File GST returns using SMS

How can I file GST returns using SMS

CBIC provided the facility to file GST returns using SMS. The following returns can be filed via SMS.

- GSTR 1

- GSTR 3b

The filing of the return via SMS is available only for the NIL returns. At present we have to file two normal returns in GST. Those returns are GSTR 1 and GSTR 3b. Both can be filed via SMS.

The filing of GSTR 3b via SMS was operationalized from 8th June 220. Rule 67A was inserted in the CGST Rule. It is inserted from the same date. The relevant notification is, no. 44/2020. Now Scope of Rule 67A is extended to GSTR 1 also. Notification no. 58/2020 is issued to make it applicable. This functionality will start in 1st week of July 2020 itself.

The process to file return via SMS:

Here we have explained the process to file GST returns using SMS. Only NIL is eligible for filing via SMS. A NIL return means the return not having any value in any table.

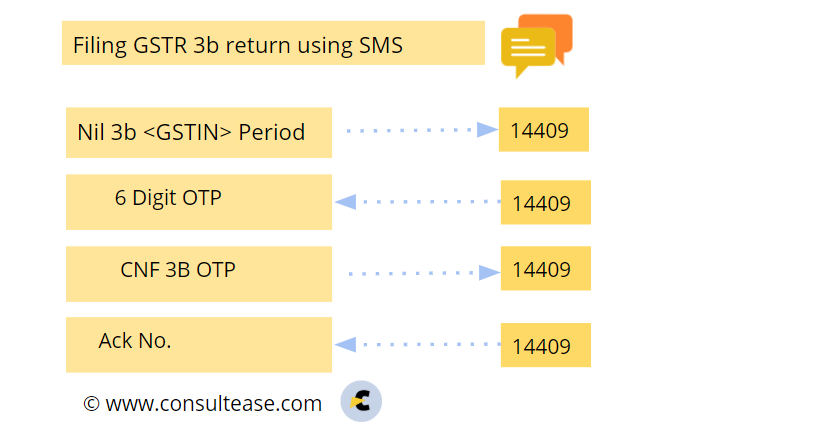

GSTR 3b:

First of all, send {NIL 3B (Your GSTIN) Period) to 14409. You will receive an OTP. Send this OTP with CNF 3b to the same number. Now you will receive an acknowledgment number. Always check the status of your return. You need to log in to the GST website and check the status. Thus there are chances of mistake. Be careful. Skipping the return can cost you higher.

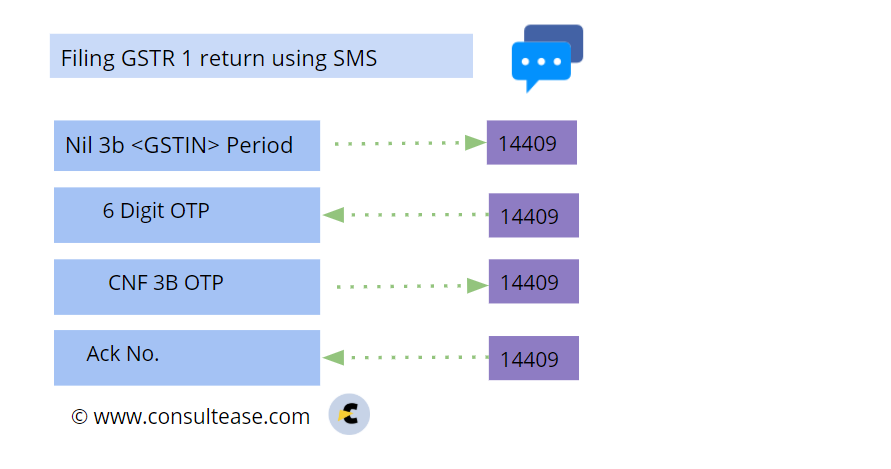

GSTR 1:

Recently CBIC also allowed the filing of GSTR 1 via SMS. This facility will start from 1st July 2020. Send NIL R1 GSTN Period to 14409. The period is in MMYY format. You will receive an OTP, valid for 30 minutes. Then send CNF R1 (OTP) to the same number. You will receive the acknowledgment. Thus an easy cake to save compliance burden.

File your GSTR 3b without late fees:

CBIC also announced a time measure to give release from late fees. You can file your GSTR 3b from 1st July 2017 to January 2020 without a late fee. You need to file them from 1st July 2020 to 31st August 2020. In the case of NIL GSTR 3b, the late fees are NIL. But in case of other than NIL return the late fees is Rs. 500 per return. Thus if your returns are pending from July 2017 to Jan 2020, The late fee is Rs. 500* 31 Months. The maximum amount of late fees is Rs.15500. Because now fees are reduced to 5% of original late fees. Pls avail this facility to get rid of old returns.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.