Compilation of selected GST Concept Notes and Articles on burning topics published in 2020

Table of Contents

- GST on Contracts of Guarantee – Uncertainty Prevails

- Introduction

- Types of Guarantee

- (i) Personal Guarantee

- (ii) Bank Guarantee

- (iii) Corporate Guarantee

- Bank Guarantee vis a vis Corporate Guarantee

- Taxability of Corporate Guarantee

- Provisions of the Income Tax Act, 1961.

- Read & Download the full copy in pdf:

GST on Contracts of Guarantee – Uncertainty Prevails

Introduction

With the introduction of the GST regime, different wings of the Department have become active in scrutinizing transactions involving various issues relating to the interpretation of GST provisions. One such transaction which has come up for consideration are contracts of guarantee. A Contract of Guarantee is in the nature of collateral security for providing financial assistance, which is globally acknowledged to be an instrument for securing and enforcing claims.

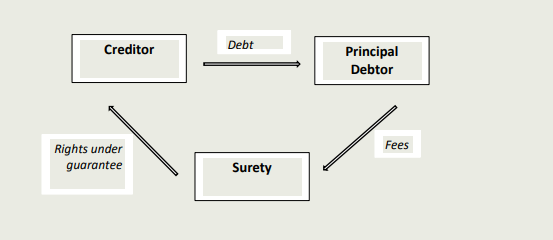

Section 126 of the Indian Contract Act,1872 defines a contract of guarantee as a promise to perform or discharge the liability of a third person in case of his default. A guarantee is a legal promise made by the Surety to repay the debt of the Creditor on account of a default by the Principal Debtor. The surety acts on the request of the principal debtor and his liability are secondary in terms of repayment. It is in the nature of assurance and covers the risk of non-compliance of contractual obligations by a party for the efficient and timely realization of claims.

There are three parties in a contract of guarantee and flow of obligations and can be analyzed as under:

The creditor here acquires two rights (i) agreed repayment from the principal debtor for debt (ii) a claim or right to call on the guarantor for repayment. The liability of the surety is contingent and does not arise per say and it cannot be said that corporate guarantees are themselves in form of business consideration. The surety will not pay to the principal debtor, but to the creditor and the law does not mandate a relationship between them. Such guarantees are given on basis of overall performance and goodwill of the principal debtor.

Related Topic:

Handbook on Resolution Plan under The Insolvency and Bankruptcy Code, 2016: ICAI

Types of Guarantee

Contracts of Guarantee can be broadly classified on the basis of the surety into three types:

(i) Personal Guarantee

A Personal guarantee is a promise made by an individual, usually in his capacity as an executive or a partner or director of an enterprise for repayment of loan upon default of the enterprise.

(ii) Bank Guarantee

A Bank guarantee is similar to a personal guarantee, with the only difference that the Bank is the surety, and it undertakes an obligation to repay the loan on default of the principal debtor. The Banks before giving the guarantee perform a scrutiny analysis by running risk assessment processes and ensures repayment by security in form of cash or capital assets. Banks charge a commission for the same.

(iii) Corporate Guarantee

A Corporate guarantee is a guarantee in which a corporation agrees to take responsibility for the performance or discharge of the financial obligations of the principal debtor to the creditor. Such guarantees are common in business parlance as collateral securities to facilitate financial credibility for associated enterprises and are in nature of inter-corporate deposits. Corporate guarantees are usually unsecured and are given without payment of any fees/consideration. Corporate guarantees are regulated by provisions of the Companies Act, 2013 & Foreign Exchange Management (Guarantees) Regulation, 2000.

Related Topic:

Handbook on Corporate Insolvency Resolution Process under The Insolvency and Bankruptcy Code, 2016: ICAI

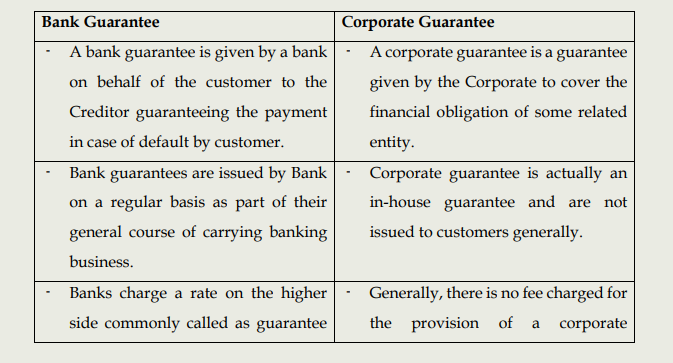

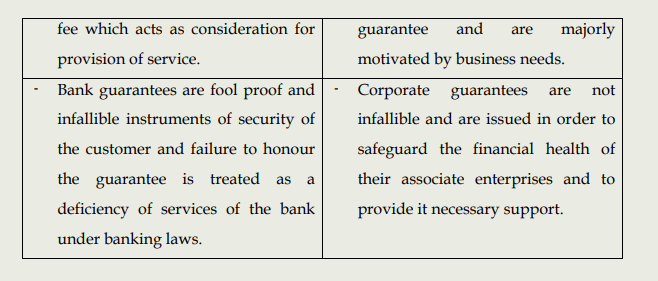

Bank Guarantee vis a vis Corporate Guarantee

In a number of judicial pronouncements including Glenmark Pharmaceuticals, Micro Ink Limited, and Sterlite Industries India, the nature of a bank guarantee and its difference from that of a corporate guarantee has been explained in the following manner

Taxability of Corporate Guarantee

Under GST, tax is leviable not only on all forms of supply made for consideration but also includes activities specified in Schedule I which cover the supply of goods and services or both between related/distinct persons when made in the course or furtherance of business. Therefore, any guarantee given between such persons would be considered and deemed to be supplied, even in the absence of a per say consideration. However, a question arises if there is an element of supply at all in the case of corporate guarantees or for that matter any sort of guarantees.

Related Topic:

GST on Corporate Guarantees

Provisions of the Income Tax Act, 1961.

Taxability of Corporate guarantees has been a subject of dispute in the Income Tax Act, 1962 under the Transfer pricing provisions enumerated in Chapter X. It needs to be determined if the commission received/paid for corporate guarantees comes under the scope of international transaction under section 92B. The Court in Micro link4 concurring with the view of the OECD Guidance5 categorically held that corporate guarantees are in the nature of quasi capital and shareholder activities to provide or compensate for the lack of core strength of raising finances from the banks and cannot be construed to be in nature of provision of service.