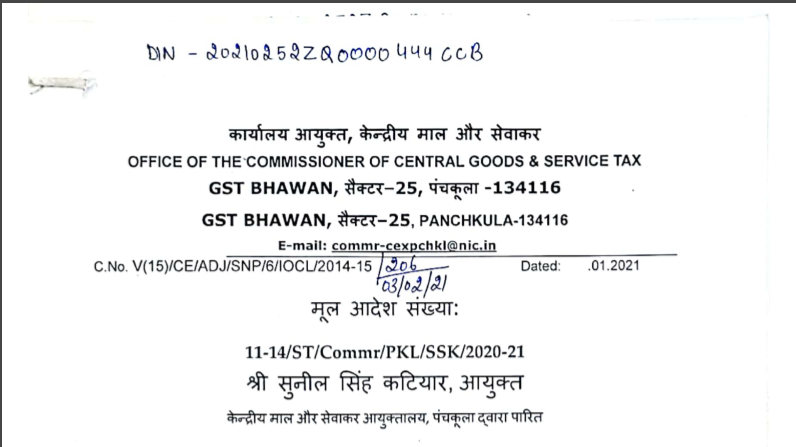

CGST Commissioner Order in the case of M/s Indian Oil Corporation Limited.

1. This copy is granted free of charge for the private use of the person (s) to whom it is sent.

2. Any person aggrieved with this Order may appeal against this Order to the Customs, Excise and Service Tax Appellate Tribunal, 14-3d Floor, SCO No. 147-148, Sector 17C, Chandigarh within three months from the date of its communication. The appeal must be addressed to the Assistant Registrar, Customs, Excise, and Service Tax Appellate Tribunal, 14-3rd Floor, SCO No. 147-148, Sector 17C, Chandigarh.

3. The Appeal should be filed in Form No. S.T.-5. It shall be signed by the persons specified in sub-rule (2) of Rule 3 of the Central Excise (Appeals) Rules, 2001. The Appeal including the statement of facts and grounds of appeal shall be filed in quintuplicate accompanied by an equal number of copies of the order (one of which at least shall be certified copy) appealed against. All supporting documents of the appeal should be forwarded in quintuplicate.

4. The Appeal including the statement of facts and the grounds of appeal shall be filed in quintuplicate and shall be accompanied by an equal number of copies of the order appealed against (one of which at least shall be a certified copy.)

5. The form of appeal shall be in English or Hindi and should be set forth, concisely, and under distinct heads of the grounds of appeals without any argument or narrative and such grounds should be numbered consecutively.

6. The prescribed fee of seven and a half percent, of the duty, in the case where duty or duty and penalty are in dispute, or penalty, where such penalty is in dispute, under the provisions of Section 86 of the Finance Act, 1994 shall be paid through a crossed demand draft, in favor of the Assistant Registrar of the Bench of the Tribunal, of a branch of any Nationalized Bank located at the place where the Bench is situated and the demand draft shall be attached to the form of appeal.

7. The copy of this order attached therein should bear a court fee stamp of Re. 1.00 as prescribed under Schedule 1, Item 6 of the Court Fees Act, 1870.

8. An appeal should also bear a court fee stamp of Rs. 4.00.

Regd. AD / Speed Post

To,

M/s Indian Oil Corporation Limited,

Panipat Refinery, Village Baholi,

Panipat-132140

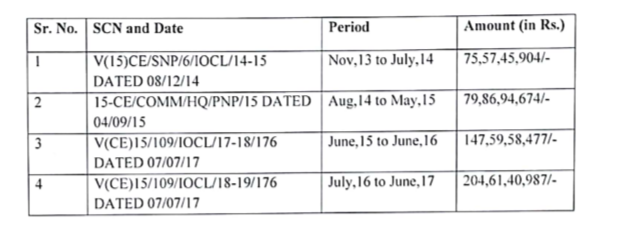

These proceedings arise from the following Show Cause Notices issued to M/s Indian Oil Corporation Ltd., Panipat Refinery, Village Baholi, Panipat (hereinafter referred to as ‘the party ‘)

Since all the above four SCNS have a common issue, they are being taken up together for decision in a common adjudication order.

1. BRIEF FACTS OF THE CASE: M/s Indian Oil Corporation Ltd., Panipat Refinery, Village Baholi, Panipat (hereinafter referred to as ‘the party’) are engaged in the manufacturing of petroleum products falling under Chapter Heading No. 27 and Plastic Product falling under Chapter Heading No. 39 of the Schedule 2 of the Central Excise Tariff Act, 1985 and are having Central Excise Registration No AAACI168IGXM015. They are selling their products using their pipeline, road, and rail for transportation. The goods are sold through their marketing offices at depots situated at different locations including Panipat. They are receiving their main inputs ‘Crude Oil’ through the pipeline laid down by M/s IOCL, Pipeline Division. M/ s IOCL’s Pipeline Division has also offices located at different locations such as New Delhi, Noida, Rajkot, and Jaipur, etc.

2. The party is also engaged in receiving as well as providing various taxable services under various categories viz. Goods Transport Operators, Business Auxiliary Services, Consulting Engineer, Maintenance or Repair Service, Technical Testing and Analysis, Inspection and Certification, Erector Commission and Installation, Management Consultants, Banking and Financial, Credit Card Related Services, Renting of Immovable Property Services, Commercial Training and Coaching and Supply of Tangible Goods. They are hailing Service Tax back along with a copy of the bill enlisting the charges of electricity consumed over and above the supply made to the grid by them through the windmill. They further stated that in the rare eventuality when they draw less from the grid than the subject credit is being reversed by them by resorting to rule 6 (3) of the Cenvat Credit Rules, 2004.

14. I observe that the plea of the party is tenable as electricity produced by the windmill is supplied back to their pipeline network through the grid and therefore the claim of the party that electricity is consumed captively by the mis admissible and consequently the credit is also admissible to them. In any case, the reversal, if necessary, under rule 6(3) is also being made.

15. In view of the foregoing discussions, I find that: –

i. Credit on input services used in the manufacture and clearance of dutiable goods up to the place of removal i.e., up to terminals/depots in case of domestic clearances and port of export in case of exports is admissible to them and same is available for distribution under input service distribution and the party has rightly availed Cenvat credit on various such services on the basis of invoices issued by other offices under the ambit of input service distribution.

ii. Credit on input services used for procurement of input like crude oil from the port of landing to the manufacturing units are also admissible to them and available for distribution under input service distribution as envisaged in Rule 7 of Cenvat Credit Rules, 2004.

Accordingly, the CENVAT Credit amounting to Rs 507,65,40,042 / – proposed to be denied in Show Cause Notices in reference as given in for I is available to them, and demand of the said amount is not sustainable.

iii. I further find that provisions of interest and penalty under rules 14 and 15 of Cenvat Credit Rules 2004 read with section 11 AA and 11 AC of Central Excise Act, 1944 are not applicable on them as the demand is found not sustainable.

16. Judicial Discipline: I further observe that this issue have been decided by my predecessors vide Orders in – Original No. 12/ST/Commr/BKI/RTK/2011 and 3 / ST / Commr / BKJ / RTK / 2012 which was remanded back for denovo adjudication by the Hon’ble CESTAT vide Final Order No 57740-41 / 2013-EX to be decided in line with subsequent orders of the Commissioner vide O-1-0 Nos 47-49 / ST / COMMR / DM / RTK / 2012-13. Accordingly, the matter was adjudicated in denovo proceedings vide Order-In -Original No. 98- 99 / ST / COMMR / DM / 2013-14 dated 31.03.2014 dropping the demand. In an appeal filed by the department against the said orders, the Hon’ble CESTAT vide Final Order No.60712 of 2019 dated 23.05.2019, have upheld the orders of the Commissioner. Therefore, I am also judicially bound to follow the decision of the appellate authority. Accordingly, I pass the following order: –

ORDER

The proceeding initiated vide four show-cause notices, mentioned in first for of the order, are hereby dropped.

(Sunil Singh Katiyar)

Commissioner

Regd. Ad.-

To

M/s Indian Oil Corporation (Refinery),

Baholi, Panipat,

Haryana-132140

Copy to:

1. The Chief Commissioner CGST & CX Panchkula Zone, Panchkula.

2. The Deputy Commissioner, CGST Division Panipat, Haryana.

3. Guard File.

Advocate Dinesh Verma

Advocate Dinesh Verma