FAQ’s on GSTR 2A in GST

Table of Contents

What is GSTR 2A?

GSTR 2A provides for the auto drafted details of various data at the GST portal.

What information is auto-populated in GSTR 2A?

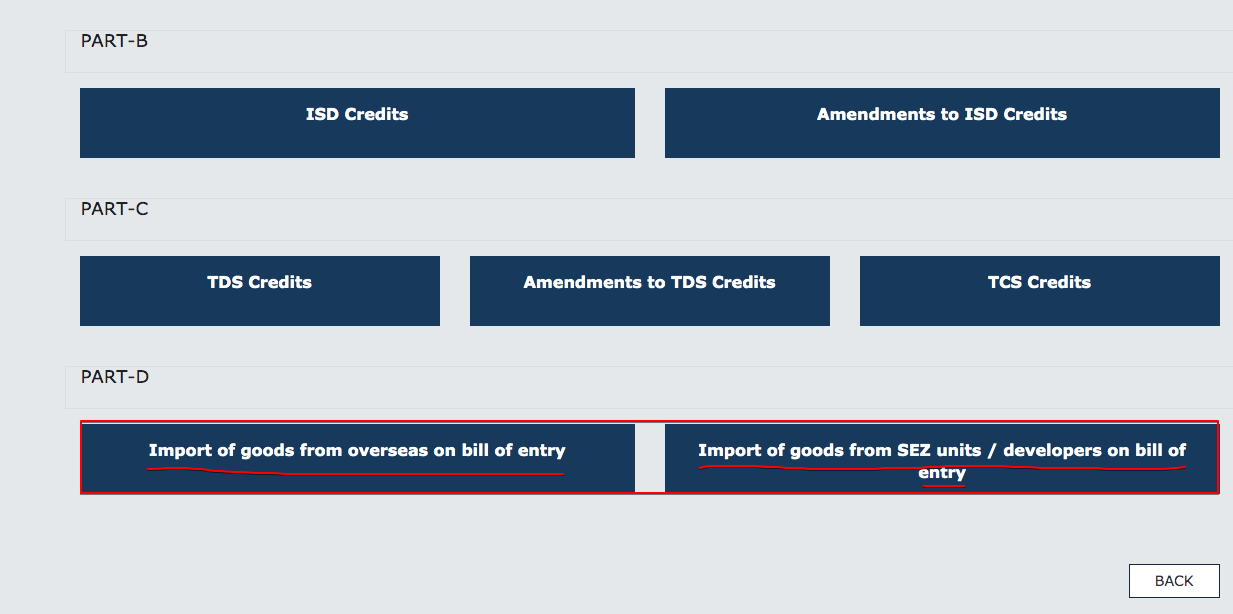

GSTR 2A contains four parts. Each portion has some auto-populated data.

| Part A | It contains the details of invoices uploaded by suppliers. It also contains the Debit notes/credit notes and amendments in invoices or Debit note or credit notes |

| Part B | ISD credits |

| Part C | TDS and TDS credits |

| Part D | Bill of entry |

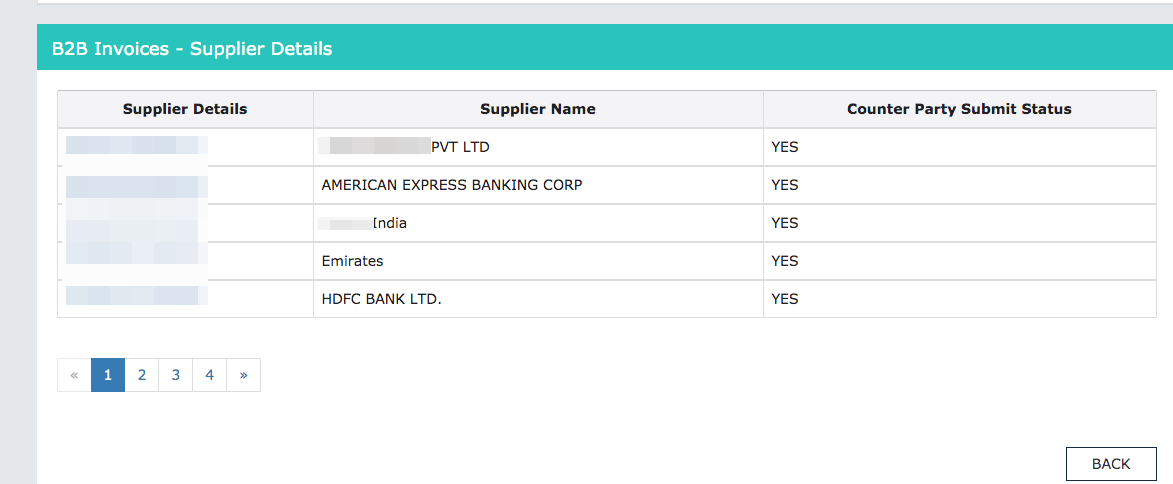

What details are auto reflected in part a of GSTR 2A?

Table A contains the details of invoices uploaded by various suppliers.

It contains the GSTIN of the supplier, the name of the supplier, and the status of filing. Further, once you click on a GSTIN, it will show the following details.

- Invoice number entered by the supplier.

- InvoiceDate

- Invoice Type

- Place of supply

- Whether the supply attracts the reverse charge

- Applicable percentage

- Total Invoice value

- Total Taxable Value

- Integrated Tax

- Central Tax

- State Tax

- Cess

Debit/credit notes

Details related to the debit or credit notes uploaded by the supplier is also available in GSTR 2A, part A.

What details are auto reflected in Part b of GSTR 2A?

In Part b details related to the ISD, credit is auto reflected

What details are auto reflected in Part c of GSTR 2A?

Part C contains the details related to the TDS & TCS. Amendments related to the TDS are also auto reflected. But in the case of TCS, amendments are not reflected.

What details are auto reflected in Part d of GSTR 2A?

Newly introduced part d provides for the information related to the bill of entry. A bill of entry filed by the taxpayer is auto-populated here.

How we can match GSTR 2A?

There are many matching tools. You can download a free tool here. We can download the excel of 2A. Then we can match it with our purchases. Now, an input tax credit for the invoices not reflecting in 2A is not available. After reconciliation, we can take the ITC of matching invoices.

It also reflects in table 8 of the GST annual return. But the invoices where the PoS is not in the state of the supplier are not included in table 8. As per GST provisions, its ITC is not allowed. e.g. in the case of Hotel services taken in other states. The place of supply is in the state of the Hotel. This ITC is not allowed.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.