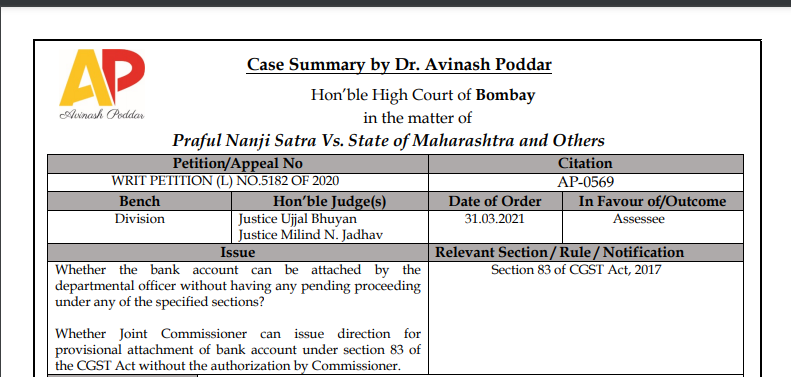

Bombay HC in the case of Praful Nanji Satra Vs. State of Maharashtra

Table of Contents

Case Covered:

Praful Nanji Satra

Vs.

State of Maharashtra and Others

Issue:

Whether the bank account can be attached by the departmental officer without having any pending proceeding under any of the specified sections?

Whether Joint Commissioner can issue direction for provisional attachment of bank account under section 83 of the CGST Act without the authorization by Commissioner.

Brief Facts of the Case:

- Petitioner is a businessman having his office in Mumbai. There are various other offices carrying on their business from the said address.

- Petitioner has rented out commercial premises on leave and license basis receiving license fees from the licensees. Since the petitioner is required to pay goods and services taxes (GST) on such license fees, he is duly registered with the GST department and submitting GST returns regularly.

- On 17.01.2020, the office of respondent no.2 carried out search operations in the office address of the petitioner in respect of other companies having their offices there. However, no such search was undertaken against the petitioner and the petitioner has not received any summons from the office of respondent no.2.

- It is stated that the petitioner had submitted GST returns till February 2020 and had accordingly paid GST. However, because of the Covid-19 pandemic, the petitioner had not received any license fee in respect of the rented premises from March 2020, and accordingly, no GST was deposited from March 2020.

- Resultantly, the petitioner submitted GST return for June 2020 declaring NIL tax. As it is, respondents had extended the last date for filing of GST return till 31.07.2020.

- On or about the 3rd week of June 2020, the petitioner came to know that his bank account bearing No.001101218141 maintained with the ICICI Bank, Andheri West Branch, Mumbai, was provisionally attached by respondent no.3.

- Since the petitioner was not served with a copy of the provisional attachment order, a copy of the same was sought for and obtained by him from the ICICI Bank, which shows that the petitioner’s bank account was provisionally attached under section 83 of the MGST Act.

- Aggrieved by such provisional attachment order of bank account, petitioner submitted detailed representation before respondent no.3 on 01.07.2020, requesting the said authority to withdraw the provisional attachment of bank account forthwith. However, there was no response to the said representation.

- Referring to the provisions of section 67 of the MGST Act, it is stated that after visiting the said premises and carrying out the search, it was found out that there is a group of companies that are registered in the same place as that of the petitioner.

- In all these companies, family members of the petitioner or the petitioner himself are either proprietor/ director/shareholder. They are supplying goods and services to each other and making money transactions with each other.

- In order to protect the interest of revenue and in the exercise of the power conferred under section 83 of the MGST Act, account No.001101218141 of the petitioner maintained in the ICICI Bank, Andheri West Branch was provisionally attached clarifying that no debit shall be allowed to be made from the said account or from any other account operated by the petitioner without the prior permission of the GST department.

Related Topic:

Bombay HC in the case of KLT Automotive and Tubular Products Limited

Brief Arguments by Petitioner/ Appellant:

By fling, this petition under Article 226 of the Constitution of India, petitioner seeks quashing of provisional attachment order dated 19.06.2020 issued by respondent no.3 attaching the bank account of the petitioner maintained with the ICICI Bank, Andheri West Branch, Mumbai.

It is submitted that even if the representation dated 01.07.2020 is construed to be an application under rule 159 (5) of the MGST Rules, then respondents were under an obligation to give a hearing to the petitioner and thereafter to take a decision in the matter. No such hearing was granted to the petitioner, not to speak of any decision taken.

While Mr. Pande has assailed the impugned provisional attachment as being without jurisdiction as no proceeding under any of the sections mentioned in section 83 of the MGST Act was pending against the petitioner and that power under section 83 is to be exercised solely by the Commissioner and not by the Joint Commissioner.

Brief Arguments by Respondents:

Ms. Chavan on the other hand has supported the impugned action as being just, proper and valid. Further Ms. Chavan has produced one file stated to contain the relevant note sheets and documents from out of the entire original file for perusal by the Court. On 08.02.2021, the file was retained for perusal.

Judgement/ Ratio (in brief):

Contending that proceedings under sections 62, 63, 64, 67, 73, and 74 of the MGST Act are pending against the petitioner, provisional attachment order has been justified. Petitioner has reiterated that to the best of his knowledge, no proceedings under sections 62, 63, 64, 67, 73, and 74 of the MGST Act were pending against him.

From a perusal of sub-section (1) of section 83, what is noticeable is that during the pendency of any proceedings under sections 62 or 63 or 64 or 67 or 73 or 74, the Commissioner should be of the opinion that for the purpose of protecting the interest of the government revenue, it is necessary to provisionally attach any property including bank account belonging to the taxable person, he may do so by making an order in writing.

On a proper analysis of the said provision, we find that the following conditions are essential to clothe jurisdiction upon the Commissioner for exercising power under section 83.

Since the power under section 83 is vested in the Commissioner, it is necessary to refer to the definition of Commissioner in the MGST Act. Section 2 (24) of the MGST Act defines ‘Commissioner’.

The record does not disclose any authorization by the Commissioner to the Joint Commissioner to carry out provisional attachment. There is also no averment to that effect in the reply affidavit of the respondents. That apart, section 83 does not provide for such delegation or authorization.

Consequently and in the light of the above, we are of the opinion that the impugned provisional attachment order dated 19.06.2020 cannot be sustained. The same is hereby set aside and quashed. Respondents are directed to forthwith withdraw the provisional attachment of the bank account of the petitioner bearing account No.001101218141 maintained with ICICI Bank Limited, Andheri West Branch, Mumbai.

The writ petition is accordingly allowed. However, there shall be no order as to costs.

Head Note/ Judgement in Brief:

Unless there is reason to believe of Commissioner that the collection will be difficult and therefore it is necessary to attach the property including bank account provisionally, the order of attachment is without the authority of law. Order of provisional attachment issued by Joint Commissioner in the present case without the authority of Commission.

Dr. Avinash Poddar

Dr. Avinash Poddar

Ahemdabad, India

Avinash Poddar, currently practicing as a lawyer, as a Law Graduate, a fellow member of Institute of Chartered Accountants of India, Certified Financial Planner, Microsoft Certified Professional and DISA (Diploma in Information Systems Audit) from ICAI. He has also completed various certificate courses of ICAI such as Arbitration, Forensic Accounting and Fraud Detection, Valuation, IFRS, Indirect Taxes. He has also completed post-graduate diploma is Cyber Crime (PGCCL).