Composition late fees waiver- 5 things to know

Composition late fees waiver-

The best relief of GST for small taxpayers. Late fees of composition dealers are waived off. But there are conditions and restrictions. Please read all of these carefully before you lose the benefit. Composition late fees waiver was a demand for a long. It is fulfilled with terms and conditions.

Composition late fees waiver- Important points

- The late fees waiver is only up to return of the march 2020 quarter. The duration which is exempted is from July 2017 to March 2020. Thus the benefit is not applicable to the return of June quarter of 2020 and onwards.

- The provision is introduced by notification no. 67/2020 -CT dated 21 September 2020.

- A proviso is inserted in notification no. 73/2017 dated 29th December 2017.

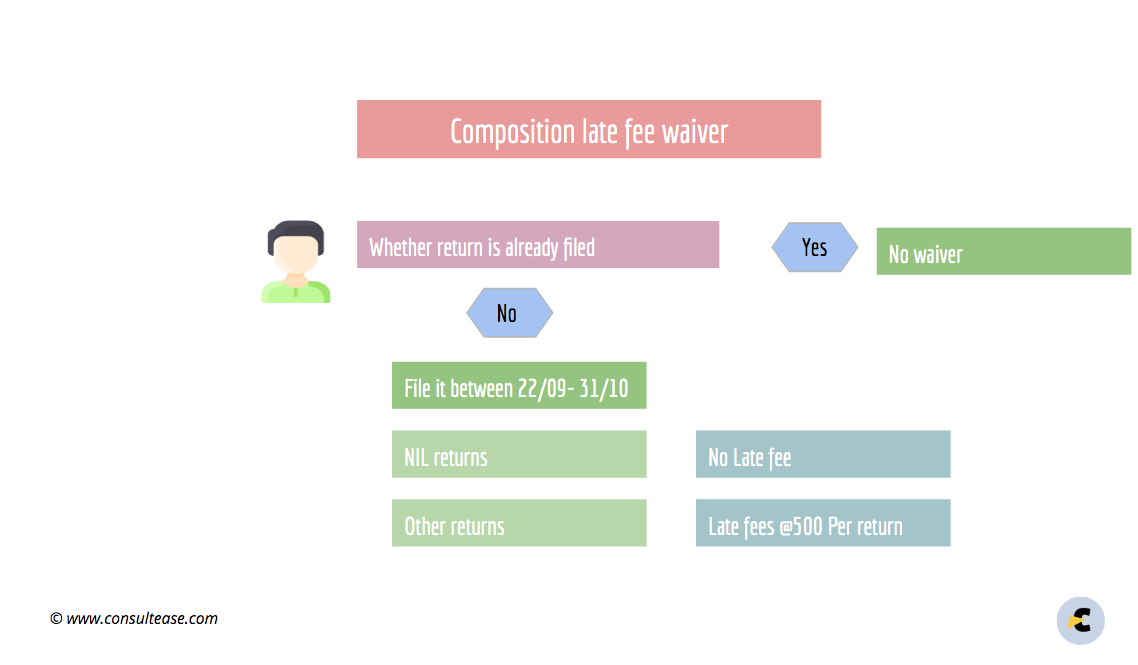

- A full waiver of late fees for composition returns is only for the NIL returns. when there is a tax payable in a return, the waiver is limited to Rs. 500 per return. A composition dealer is required to file a return every quarter. Thus the maximum late fees can be Rs. 500 for each quarter from July 2017 to March 2020.

- The waiver from late fees is when return is filed in the prescribed period. That is the 22nd day of September 2020 to the 31st day of October 2020.

- In case the return is already filed with late fees. No refund is available as the benefit is only for the prospective filers.

- The refund of fees already paid is not covered.

- This scheme is only for prospective filing. Although it covers the composition returns since inception till March 2020.

- At present, a composition dealer is required to file a quarterly return.

- The form for composition return forms CMP 08. They are also required to file a yearly return in form GSTR 4A. The annual return is also applicable to them but for the first two years, their annual return is exempted. Because taxpayers having less than 2 Cr turnover are not required to file an annual return in GSTR 9.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.