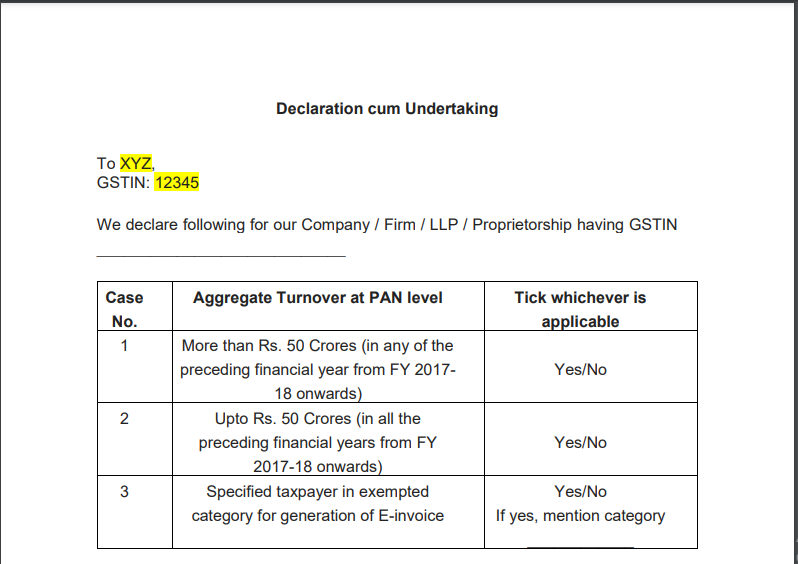

Declaration cum Undertaking

To XYZ,

GSTIN: 12345

We declare following for our Company / Firm / LLP / Proprietorship having GSTIN ____________________________

| Case No. | Aggregate Turnover at PAN level | Tick whichever is applicable |

| 1 | More than Rs. 50 Crores (in any of the preceding financial year from FY 2017-18 onwards) |

Yes/No |

| 2 | Upto Rs. 50 Crores (in all the preceding financial years from FY 2017-18 onwards) |

Yes/No |

| 3 | Specified taxpayer in exempted category for generation of E-invoice | Yes/No If yes, mention category ____________ |

We acknowledge that the declaration furnished above is true and correct.

We undertake the following:

- To report tax invoice/debit note/credit note/export invoice or any document as may be prescribed by Government of India / CBIC or may be prescribed at any future date, on invoice registration portal (“IRP”) for generation of invoice registration number (“IRN”) since our aggregate turnover in any of the preceding financial years from FY 2017-18 onwards exceeds Rs.50 Crores or any other threshold as may be prescribed by Government of India / CBIC at any future date.

- To declare unique IRN and QR code which is generated by IRP on tax invoice/debit note/credit note/export or any document as may be prescribed by Government of India / CBIC at any future date.

- To undertake timely and correct reporting/furnishing of details on GSTN portal of tax invoice/debit note in returns/statements as prescribed by the Government of India / CBIC or as may be prescribed at any future date so that correct details are made available to XYZ in GSTR-2A/GSTR-2B in a timely manner.

- To deposit GST with the government in a timely manner.

- To undertake all the compliances related to above in terms of law (illustratively, generation of proper E-way bill, etc.).

We acknowledge that the undertaking/declaration furnished above is true and correct.

In case, any GST liability, interest, penalty or any other amount becomes payable or input tax credit is denied to XYZ, we shall indemnify XYZ for the same within a period of 30/XYZ days… Indemnification is irrespective of the fact whether or not litigate/contest the liability/denial.

CA Shivashish Karnani

CA Shivashish Karnani