GST on Corporate Guarantees

Table of Contents

GST on Corporate Guarantees

1. Introduction

The Goods and Services Tax Regime brought a plethora of changes to the pre-existing taxation regime of the country. In the current paper, the author has made efforts to take into account a wholesome view of the taxability of corporate guarantees without consideration under the GST regime. In Chapter 2, the scope of guarantees and indemnities are deliberated upon. Chapter 3 refers to understanding the meaning of corporate guarantees and how it is different from personal guarantee and bank guarantee. Chapter 4 refers to the taxability of corporate guarantee under the GST Regime.

2. Guarantees And Indemnities (Indian Contract Act, 1872)

2.1. Guarantee is defined under Section 126 of the Indian Contracts Act, 1872. A guarantee is a contract to perform the promise or discharge the liability of a third person in case of his default. The three parties to the contract are:

a. the person who gives the guarantee is called the Surety,

b. the person for whom the guarantee is given is called the Principal Debtor and

c. the person to whom the guarantee is given is called the Creditor.

For example, if A advances a loan of Rs. 1,000 to B and C promises to A that if B does not repay the loan, C will repay it on his behalf. This is a contract of guarantee. Here B is the principal debtor, A is the creditor and C is the surety or guarantor\

2.2. A contract of indemnity as defined under Section 124 of the Indian Contracts Act, 1872, is a contract by which one party promises to save the other party from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person. For example, C enters into a contract to indemnify B against a consequence of a legal suit that may be filed by F in respect of a certain sum of money of Rs. 500. Such a contract may be expressed or implied. The above example is of an expressed contract, however; if any person acts on the request of another and incurs any expenses, then such a person can recover such expenses from the person who requested the same. This instance is an implied contract of indemnity. The two relevant parties are:

a. The Indemnifier (person who makes good of the loss), and

b. The Indemnified or indemnity holder (the person whose loss is made good).

2.3. A contract of insurance is also one of the examples of an indemnity contract under English Law. Such a contract has a consideration attached to it in form of the insurance premium. However, under the Indian Contracts Act, 1872, the contract of indemnity is restricted to the indemnification of the loss caused by the promisor or any other person. Therefore, the loss caused by any accidents or events that are not concerned with the conduct of any person appears to be out of the scope of such indemnification.

2.4. Therefore, a contract of guarantee and such as indemnity must satisfy all the elements of a valid contract. However, when it comes to consideration of a contract, there is a special feature with regard to the contract of guarantee. The consideration received by the principal debtor is sufficient for surety for the purpose of this contract of guarantee. Thus, anything is done or any promise made for the benefit of the principal debtor may be a sufficient consideration to the surety for giving the guarantee.

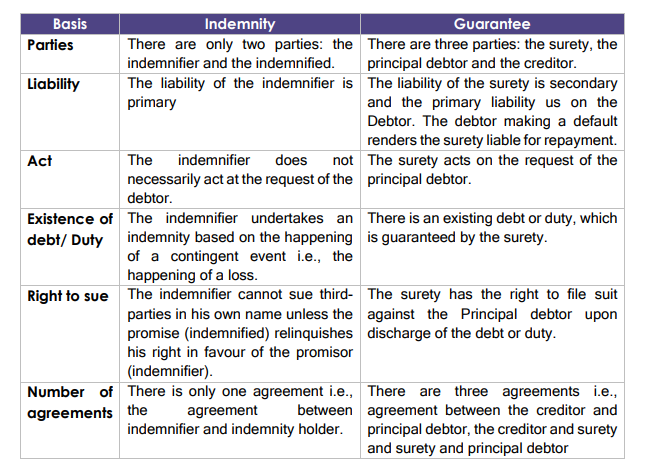

2.5. Distinction between the Indemnity and guarantees:

“Whether a contract is one of guarantee or of indemnity is a question of construction in each case”

3. Corporate Guarantee

3.1. After establishing the distinction between the fundamental nature of a Contract of Indemnity and Guarantee, let us understand the concept of corporate guarantee.

3.2. A Corporate Guarantee is a guarantee in which any corporation agrees to be responsible for the financial obligations of, or the performance of, contractual obligations by the principal debtor to the creditor, in the event the principal debtor fails to discharge his obligation to the Creditor. These transactions usually include inter-group Corporate guarantees, which are given to facilitate a smoother financial functioning to the ‘Related’ or ‘Associated’ persons.

3.3. Corporate Guarantees without consideration are quite a generic transaction among companies wherein holding or parent companies issues a corporate guarantee to various Banks or other Financial Institutions as collateral security for the credit facilities availed by its subsidiaries. Also, corporate guarantee, is unsecured, which means it is not secured by or tied to any specific asset of the surety. Corporate guarantees to related parties without consideration are based on the business needs and for group synergy.

Corporate Guarantee and Personal Guarantee

3.4. Corporate Guarantee is different from Personal Guarantee in the sense that Personal Guarantee is a promise made by an individual being in a capacity of an executive or partner of a business which has taken any debt and the promisor assumes a personal responsibility of repayment upon default by the business. For example, as per the banking practices the banks require collateral security for providing financial assistance which may generally take the form of a personal guarantee taken from a director/ partner of such Borrower Company/ firm.

Read & Download the full copy in pdf: