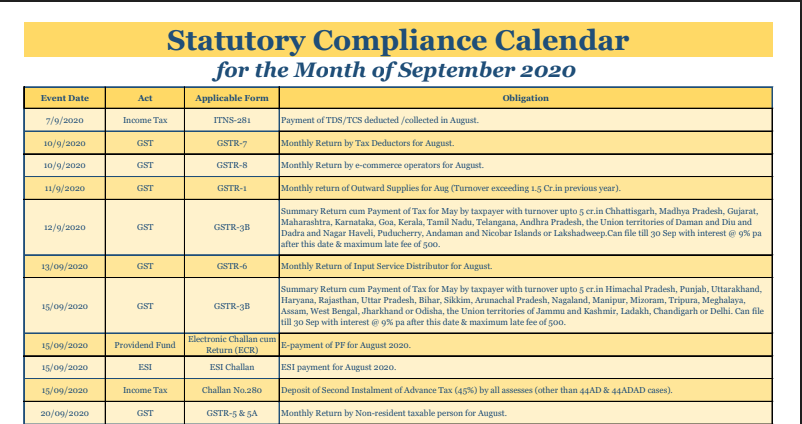

Statutory Compliance Calendar for the Month of September 2020

Statutory Compliance Calendar for the Month of September 2020

| Event Date | Act | Applicable Form | Obligation |

| 7/9/2020 | Income Tax | ITNS-281 | Payment of TDS/TCS deducted /collected in August. |

| 10/9/2020 | GST | GSTR-7 | Monthly Return by Tax Deductors for August. |

| 10/9/2020 | GST | GSTR-8 | Monthly Return by e-commerce operators for August. |

| 11/9/2020 | GST | GSTR-1 | Monthly Return of Outward Supplies for Aug (Turnover exceeding 1.5 Cr.in previous years). |

| 12/9/2020 | GST | GSTR-3B | Summary Return cum Payment of Tax for May by the taxpayer with turnover up to 5 cr.in Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep.Can file till 30 Sep with interest @ 9% pa after this date & maximum late fee of 500. |

| 13/09/2020 | GST | GSTR-6 | Monthly Return of Input Service Distributor for August. |

| 15/09/2020 | GST | GSTR-3B | Summary Return cum Payment of Tax for May by a taxpayer with turnover up to 5 cr.in Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi. Can file till 30 Sep with interest @ 9% pa after this date & maximum late fee of 500. |

| 15/09/2020 | Provident Fund | Electronic Challan cum Return (ECR) | E-payment of PF for August 2020. |

| 15/09/2020 | ESI | ESI Challan | ESI payment for August 2020. |

| 15/09/2020 | Income Tax | Challan No.280 | Deposit of Second Instalment of Advance Tax (45%) by all assesses (other than 44AD & 44ADAD cases). |

| 20/09/2020 | GST | GSTR-5 & 5A | Monthly Return by Non-resident taxable person for August. |

| 20/09/2020 | GST | GSTR-3B | Summary Return cum Payment of Tax for Aug by taxpayers having an aggregate turnover of more than Rs. 5 cr in a previous financial year. |

| 23/09/2020 | GST | GSTR-3B | Summary Return cum Payment of Tax for Jun by the taxpayer with turnover up to 5 cr.in Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep.Can file till 30 Sep with interest @ 9% pa after this date & maximum late fee of 500. |

| 25/09/2020 | GST | GSTR-3B | Summary Return cum Payment of Tax for June by the taxpayer with turnover up to 5 cr.in Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi. Can file till 30 Sep with interest @ 9% pa after this date & maximum late fee of 500. |

| 27/09/2020 | GST | GSTR-3B | Summary Return cum Payment of Tax for Jul by taxpayer with turnover upto 5 cr.in Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep. Can file till 30 Sep with interest @ 9% pa after this date & maximum late fee of 500. |

| 29/09/2020 | GST | GSTR-3B | Summary Return cum Payment of Tax for July by the taxpayer with turnover up to 5 cr.in Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi. Can file till 30 Sep with interest @ 9% pa after this date & maximum late fee of 500. |

| 30/09/2020 | GST | GSTR-3B | Summary Return cum Payment of Tax for Feb, Mar, Apr, May, Jun & Jul with interest & maximum late fee of 500. (Irrespective of Turnover) |

| 30/09/2020 | GST | GSTR-9 | GST Annual Return for 18-19. Mandatory if Turnover > 2 cr. |

| 30/09/2020 | GST | GSTR-9C | GST Audit Report for 18-19. Mandatory if Turnover > 5 cr. |

| 30/09/2020 | Income Tax | Form 26QB | Deposit of TDS on payment made for the purchase of property in August. |

| 30/09/2020 | Income Tax | – | Investment etc for Capital Gains exemption in FY 19-20. |

| 30/09/2020 | Income Tax | Form 26QD | Deposit of TDS u/s 194M for August. |

| 30/09/2020 | Income Tax | ITR- 1 to 7 | Last date for filing Original & Revised ITR for AY 2019-20. |

| 30/09/2020 | GST | GST-REG 21 | Filing of Application for Revocation of Cancellation of Registration where registration cancelled up to 12.06.2020. |

Read the Copy:

CA Rohit Kapoor

CA Rohit Kapoor

Delhi, India

CA Rohit Kapoor is a member of the Institute of Chartered Accountants of India (ICAI) and has vast experience in Direct Taxes with the working experience of 8+ Years. Rohit has also delivered Sessions in the Workshops, Training Session, etc. organized by RSMS, RAK, BCI, PSF, etc. He is also on the Board of Various Public Companies and National Level NGOs.