HSN Reporting Changes

I have in this article attempted to explain the changes in HSN Reporting from May 2021 in GSTR 1, as I feel that many members may have questions in respect of the same. This is an effort to address and provide answers to select questions for the benefit of all.

Table of Contents

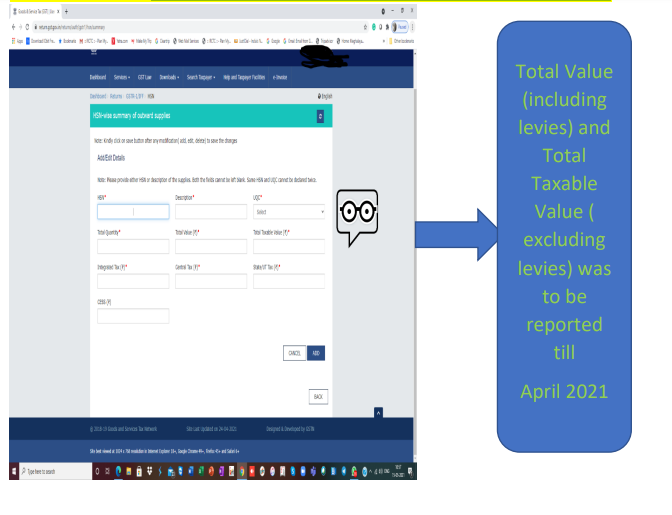

- Table 12- Reporting in GSTR 1 till April 2021

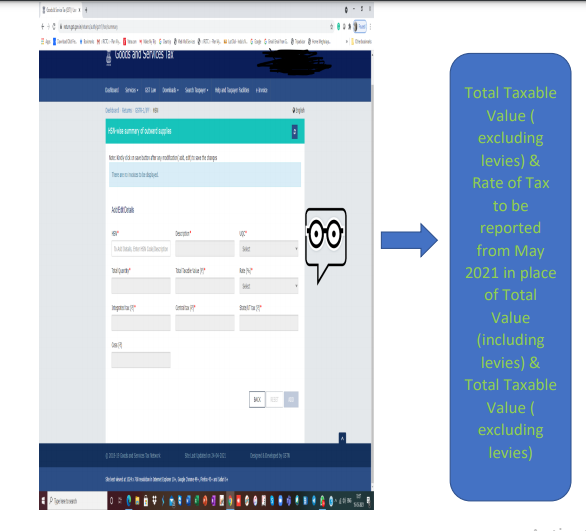

- Table 12- Reporting in GSTR 1 from May 2021

- 1. In respect of GSTR -1 reporting for the month of April 2021 which is not filed yet or pending to be filed, will RTP be required to report Taxable Value in Table 12 or rate of Tax in Table 12?

- 2. In respect of GSTR -1 reporting for the month of May 2021, will RTP be required to report Taxable Value in Table 12 or rate of Tax in Table 12?

- 3. In respect of GSTR -1 reporting for the month of May 2021, if the rate of tax is not reported in Table 12, will the return get uploaded?

- 4. In respect of GSTR -1 reporting for the month of May 2021, if the rate of tax is reported in Table 12, will the return get uploaded or will it generate an error report referencing the Rate of Tax reported as per the HSN Rate structure stored on the GSTN Portal?

- 5. Once HSN and Rate of Tax are reported in Table 12 of GSTR 1, will it generate defective notices under GST laws vis-àvis HSN Code reported by the RTP in E waybills?

- 6. Presently up to FY 1920, there was a waiver from reporting the values in Tables 17 & 18 of GSTR 9, will such waiver continue for FY 2021?

- 7. In the cases of RTP’s who are required to generate e-invoices compulsorily, will such data of HSN be auto-populated in GSTR 1 in the future?

- 8. Whether such HSN and SAC reporting in Table 12 of GSTR 1, will it be used by Govt. using Data Analytics?

- 9. Whether such non-compliance would trigger penalty u/s 125 of the CGST Act 2017?

Table 12- Reporting in GSTR 1 till April 2021

Table 12- Reporting in GSTR 1 from May 2021

Note: Amendment Trail

1. Notification No. 79/2020 Central Tax dated 15/10/2020 – Serial Number 7

In view of the above Notification, the words “Total Value” have been substituted by the words “Rates of Tax”.

2. Notification No 78/2020 Central Tax dated 15/10/2020

• Significant changes introduced in HSN Reporting with the effect from April 1, 2021;

• Taxpayers may therefore note that based on the harmonious interpretation of the Notifications, as referred above, read with Customs Tariff Act, 1975, as made applicable to GST; the number of digits of HSN, as specified vide Notifications No. 12/2017 & 78/2020 (Central Tax), are the minimum number of digits of HSN to be mentioned on the invoice.

• Compulsory reporting of HSN in Table 12 of GSTR 1 – either minimum 4 digits or 6 digits of HSN (Harmonized System of Nomenclature) as well as in the Tax Invoices.

• The number of Digits of HSN Code is mapped to the Aggregate Turnover on PAN in the preceding financial year.

o Aggregate Turnover in the preceding Financial Year. Number of Digits of Harmonized System of Nomenclature Code (HSN Code)

o It was made mandatory for all B2B supplies as well as Zero-rated supplies with or without taxes either under LUT and/or Bond.

3. Besides above, new Information on GSTN Portal Dashboard of RTP in respect of Determination of Aggregate Turnover which was enabled on November 9, 2020;

4. Please note that there was no specific exemption available for non-quoting of SAC from day one of GST Act 2017, thus the same was required to be reported in GSTR 1, Tax Invoices, Receipt Vouchers, etc.

5. Notification No 82/2020 Central Tax dated 10/11/2020 – Serial No 7

In FORM GSTR-1, in the Instructions, after serial number 17, the following instruction shall be inserted, namely: –

“18. It will be mandatory to specify the number of digits of the HSN code for goods or services that a class of registered persons shall be required to mention as may be specified in the notification issued from time to time under proviso to rule 46 of the said rules

My personal suggestion: All stakeholders should revamp and implement their system of reporting to generate HSN Code having 8 Digits, thereby ignoring beneficial notification details shared above. So that in the future, hopefully, no further system changes would be needed from an HSN Reporting perspective.

FAQ based on above changes in HSN Reporting’s

1. In respect of GSTR -1 reporting for the month of April 2021 which is not filed yet or pending to be filed, will RTP be required to report Taxable Value in Table 12 or rate of Tax in Table 12?

Till the month of April 2021 viz. GSTR 1 Returns pertaining to any period up to April 2021, all RTPs would be required to report only Taxable values (excluding levies) in Table 12 of GSTR- 1.

2. In respect of GSTR -1 reporting for the month of May 2021, will RTP be required to report Taxable Value in Table 12 or rate of Tax in Table 12?

From the month of May 2021 viz. GSTR 1 Returns pertaining to any month from 1st May 2021, all RTPs would be required to report the only Rate of Tax in place of Taxable value in Table 12 of GSTR- 1. Reporting of Taxable value (including levies) till Apr 21 would be done away in toto.

3. In respect of GSTR -1 reporting for the month of May 2021, if the rate of tax is not reported in Table 12, will the return get uploaded?

Presently GSTR 1 is getting filed even when such information is not reported in Table 12 of GSTR 1 by RTP, so I assume that it would be permitted in the future too unless it is blocked by the GSTN Portal System & considering compulsory reporting introduced by Notification No. 82/2020 dated 10.11.2020 – Sr No 7 (supra), Factually, we will know only we attempt to file GSTR 1 for the month of May 2021 whether it is permitted or not permitted.

4. In respect of GSTR -1 reporting for the month of May 2021, if the rate of tax is reported in Table 12, will the return get uploaded or will it generate an error report referencing the Rate of Tax reported as per the HSN Rate structure stored on the GSTN Portal?

Presently GSTR 1 is getting filed even when such information is not reported in Table 12 of GSTR 1 by RTP, so I assume that it would be permitted in the future & considering compulsory reporting introduced by Notification No. 82/2020 dated 10.11.2020 – Sr No 7 (supra) too unless it is blocked by the GSTN Portal System. Factually, we will know only when we attempt to file GSTR 1 for the month of May 2021, whether it is permitted, or an error message is flashed by the system.

5. Once HSN and Rate of Tax are reported in Table 12 of GSTR 1, will it generate defective notices under GST laws vis-àvis HSN Code reported by the RTP in E waybills?

If the system is integrated by way of Data Analytics and synchronization, DRC-01A and DRC-01 can or may be issued by PO as per the provisions of the GST Act 2017.

6. Presently up to FY 1920, there was a waiver from reporting the values in Tables 17 & 18 of GSTR 9, will such waiver continue for FY 2021?

I assume such waiver for nonreporting will continue for the filing of GSTR 9 for FY 2021 but we need to wait for the formal notification to be issued by the Appropriate Authorities.

7. In the cases of RTP’s who are required to generate e-invoices compulsorily, will such data of HSN be auto-populated in GSTR 1 in the future?

As of now, it is not getting auto-populated in GSTR 1, but in the future, it may be auto-populated.

8. Whether such HSN and SAC reporting in Table 12 of GSTR 1, will it be used by Govt. using Data Analytics?

If the system is integrated by way of Data Analytics and Synchronisation, then it can be used by respective stakeholders for their purposive objectives.

9. Whether such non-compliance would trigger penalty u/s 125 of the CGST Act 2017?

Yes, non-compliance can be covered under general penalty provisions u/s 125 of the CGST Act 2017.

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve the above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively on the matter.)

Nitin Bhuta

Nitin Bhuta

Presently, he is actively involved with limited scale of doing Audits, Direct & Indirect Taxation, Management Advisory as well as handling of litigation matters, etc. of Corporate as Well as Non-Corporate persons. Presently, he is actively involved vetting out of drafted legal documents pertaining to business arrangements from the tax compliance perspective.