Deductions for Medical Treatment under Income Tax

Table of Contents

Deductions for Medical Treatment under Income Tax

“A simple provision for claiming the deduction for medical treatment is not so simple to understand. Various intricacies which arises have been discussed in this Article”

I. Preamble:

Deduction from taxable income in respect of Medical Expenditure or Medical treatment. If one goes through the various intricacies involved therein, one will realize that it is not so simple as it looks. In this article, I will discuss various deductions available to a taxpayer for expenditure incurred in respect of the health of a Tax-Payer himself or his family or parents. There are situations when a deduction is available even without incurring any expenses.

II. Deduction under Section 80 D:

The first and foremost deduction is under section 80 D of the Income Tax Act, 1961. This deduction is given from the Gross Total Income of the Assessee. We shall discuss relevant provisions as applicable for Financial Year 2019-20 relevant to AY 2020-21. Broadly speaking, Tax-Payer can claim a deduction for himself, for his family, and for his parents.

Medical Insurance paid to an approved Insurance Company on the health of self or family or any of parent can be claimed. Expenditure on preventive health check-ups of self, family, or parent is also covered. Further Medical Expenditure incurred on the health of a Tax Payer who is a senior citizen during the year or on the health of any of the parent who is a senior citizen can also be claimed.

The payment of premium or medical expenses should have been made during the financial year. i.e 1/04/2019 to 31/03/2020. However, as a special relaxation, this year due to pandemic, the payment made from 1/4/2020 to 31/07/2020 will also be considered.

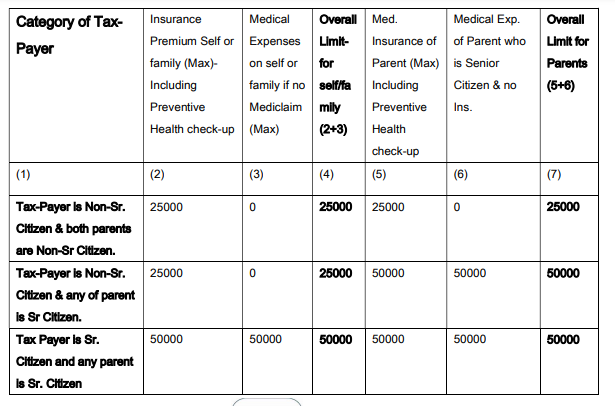

Summary of Deductions:

Points to be noted.

1. Medical Insurance Premium should not have been paid in Cash

2. Certificate for claiming deduction under section 80D should be obtained from Insurance Company

3. Preventive Health Check-up Expenses up to Rs. 5000 can be in Cash and includible in a Limit of Rs. 25,000 / 50,000

4. Medical Expenditure for self/family/parents should not be in cash and only through banking mode.

5. Medical Expenses can be claimed by a Tax Payer who is a Sr. citizen or for a parent who is Sr. citizen and only if no amount is paid for Insurance for whom medical expenses being claimed.

6. Family means -Spouse and dependent children

7. A parent need not be a dependent parent

8. The amount should have been paid during the year out of income chargeable to tax

9. Even if Husband has claimed Medical Expenses for self/spouse/ family and Parents who are Senior citizens, Wife can also claim separately for herself /spouse/family and her parents who are Senior Citizens.

10. A Tax-Payer can claim Medical expenditure for a parent who is a senior citizen and no insurance is paid for him and also the parent himself can also claim the deduction for his medical expenses.

11. If Insurance is paid in lump-sum for more than one year, then it will be allowed on a proportionate basis. The fraction for proportion shall be ascertained by placing numerator as one and denominator as the number of relevant previous years for which insurance has been paid. Relevant previous years means the previous year beginning with the previous year in which such amount is paid and the subsequent previous year or years during which the insurance shall have an effect or be in force.

12. Any contribution made to the Central Government Health Scheme or such other Scheme as may be notified by the Central Government on this behalf shall also qualify along with Insurance Premium.

13. Where the assessee is a Hindu undivided family, it shall be the aggregate of the following, namely:—

(a) amount paid to effect or to keep in force an insurance on the health of any member of that Hindu undivided family up to twenty-five thousand rupees; and

(b) the amount paid on account of medical expenditure incurred on the health of any member of the Hindu undivided family who is a senior citizen and does not exceed in the aggregate fifty thousand rupees and no insurance has been paid on the health of that senior citizen.

14. It is not necessary the assessee is a “Resident” as per Section 6 of the Income Tax Act, 1961.

Disclaimer:

(These are authors’ personal views for educational purposes and the reader is advised to consult his Consultant/Adviser in case of any clarification or further guidance. No portion of this article can be quoted or reproduced or used in any manner for any purpose without the permission of the author. No responsibility can be attributed to the author in any manner.)

Read & Download the full copy in pdf:

CA Pankaj Gupta

CA Pankaj Gupta

Mr. Pankaj Gupta is a Fellow Member of the Institute of Chartered Accountants of India (ICAI) and also Fellow Member of The Institute of Company Secretaries of India (ICSI). He has his own CA practice at Noida under the Firm Name “ P.R. Gupta & Co.” and has over 40 years of professional experience dealing in Direct Taxes, Indirect Taxes, Corporate Laws, and FEMA Laws, etc. Clientele includes Non-Residents Individuals and corporate entities. He has remained office-bearer of many professional organizations like ICAI, ICSI, Noida Management Association. He has been instrumental in organizing various professional seminars and has been a speaker at various forums and contributing professional Articles.