Indirect Tax Amendments by Finance Bill 2021

Table of Contents

- Indirect Tax Amendments by Finance Bill 2021

- I. Amendments In The CGST Act, 2017:

- Scope of Supply u/s 7(1) enlarged by way of Retrospective amendments

- Amendment of Section 16

- Abolition of GST Audit u/s 35(5) & Self Assessed Reconciliation Statement u/s 44

- Retrospective amendment to Section 50 – Interest on GST liability

- Read & download the full copy in pdf:

Indirect Tax Amendments by Finance Bill 2021

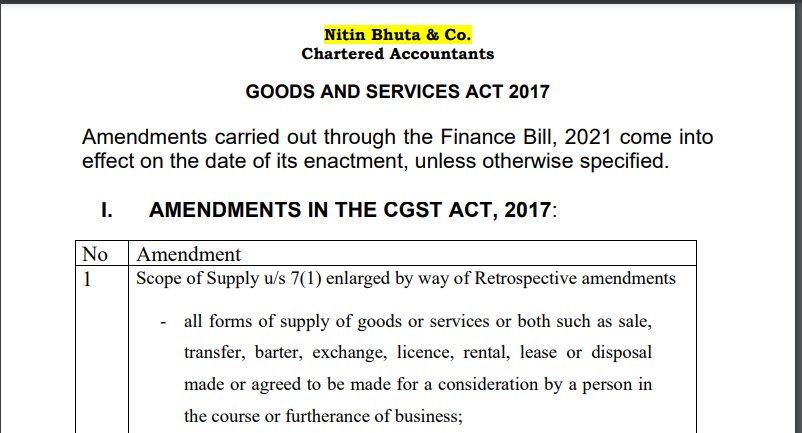

Amendments carried out through the Finance Bill, 2021 come into effect on the date of its enactment, unless otherwise specified.

I. Amendments In The CGST Act, 2017:

Scope of Supply u/s 7(1) enlarged by way of Retrospective amendments

– all forms of supply of goods or services or both such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

A new clause (aa) in sub-section (1) of Section 7 of the CGST Act is being inserted, retrospectively with effect from the 1st July 2017, so as to ensure levy of tax on activities or transactions involving the supply of goods or services by any person, other than an individual, to its members or constituents or vice-versa, for cash, deferred payment or other valuable consideration.

Consequent to the amendment in section 7 of the CGST Act paragraph 7 of Schedule II to the CGST Act is being omitted retrospectively, with effect from the 1st July 2017.

Related Topic:

Indirect Tax Impact On Funds

Our Comment

The intention of the above amendment to provide for overriding the Impact of SC Calcutta Club Judgement emphasizing on Principle of Mutuality and to cover all AOP and BOI and the same is included in 2(84) definition of the person. To amend the law for the benefits of the Sovereign is quite common enough precedents in the public domain.

Such retrospective amendment would be the subject matter of litigation. In my humble opinion, it should have proposed prospectively only so that all stakeholders can plan their affairs.

Related Topic:

Monthly End to End Indirect Taxes Updates

Amendment of Section 16

A new clause (aa) to sub-section (2) of section 16 of the CGST Act is being inserted to provide that input tax credit on invoice or debit note may be availed only when the details of such invoice or debit note have been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note.

Our Comment

ITC can be availed only if the same is reflected and reported in GSTR 1 by the supplier which would be auto-populated in GSTR 2A and GSTR 2B invariably on a real-time basis. The intention is to ensure enforcement of Rule 36(4) and but will it plug the menace of Fake Invoicing or frauds????? Can such conditions be complied? Will such amendment may create litigations as such burden can’t be imposed on TPs?

Ideally, they should have done away with the stipulation which provides that ITC can be claimed by Recipient only if the Supplier has filed the returns and paid the taxes, filing is still controllable but payment of taxes by the supplier is not controllable because of many reasons.

Related Topic:

GST Implications on Transfer of Development Rights in Real Estate Projects

Abolition of GST Audit u/s 35(5) & Self Assessed Reconciliation Statement u/s 44

Sub-section (5) of section 35 of the CGST Act is being omitted so as to remove the mandatory requirement of getting annual accounts audited and reconciliation statement submitted by specified professional.

Section 44 of the CGST Act is being substituted so as to remove the mandatory requirement of furnishing a reconciliation statement duly audited by specified professional and to provide for filing of the annual return on a self-certification basis. It further provides for the Commissioner to exempt a class of taxpayers from the requirement of filing the annual return.

Our Comment

• Filing of GSTR 9 and GSTR 9A would continue as before and even customized reconciliation statements would be implemented;

• TP needs to prepare a reconciliation statement (will they not need our help ………. Food for thought?)

• Stressful time limits may be reduced for some time as I anticipate such audit to be reintroduced in future (????? But when and how it can’t be predicted now ………);

• GST Audits as existed in the earlier regime under Excise and Service Tax would be conducted again and again at the premises of RTP on selection basis or opportunity to be appointed for special audits u/s 65 for all the Professionals;

• It may be faceless GST Audit mechanism too by the Department as Faceless is flavour of the season;

• TAR reporting and/or ITR reporting would synchronize the GST audit reporting as part of reporting exercise;

• Knowledge gained over the past 4 years by studying the law, would help during the representation proceedings if litigation arises.

• Opportunities will open for all the stakeholders be it SME, MSME, TP and or Big Firms to get involved in the process of synchronized and integrated reporting to ensure sustainability;

• I agree it is a loss of professional opportunity for all but it would open up another arena of opportunities for all but we need to work around such situation which is in our control and not the other way round………always after death there is new life

Related Topic:

Comprehensive Charts for all due dates in direct tax and indirect tax

Retrospective amendment to Section 50 – Interest on GST liability

Section 50 of the CGST Act is being amended, retrospectively, to substitute the proviso to sub-section (1) so as to charge interest on net cash liability with effect from the 1st July 2017.

Our Comment

The above amendment has been introduced to incorporate the recommendation of the 39th GST Council. Beneficial retrospective amendment. If notices for recovery on Gross Liability then it can be defended by all. Famous judgement Refex by Madras High court.

Read & download the full copy in pdf:

Nitin Bhuta

Nitin Bhuta

Presently, he is actively involved with limited scale of doing Audits, Direct & Indirect Taxation, Management Advisory as well as handling of litigation matters, etc. of Corporate as Well as Non-Corporate persons. Presently, he is actively involved vetting out of drafted legal documents pertaining to business arrangements from the tax compliance perspective.