Important – Implementation of Amendments in Indian Stamp Act w.e.f 1st of July 20 – Impact on Mutual Funds

This is to inform you that amendments to the Indian Stamp Act, 1899 was introduced as part of the Finance Act 2019. As part of the amendments, stamp duty would be applicable to mutual fund unit’s w.e.f 1st of July 20. This would be applicable to :

- All new units issued in Demat or physical mode, under all schemes. This would include :

o All purchase transactions

o SIP Trigger transactions including for past registrations.

o Dividend Reinvestments (after deduction of TDS)

o Switches including switch-in from STP registrations (includes past registration)

o Transfer of units from one Demat to another Demat account including market / off-market transfers.

- Stamp duty will not be applicable for :

o Transfer from broker to investor account

o Physical to Demat conversion.

o Unit movement on Transmission.

Computation: Stamp Duty will be computed @ .005% on the investment amount on an inclusive method : (Investment Amount /100.005)*.005.

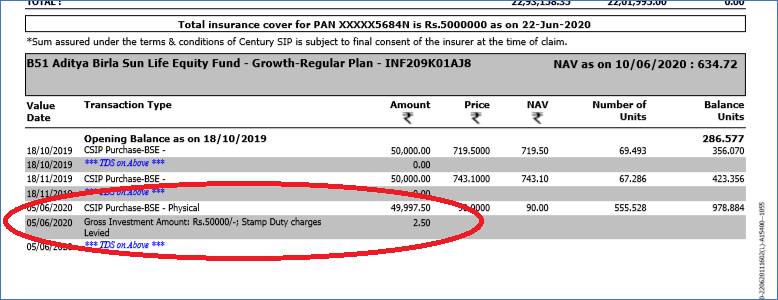

Illustration: For a purchase amount of Rs. 50,000, the computation would be as below :

| Purchase Amount | Stamp Duty (50,000/100.005)*.005) |

The amount for which units will be created |

| 50,000.00 | 2.50 | 49,997.50 |

In case of an applicable transaction charge if any, computation of stamp duty would be on the net amount after deduction of transaction charges, in the above e.g., the computation would be done on Rs.( 50,000.00 – 100.00=49,900.00)

The stamp duty charges deducted from the purchase amount would be clearly reflected in the Account statement in the below fashion :

Note:- Above image is for illustration purpose only, how stamp charges will reflect in SOA

Please note that the applicability of Stamp duty would start for all allotments that are happening w.e.f 1st of July 20 irrespective of when the transaction was accepted. For eg :

- Purchase transaction of Rs. 200,000 prior to 1st July 20, but where the NAV applicability is 1st July 20 or later, would attract Stamp duty

- Switch Transactions accepted before 1st July 20 where the Switch in units are posted on or after 1st July 20 would also attract Stamp duty.

Related Topic:

Implementation of Labour Codes

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.