GST Implication on Education Sector

Table of Contents

GST Implication on Education Sector

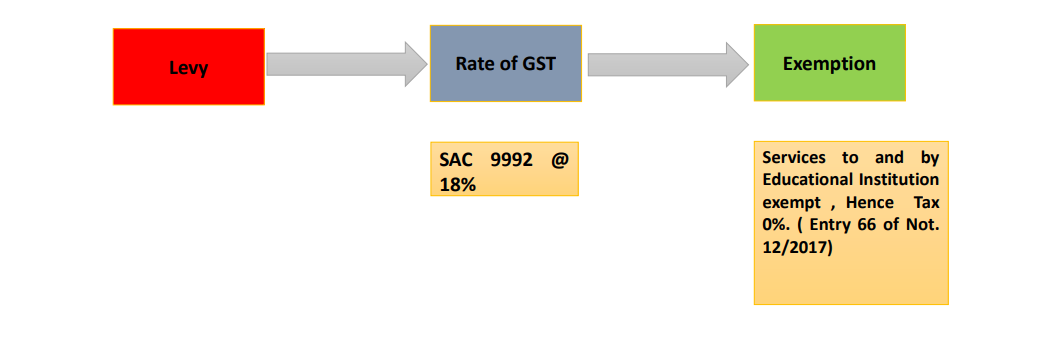

Section 9:- Levy and Rate of Tax

(1) Subject to the provisions of sub-section (2), there shall be levied a tax called the central goods and services tax on all intra-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 and at such rates, not exceeding twenty percent, as may be notified by the Government on the recommendations of the Council and collected in such manner as may be prescribed and shall be paid by the taxable person,

Thus from the above section, it is clear that section 9 covers within its ambit all the supplies of goods or services or both. Lawmakers had exempted certain supply of services by mentioning those supplies in GST Exemption notification 12/2017 CT Rate.

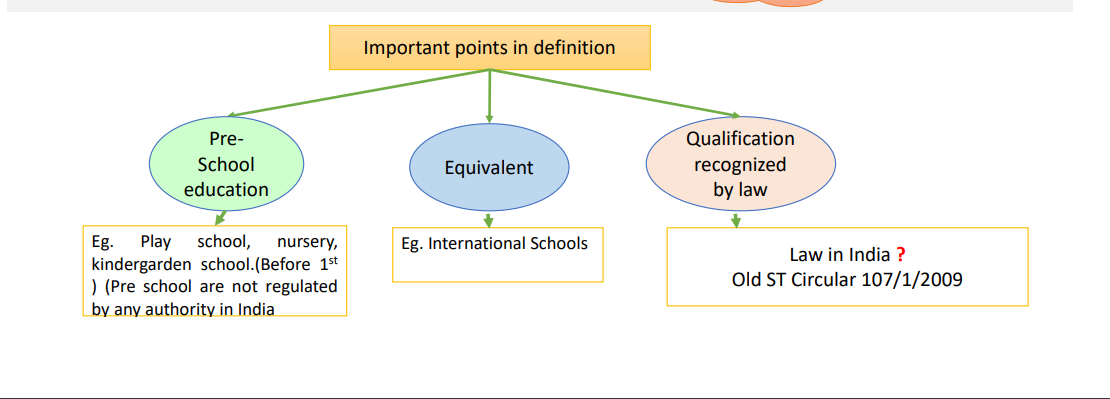

Meaning of Educational Institution

As per Definition 2(y) mentioned in notification 12/2017-CT Rate

“Educational institution” means an institution providing services by way of,-

i. pre-school education and education up to higher secondary school or equivalent;

ii. education as a part of a curriculum for obtaining a qualification recognized by any law for the time being in force;

iii. education as a part of an approved vocational education course;

Circular 107/1/2009 ST

Institute recognized by UGC(University Grant Commission), AICTE(All India Council for Technical Education), Institutions through Union Acts

Related Topic:

GST Implication on High Sea Sales

i. Indian Institute of Aircraft Engineering v. Union of India [2013]

The expression “recognized by law” is a very wide one. The legislature has not used the expression “conferred by law” or “conferred by statute”. Thus, even if the certificate/degree/diploma/qualification is not the product of a statute but has the approval of some kind in ‘law’, would be exempt.

- Training given by private coaching institutes although imparting Coaching related to Degree Courses would not be covered as such training does not lead to the grant of a recognized qualification/degree themselves.

- ILETS Institutes—Not covered by Exemption.

- Only Pre-schools are also covered by Exemption(“and” word in 2(y)(i) is wrongly used and to meet intent shud be read as “OR”).

- Day Care is covered under SAC 999351 @ 18%. Hence, Taxable. But if provided by Educational Institute to its students then Exempt.

Related Topic:

New Education Policy 2020

Approved vocational education course

As per Definition 2(h) mentioned in notification 12/2017-CT Rate

“Approved vocational education course” means, –

i. a course run by an industrial training institute or an industrial training center affiliated to the National Council for Vocational Training or State Council for Vocational Training offering courses in designated trades notified under the Apprentices Act, 1961 (52 of 1961); or

ii. a Modular Employable Skill Course, approved by the National Council of Vocational Training, run by a person registered with the Directorate General of Training, Ministry of Skill Development and Entrepreneurship;

Meaning of Education

The word “ Education” has not been defined in GST Law. However, Apex Court in case of OLE TRUSTEE, LOKA SHIKSHANA TRUST VERSUS COMMISSIONER OF INCOME-TAX, MYSORE (1975 (8) TMI 1 – SC) held that

- Education connotes that clause is the process of training and developing the knowledge, skill, mind, and character of students by normal schooling.

Read & Download the full copy in pdf:

CA Aanchal Kapoor

CA Aanchal Kapoor

Amritsar, India

CA Aanchal Kapoor qualified in first attempt as chartered accountant in 2009 and is a practising chartered accountant for past 10 years in the field of direct and indirect taxes. With special focus on GST she has done extensive study on the subject with many certified courses and GST is one of her core competency areas. Since inception of her academics, she has been placed in the merit list at various levels as a rank holder in CA and Gold medalist in graduation. In pursuing her professional career in GST she is practically into this field and has delivered various seminars on GST in Punjab, Delhi and Mumbai to profession as well as industry.