National Board of Examinations (NBE) is responsible for PostGraduate exams and training for Medical Education in India

- They are established by the Ministry of Health and works in the capacity of Educational Institution

- Examination fees charged by NBE or similar Central or State Educational Boards will be exempted from GST

- Input services relating to such services thereto would also be exempt from GST.

- This would lead to a reduction in the cost of such institutions and hence ultimately making educational more affordable

Sectoral Benefits

Real Estate – Time Of Supply For JDA

- Real Estate Builders enter into a Joint Development Agreement with the Landowners

- Certain flats/units are then allotted by Builders to the landowner in lieu of development rights

- GST is charged on such transfers. However, the Time of Supply for the same is the completion certificate

- It may effectively mean that ITC may not be utilized by the Landowner

- Amendment to be made to pre-pone the GST liability to enable claiming of ITC by Landowner

- The expectation of exemption under GST for procurement of TDR remains unfulfilled