Relief given by Government in GST Compliance Work

Table of Contents

All the following notification were issued late night, on 01.05.2021

Words highlighted in Red and Purple may give you the brief.

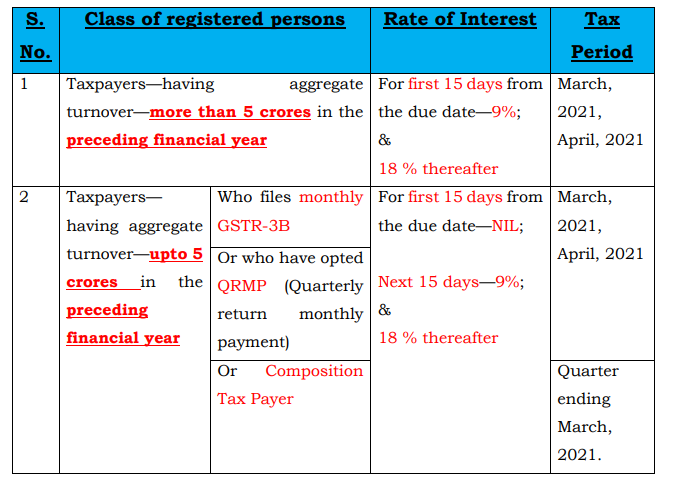

I. Notification No. 08/2021- Central Tax—Relief in Interest Provisions.

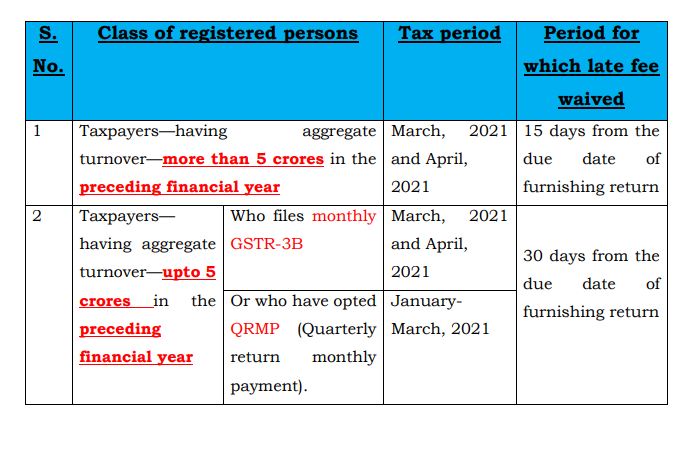

II. Notification No. 09/2021- Central Tax—Relief in levy of Late Fees.

III. Notification No. 10/2021- Central Tax—Extension of Due date for filing GSTR-4 (Annual Return for Composition dealer for the financial year ending 31st March 2021)— 31.05.2021.

IV. Notification No. 11/2021- Central Tax—Extension of Due date for filing declaration in FORM GST ITC-04 (for the period Jan 2021 to March 2021)— 31.05.2021.

V. Notification No. 12/2021- Central Tax—Extension of Due date for filing GSTR-1 (for the period—April 2021)—26.05.2021.

VI. Notification No. 13/2021- Central Tax—

A. Relaxation in the provisions of Rule 36(4)—Now, an assessee can avail ITC as per his Books of Accounts

for the period April 2021. And the condition for Rule 36(4), i.e., 105% of Eligible visible ITC from GSTR-2B, is to be seen cumulatively for the period April and May 2021.

B. Extension in filing option of Monthly IFF (IFF??— Invoice Furnishing Facility—for a dealer who has opted quarterly filing of GSTR-1 were eligible to file monthly B2B sales till 13 of succeeding month to pass-on the ITC to the recipient)—Such person can use IFF to furnish details for the period of April 2021 till 28.05.2021.

VII. Notification No. 14/2021- Central Tax—

A. Relaxation in Any Time Limit for compliance of any action (other than stated below) by any authority or any PERSON (here word PERSON is written with no prefix such as registered or taxable and ‘compliance work’ includes—issuance of a notice, filing of the appeal, reply or application of refund, sanction of refund), which falls during the period from 15.04.2021 to 30.05.2021, shall be extended up to the 31.05.2021.

B. For Verification of the application and approval of registration whose compliance date by any authority or any person falls during the period from 01.05.2021 to 31.05.2021, then, the time limit for completion of such action shall be extended up to 15.06.2021.

C. If the time limit for issuance of an order for a refund for which SCN was issued, falls within 15.04.2021 to 30.05.2021, in such cases the time limit for issuance of the said order shall be extended to fifteen days after the receipt of the reply to the notice from the registered person or the 31.05.2021, whichever is later.

But such extension shall not apply in following—

a) On Time and Value of Supply—Example—if any goods are sold on 15.04.2021—then it shall be treated as a sale of April month itself and not of May month;

b) In the case of Composition Dealers—If the composition dealer crosses the turnover limit, then he has to opt-out of the scheme on that very day when he has crossed the limit, even if this period falls within 15.04.2021 to 30.05.2021;

c) Person who is required to register has to comply with registration procedure as a normal or composition or casual or Non-resident;

d) Issuance of Invoice;

e) Furnishing of Outward details in GSTR-1 or IFF, Composition return, provisions of late fees or interest (as they are extended individually);

f) Inspection of goods in movement u/s 68 (in so far as e-way bill is concerned).

g) Power to arrest u/s 69, Liability of partners of firm to pay tax u/s 90.

h) Penalty u/s 122 (penalties on transactions like—issuance of inv without supply or vice versa, collecting tax but not depositing) and section 129 (Detention, seizure, and release of goods and conveyances in transit).

Relief in Interest Provisions

Relief in levy of Late Fees

CA Ashutosh Sharma

CA Ashutosh Sharma