The Authority For Advance Ruling In Karnataka In Case of M/s T & D Electricals

Table of Contents

The Authority For Advance Ruling In Karnataka In Case of M/s T & D Electricals

Whether A Contractor Is Required To Take Registration In A State In Which He Is Providing Works Contract Service.

APPLICANT: M/S T& D Electricals, Jaipur, Rajasthan

Facts of The Case:

The applicant is a contractor registered in Jaipur, Rajasthan. They have been awarded a contract by M/s Shree Cement Limited, Rajasthan for electrical, instrumentation, and IT jobs (Works Contract) at the township, Karnataka Cement Project (a unit of Shree Cement Ltd.).

Following are the main questions that have been asked by the applicant:

1) Whether applicant is required to take Separate registration in Karnataka state?

2) If registration is not required separately in Karnataka state and if we purchase goods from a dealer of Rajasthan (same state) and want to ship goods directly from premises of dealer of Rajasthan to township Karnataka then CGST & SGST would be charged from us or IGST by the dealer of Rajasthan?

Alternatively, If registration is not required in Karnataka state and if we purchase goods from the dealer of Karnataka (different state) to use the goods at township at Karnataka the whether IGST would be charged from us or CGST & SGST by the dealer of Karnataka?

Step by Step Process:

1) As per decision given by AAR, there is no requirement to take separate registration because Section 22 of CGST Act states that every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both if his aggregate turnover in a financial year exceeds twenty lakh rupees.

In the instant case, the applicant has only one principal place of business, which is located in Rajasthan, for which registration has obtained.

Also, as per section 2 (71) of the CGST Act, the Location of supplier of services means where supply is made from a place other than the place of business for which registration has been obtained (fixed establishment), such fixed establishment shall be the location of the supplier. But in this case, there is no other fixed establishment as admitted by the applicant.

2) This question consists of two separate cases :

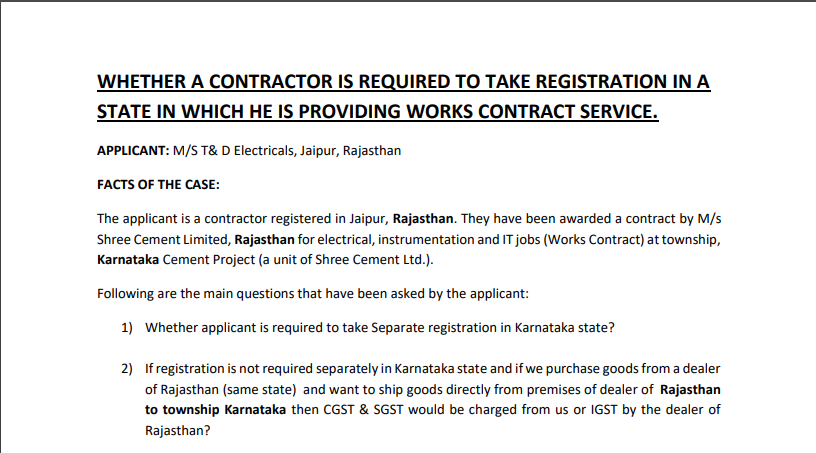

Case I: Where inputs/goods are purchased from a dealer of Rajasthan, whether it will be inter-state supply or intrastate supply? (refer case I of the diagram)

AAR in its ruling has invoked section 10(1)(b) of IGST Act, 2017 which is Bill to Ship to supply. It says where the goods are delivered by the supplier to a recipient or any other person on the direction of a third person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to the goods or otherwise, it shall be deemed that the said third person has received the goods and the place of supply of such goods shall be the principal place of business of such person;

Now, in this case, the dealer of inputs is located in Rajasthan and has supplied goods to Karnataka Cement Project (unit of Shree cement) on the direction of third-person i.e applicant who is located in Jaipur, Rajasthan. Since the location of the supplier is Rajasthan and the place of supply is where the third person is located which in our case is also Rajasthan. Hence supply will be INTRASTATE supply and thus CGST and RGST shall be applicable (INVOICE A of the above diagram).

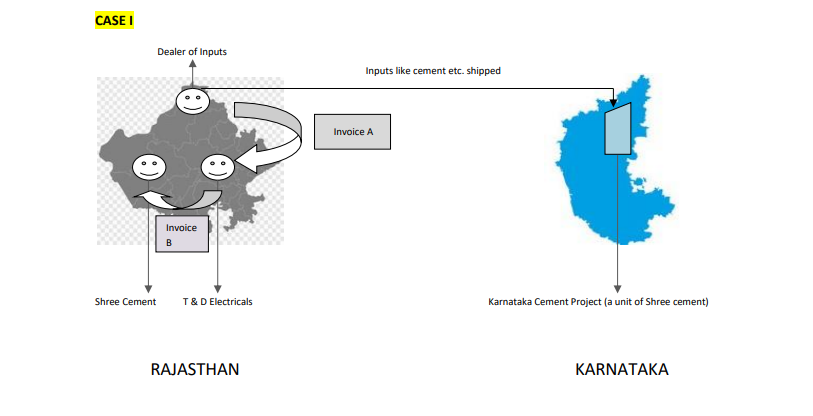

Case II: Where inputs/goods are purchased from a dealer of Karnataka, whether it will be inter-state supply or intrastate supply? (refer to case II of the diagram)

Keeping in mind section 10(1)(b), in this situation location of the supplier is located in Karnataka from where he directly supplied inputs to the Karnataka Cement Project (unit of Shree cement) on the direction of third-person i.e applicant who is located in Jaipur, Rajasthan. So the location of the supplier is Karnataka and the place of supply in Rajasthan, it will be an INTERSTATE supply and this IGST is to be levied (INVOICE A of the above diagram).

Outward Supply: Inter or Intra?

Above both, the cases were about Inward supplies taken by the applicant in order to provide works contract service. What about outward supply provided by the applicant to its client located in Rajasthan itself? Whether it will be INTRASTATE OR INTERSTATE?

In order to determine the applicability of tax, reference has been given to Section 12(3) of IGST Act which states Place of supply of services directly in relation to immovable property, including services provided by architects, interior decorators, surveyors, engineers and other related experts or estate agents, any service provided by way of grant of rights to use immovable property or for carrying out or co-ordination of construction work; shall be the location at which the immovable property or boat or vessel, as the case may be, is located or intended to be located.

In the instant case, the location of the supplier is where the applicant is located i.e Jaipur, Rajasthan, and though the recipient is also located in Rajasthan but the place of supply shall be where the immovable property is located which is Karnataka. So it will be an INTERSTATE supply and the applicant will be required to charge IGST on his works contract services (INVOICE B of both above diagrams).

Crux:

If we arrange supply in an above-discussed manner, a works contract supplier needs not to get registered in all such states in which he is performing his services. This way there will be a seamless flow of credit as well.