Non-Resident Taxable Person (NRTP) (Section 2(77) Of CGST ACT)

Table of Contents

- Non-Resident Taxable Person (NRTP) (Section 2(77) Of CGST ACT)

- Registration Requirements: –

- Advance Deposit of Tax: –

- The validity of Registration Certificate Granted to CTP: –

- Return: –

- Input Tax Credit: –

- Refund: –

- What is the process to obtain a GST Registration for a Non-resident Taxable Person?

- FAQ:-

- Question 1:- Can an NRTP opt for Composition?

- Question 2:- When should I apply for a Registration as an NRTP?

- Question 3:- Can I extend my Registration as an NRTP?

- Question 4:- I have deposited advance tax but do not want to continue the business. How shall I get my money back?

- Read the Copy:

Non-Resident Taxable Person (NRTP) (Section 2(77) Of CGST ACT)

“Non-resident taxable person” means any person who

➢ Occasionally undertakes transactions

➢ Involving the supply of goods or services or both

➢ Whether as principal or agent or in any other capacity

➢ But who has no fixed place of business or residence in India

Note: – A non-resident taxable person making taxable supply in India has to compulsorily take registration. There is no threshold limit for registration

For Example: – A repair and maintenance service provided by an employee of a Company registered in The USA to a Manufacturing Company in India. USA Registered Company does not have any Place of Business or residence in India. Thus it is required to take registration as a Non-Resident Taxable Person in GST.

A non-resident taxable person cannot exercise the option to pay tax under composition levy.

Registration Requirements: –

➢ A Non-Resident Taxable Person to apply for registration at least five days prior to the commencement of business.

➢ Section 25 of the CGST Act requires that a person wishing to get himself registered under GST law must have a PAN issued by Income Tax Department. Where an NRTP does not have a PAN, he may be granted registration on the basis of a self-attested copy of his valid passport along with an application signed by his authorized signatory who is a resident of India having a valid PAN.

➢ In the case of a business entity incorporated or established outside India, the application for registration shall be submitted along with its tax identification number or unique number on the basis of which the entity identified by the foreign government.

Related Topic:

TAXABILITY OF TDR ON OR AFTER 01.04.2019

Advance Deposit of Tax: –

While submitting the registration application, NRTP is required to deposit tax in advance equivalent to the estimated amount of tax liability for the period for which registration is sought.

For Example:– Mr. X estimated his tax liability service at 100000. He is required to make an advance payment of tax of Rs. 18000 (100000*18%) to obtain temporary registration.

Such a person will get a TRN (temporary reference number) for making an advance deposit of tax which shall be credited to his Electronic cash ledger. An acknowledgment of receipt of an application for registration is issued only after the said deposit.

Where an extension of time is sought, NRTP will deposit an additional amount of tax equivalent to the estimated tax liability for the period for which the extension is sought.

Related Topic:

Summons, Cross-Examination, And Arrest, Under CGST Act, 2017

The validity of Registration Certificate Granted to CTP: –

• The registration certificate obtained by NRTP shall remain valid for the period specified in the registration application or 90 days from the effective date of registration, whichever is earlier.

The time period of 90 days can be extended further by a period not exceeding 90 days by making an application before the end of the validity of the registration.

• NRTP will make taxable supplies only after the issuance of the certificate of registration.

Related Topic:

Casual Taxable Person (CTP) (Section 2(20) of CGST Act)

Return: –

➢ The non-resident taxable person shall furnish a return in FORM GSTR-5 electronically through the Common Portal, either directly or through a Facilitation Centre notified by the Commissioner,

➢ Including therein the details of outward supplies and inward supplies and shall pay the tax, interest, penalty, fees or any other amount payable under the Act or,

➢ These rules within twenty days after the end of a calendar month or within seven days after the last day of the validity period of registration, whichever is earlier.

Input Tax Credit: –

➢ The input tax credit shall not be available in respect of goods or services or both received by a non-resident taxable person except on goods imported by him.

➢ The taxes paid by a non- resident taxable person shall be available as credit to the respective recipients.

Refund: –

➢ The amount of advance tax deposited by a non-resident taxable person under will be refunded only after the person has furnished all the returns required in respect of the entire period for which the certificate of registration granted to him had remained in force.

➢ The refund can be applied in serial no. 13 of the FORM GSTR -5.

What is the process to obtain a GST Registration for a Non-resident Taxable Person?

➢ As a Non-Resident Taxable Person, you must fill Part A of the Registration Form, which consists of:

➢ Legal Name of the Non-Resident Taxable Person.

➢ Permanent Account Number (PAN) of the Non-Resident Taxable Person/ Passport Number of the Non-Resident Taxable Person/ Tax Identification Number (TIN) or unique number on the basis of which the entity is identified by the Government of that country

➢ Name of the Authorized Signatory (as per PAN)

➢ PAN of Authorised Signatory

➢ Email Address of Authorised Signatory

➢ Indian Mobile Number of Authorised Signatory.

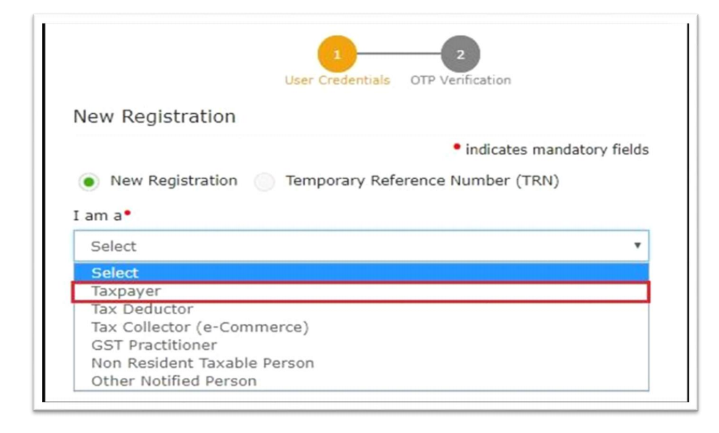

Remember to select Non-Resident Taxable Person in the mandatory dropdown – ‘I am a’

Please refer to screenshot below:

➢ Once, the PAN, email, and mobile number are validated, a Temporary Reference Number (TRN) will be generated and communicated to you via SMS and email. Based on the generated TRN, you will be able to retrieve the application and fill in Part B of the application form.

➢ On successful submission of the application with authentication, Application Reference Number (ARN) will be generated and intimated to you via email and SMS.

➢ You can track the status of the application using this ARN.

➢ Once the application for registration is approved, the GSTIN and temporary password are generated and communicated via e-mail and SMS to the primary Authorized Signatory. Status of the GSTIN changes from “Provisional” to “Active”. Registration Certificate (RC) is generated and is available at your Dashboard to view print, and download.

FAQ:-

Question 1:- Can an NRTP opt for Composition?

NRTP cannot opt for composition.

Question 2:- When should I apply for a Registration as an NRTP?

You should apply for Registration as an NRTP at least 5 days prior to the commencement of business.

Question 3:- Can I extend my Registration as an NRTP?

Yes, you can extend your Registration as an NRTP once for an additional period of 90 days, if you apply for an extension of registration before the expiry of the initial period for which registration was granted.

Question 4:- I have deposited advance tax but do not want to continue the business. How shall I get my money back?

You can apply for a refund of advance tax deposited at the time of filing of an application for surrender of registration.