Suggestions to Rationalise Current Direct Tax Structure

Table of Contents

- Suggestions to Rationalise Current Direct Tax Structure

- 1 Allow Filling ITR After 31-March of AY

- 2 REDUCTION IN % OF Minimum Maintenance of NET PROFIT in SECTION 44ADA for Professionals

- 3 Rationalise 44AE – Reduce Presumptive Rate

- 4 Tax Rates In Case of Firms

- 5 PARTNERSHIP FIRM – 40(b) limit of Max. REMUNERATION

- 6 PARTNERSHIP FIRM & INGENUINE HARDSHIP OF TAX AUDIT u/s 44AD OR higher Net profit 8%/6%

- 7 5 Year Continuity rule in case of 44AD

- 8 Rationalise Due Dates For Avoiding Clash ( staggered manner)

- 9 Remove TCS On Goods

- 10 Rationalise Late Fees

- Suggestions To Reforming Direct Taxes

- 11 Rationalise New Tax Rates In Case of Individuals / HUF

- 12 Reporting of LTCG & STCG On Shares / Debentures / MFs / Securities In 26AS

- 13 Suggestion To Bring TCS For Jewelry Sector

- 14 Suggestion To Increase Taxpayer Trust & Trust In Our Taxation System – Honoring The Honest

- 15 Solution To Bring Black Money / Undisclosed Assets Into System

Suggestions to Rationalise Current Direct Tax Structure

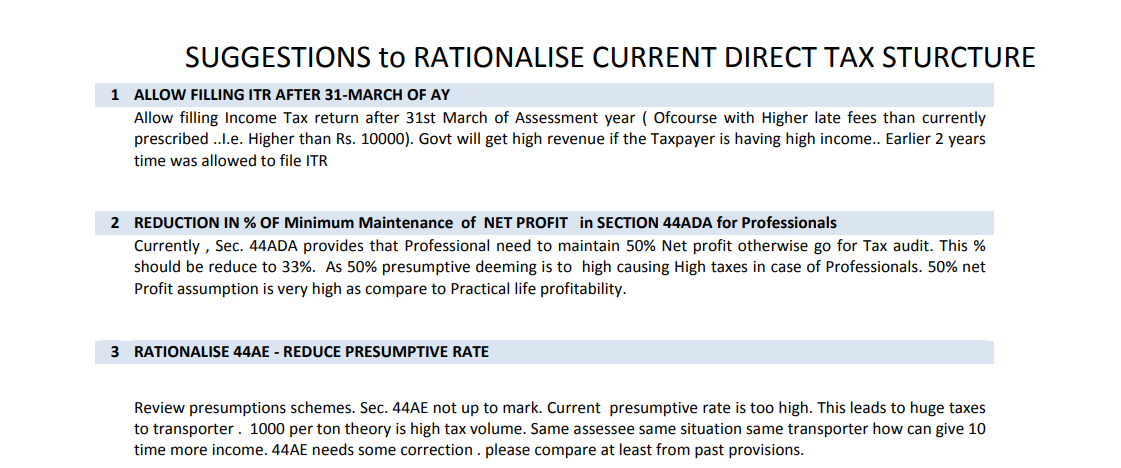

1 Allow Filling ITR After 31-March of AY

Allow filling Income Tax return after 31st March of Assessment year ( Ofcourse with Higher late fees than currently prescribed ..I.e. Higher than Rs. 10000). Govt will get high revenue if the Taxpayer is having a high income.. Earlier 2 years time was allowed to file ITR

2 REDUCTION IN % OF Minimum Maintenance of NET PROFIT in SECTION 44ADA for Professionals

Currently, Sec. 44ADA provides that Professional need to maintain 50% Net profit otherwise go for a Tax audit. This % should be reduced to 33%. As 50% of presumptive deeming is too high causing High taxes in case of Professionals. 50% net Profit assumption is very high as compare to Practical life profitability.

3 Rationalise 44AE – Reduce Presumptive Rate

Review presumptions schemes. Sec. 44AE not up to mark. The current presumptive rate is too high. This leads to huge taxes to the the transporter. 1000 per ton theory is high tax volume. Same assessee same situation same transporter how can give 10 times more income. 44AE needs some correction. please compare at least from past provisions.

4 Tax Rates In Case of Firms

Currently, They are paying 31.2%. This should be reduced to 25% as corporate are paying at 26%

5 PARTNERSHIP FIRM – 40(b) limit of Max. REMUNERATION

Currently 1.5 lac is allowed in case of lower Book profit or loss. . This should be increased to 3 Lac Currently, up to 3 lac Book profit – 90% and remaining 60% of Book profit for calculating Max Remuneration. . This 3 lac should be increased to 10 lac

6 PARTNERSHIP FIRM & INGENUINE HARDSHIP OF TAX AUDIT u/s 44AD OR higher Net profit 8%/6%

In case of partnership firms, They need to maintain 8% / 6% Net profit after deducting Remuneration & Interest otherwise they have to go for Tax Audit. This came in Finance Act, 2016 by Deletion of the proviso to sub-section (2) providing for deduction of interest and remuneration paid to partners by the firm from the presumptive income under section 44AD – Proviso to remain/restored to avoid genuine hardship to small and medium firms. Allow deduction in respect of remuneration paid to partners within the limits set out in section 40(b), the proviso to section to 44AD(2) may be restored. This way, the Partnership Firm doesn’t need to maintain HIGHER NET PROFIT.

7 5 Year Continuity rule in case of 44AD

Sec. 44AD opt-in and opt-out also a tricky & very harsh. As one must comply for 5 years continues This 5-year terms can be taken 1 year or 2 years.

8 Rationalise Due Dates For Avoiding Clash ( staggered manner)

ITR 1, 2 = 31-7

ITR 3,4, 5 = NON Audited = 31-8

ITR -3, 5 AUDITED & their TAR = 31-10

ITR 6,7 & their TAR= 30-11

TRANSFER PRICING CASE TAR & ITR = 31-12

Every year schema released every late. 26AS updated late. So these problems can be tackled

9 Remove TCS On Goods

This is nothing but a useless Formality. There is no new revenue coming to Government

10 Rationalise Late Fees

for late filling if TCS / TDS return – Rs. 200 per day should be reduced to 25 per day

for late filing of IT return (234f) late fees should be decreased to 1000 till 31-12, then 5000 till 31-3

Suggestions To Reforming Direct Taxes

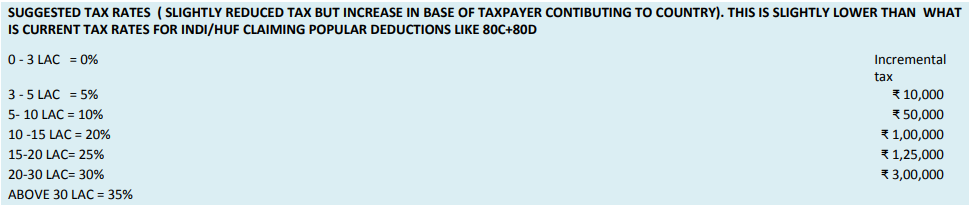

11 Rationalise New Tax Rates In Case of Individuals / HUF

NO NEW VS OLD RATE. ONLY ONE SET OF TAX RATE SLAB AS BELOW

NO STANDARD DEDUCTION OF 50000 TO SALARIED \ PENSIONERS

NO REBATE OF 12500 AS PER SEC. 87A

NO DEDUCTION AS PER CHAPTER VI-A ( I.E NO DEDUCTION OF LIC+MEDICLAIM+PPF+HOUSING LOAN + NSC +SCHOOL FEES + DONATIONS + ETC ETC )

NO CONFUSION OF SELECTION OF OLD VS NEW

NO CONCEPT OF GTI IN CASE OF INDIVIDUALS / HUF

3 LAC STRAIGHT BASIC EXEMPTION LIMIT TO ALL.

NO CESS

STRAIGHT WAY TAX AFTER 3 LAC INCOME… EACH EARNING COUNTRYMEN WILL CONTRIBUTE TO DEVELOPMENT OF COUNTRY

12 Reporting of LTCG & STCG On Shares / Debentures / MFs / Securities In 26AS

THERE SHOULD BE REPORTING OF LTCG / STCG WHEN SALE OF EQUITY SHARES / MF, AS PER INCOME TAX NORMS. THIS WILL ENSURE THAT ALL SUCH TRANSACTIONS WILL BE REPORTED UNDER ITR

13 Suggestion To Bring TCS For Jewelry Sector

IT IS VERY INGONRED AREA. TCS ON SALE OF GOLD / GOLD ORNAMENTS / DIAMOND ETC if more than RS. 50000 under a B2C transaction. TCS WILL BE COLLECTED BY JEWELER & REPORTING IN FORM 26AS TO BE DONE AS USUAL. AGAIN, THIS WILL ENSURE THAT ALL SUCH TRANSACTIONS WILL BE REPORTED UNDER ITR. it will tap on huge black money stuck in Gold

14 Suggestion To Increase Taxpayer Trust & Trust In Our Taxation System – Honoring The Honest

It’s high time that Government should think about giving some benefits to those taxpayers (only individuals) who have contributed to the Economy by paying high taxes in last 70 years. They are the true nation-building partner. They are the true contributors to the growth of our country. It’s high time Government should think of giving them back & salute their contribution to economy, honesty & loyalty towards the country. We have to see other countries how they respect their High taxpayers like the USA giving more retirement benefits based on Tax paid in past. A proper scheme should be thought upon.

Related Topic:

The Direct Tax Vivad Se Vishwas Rules, 2020

SO WHAT CAN BE DONE?

1. GIVE PRIORITY IN PASSPORT LINE, AIRPORT TICKET COUNTERS 2. GIVE PRIORITY IN RAILWAY RESERVATION, 3. GIVING PRIORITY IN GETTING ANY GOVERNMENT DEPARTMENT WORK DONE, 4. GIVING THEM SOME RETIREMENT BENEFIT IN PENSION 5. HEALTHCARE BENEFITS LIKE HEALTH INSURANCE FREELY ETC ETC ETC

15 Solution To Bring Black Money / Undisclosed Assets Into System

DISCLOSE OF UNDISCLOSED MONEY / PROPERTY / FINANCIAL ASSETS. By ONE TIME AMNESTY SCHEME. MONEY / ASSETS DISCLOSED IN THIS SCHEME. 50% PAYMENT NOW AS TAX. 50% OF AMOUNT TO BE DEPOSITED IN BANK AS FIXED DEPOSITS with Lock-in of 5 years. SO THAT 100%, BLACK-MONEY WILL COME INTO SYSTEM.