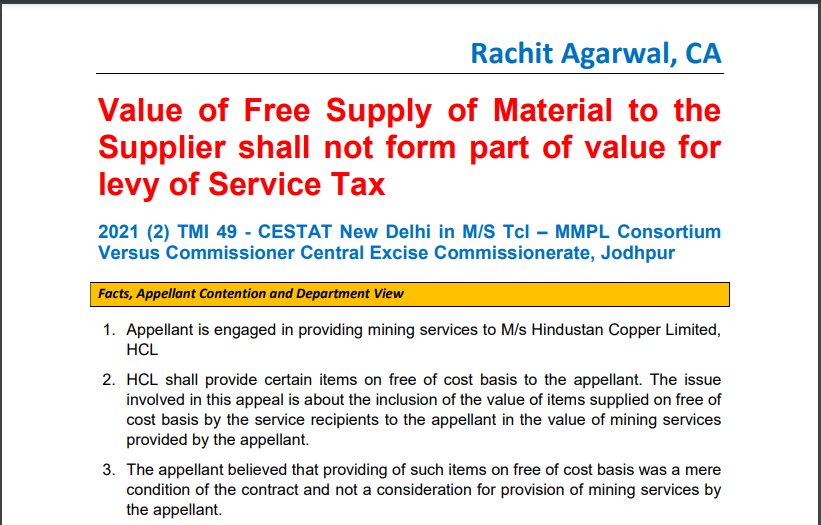

2021 (2) TMI 49 – CESTAT New Delhi in M/S Tcl – MMPL Consortium Versus Commissioner Central Excise Commissionerate, Jodhpur

Facts, Appellant Contention, and Department View

1. Appellant is engaged in providing mining services to M/s Hindustan Copper Limited, HCL

2. HCL shall provide certain items on free of cost basis to the appellant. The issue involved in this appeal is about the inclusion of the value of items supplied on free of cost basis by the service recipients to the appellant in the value of mining services provided by the appellant.

3. The appellant believed that providing such items on free of cost basis was a mere condition of the contract and not a consideration for the provision of mining services by the appellant.

4. Commissioner, however, by order “it is evident that the assessee while providing mining service to HCL, received a free supply of certain items/facilities without which the taxable service could not have been rendered by them.

Order Pronounced

In view of the aforesaid decision of the larger bench of the Tribunal in Bhayana Builders and of the Supreme Court in Bhayana Builders, it is not possible to sustain the demand of service tax that has been confirmed by the Commissioner.

Read & Download the Copy in pdf: