Workshop on GST – E-way Bill

Table of Contents

Workshop on GST – E-way Bill

Consequences of Non-Compliance of E Way Bill provision :

✓ where any person transports any goods or stores any goods while they are in transit

✓ In contravention of the provisions of this Act/Rules or the rules

✓ all such GOODS AND CONVEYANCE shall be liable to detention or seizure.

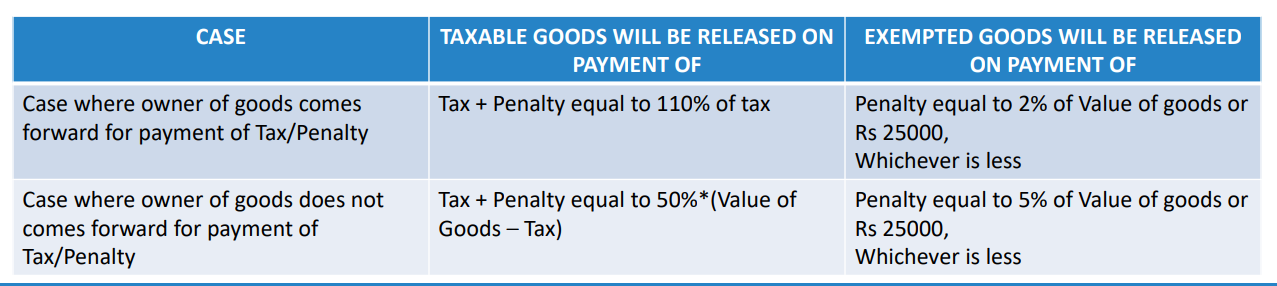

✓ It will be released upon below payment

What is Electronic Way Bill (EWB):

✓ Electronic Way Bill (E-Way Bill) is basically a compliance mechanism

✓ Wherein by way of a digital interface

✓ The person causing the movement of goods uploads the relevant information

✓ Prior to the commencement of movement of goods and

✓ Generates e-way bill on the GST portal

✓ An E-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding Rs 50,000.

✓ It is generated from the GST Common Portal by the registered persons or transporters

Related Topic:

Who is required to make an E-way bill in GST? procedure and liability

Need and Benefits of E – Way Bill:

1) Compliance of GST Law: It is a mechanism to ensure that goods being Transported, comply with GST Law i.e. Invoicing, disclosure, Tax payment, etc.

2) Tracking: It is an effective tool to track the movement of Goods.

3) To Check Tax Evasion

4) Uniform Provisions across Nation: The e-way bill provisions under GST will bring in a uniform e-way bill rule which will be applicable throughout the country. Earlier different states prescribed different way bill rules which made compliance difficult and it was a major contributor to the bottlenecks at the check posts

5) Reduction in Transport Time: The physical interface will be replaced by a digital interface, which will facilitate faster movement of goods.

6) Valid across India: One E-way bill is valid in every State and Union territory. No need to prepare statewise EWB.

7) Beneficial to Economy: Indian economy save up to Rs 2300 crore in transportation which they lost annually due to truck delays at state check posts

8) Increase in Government Revenue: It is expected that due to the Eway bill, government revenue is will increase by 20%.

9) Beneficial to logistic Industry: It is bound to improve the turnaround time of vehicles and help the logistics industry by increasing the average distances travelled, reducing the travel time as well as costs.

10) The abolition of check posts: It’s a huge relief for truckers who would earlier have to wait in queue for hours to clear the check posts. No need for Transit pass when goods passing through the different state.

11) Nature Friendly: It is expected that due to the E-way bill, 50 Tons of Paper will be saved Every Day.

EWB related Central Govt Notification:

Below Central Notifications are issued for EWB as of now

✓ Notification No 12/2018 dated 07.03.18 – Revised EWB Rules notified

✓ Notification No 15/2018 dated 23.03.18 – EWB Rules made effective from 1st April 2018

Read & Download the full Copy in pdf:

Swapnil Munot

Swapnil Munot

Delhi, India

CA Swapnil Munot is having keen interest & expertise in Indirect Tax and Foreign Trade policy. He has authored a book on GST, titled “HANDBOOK ON GST”. Also authored E-Book on “GST E Way Bill” and “GST Amendment Act”. He has conducted 290+ Seminars across India on GST for Government Officers, Commissioners, Professionals and Industries at the various forums – FIEO, ICAI, MCCIA, MSME, WMTPA, CII, NACIN, ICMA (Now ICAI), YASHADA, Various Associations, Institution, and Colleges, etc.