GST ANX-1 and ANX-2 of New Return Prototype

Table of Contents

- GST ANX-1 and ANX-2 of New Return Prototype

- 1. What is this web portal all about?

- 2. What are the Offline Tools planned under New Return?

- 3. What is the purpose of Prototype?

- 4. What can you do on a Prototype?

- Instructions for using Prototype of New Return

- A. General

- B. Form GST ANX-1: Annexure of Outward Supplies, Imports & Inward supplies attracting reverse charge

- C. GST ANX-2: Annexure of Inward Supplies

- D. Functionalities not available in this prototype:

- Read the copy:

GST ANX-1 and ANX-2 of New Return Prototype

In these, we will see the new functionalities launch by the GSTN related to the new return as a demo to the taxpayer. The detailed analysis is:

1. What is this web portal all about?

Web-based Prototype of Offline Tool of New Return is an interactive demo or mock-up of the “Offline Tools of New Return” to give stakeholders a feel of what the Tool will look like and get their feedback on the same before it goes live. It is an interactive prototype, which allows users to navigate from page to page and use functionality such as drop-down menus, invoice upload, upload of purchase register for matching with a system created inward supplies, etc.

- It is only a screen layout of the Offline Tool for viewing and familiarizing the stakeholders with the offline tool being developed to prepare the proposed return and obtaining their feedback.

- It contains a specimen of the screens which will be made available in the actual Offline Tool to be deployed on the GST Portal soon.

- It is a web-based Prototype to view the working of Offline Tool by taxpayers while filing their return in proposed Form GST ANX-1 and GST ANX-2.

- The values entered in the prototype screens may not match with the calculated summary shown in summary screens. The prototype does not perform addition/subtraction or other arithmetic calculations.

2. What are the Offline Tools planned under New Return?

In the proposed system of new GST Return filing, a normal taxpayer would have to file FORM GST RET-1 (Normal) or FORM GST RET-2 (Sahaj) or FORM GST RET-3 (Sugam) on either a monthly or quarterly basis. Annexure of supplies (GST ANX-1) and Annexure of Inward Supplies (GST ANX-2) will be filed as part of these returns. All the outward supplies will be detailed in GST ANX-1 while GST ANX-2 will contain details of inward supplies auto-populated mainly from the suppliers GST ANX-1. It will also contain details auto-populated from Form GSTR-5 and Form GSTR-6.

3. What is the purpose of Prototype?

While the actual Offline Tool of ANX-1 and ANX-2 are being designed for taking feedback on the use of Offline Tool of New returns and suggestions from users to provide the matching facility with taxpayer’s purchase register to find out mismatches of invoices not uploaded or incorrectly uploaded by suppliers, it was thought valuable to run it again as a Prototype to get feedback on user interface and functionalities to enable us to deliver the best-suited product.

4. What can you do on a Prototype?

Since it is a mock-up and not the real tool, you can enter data but it will not be saved.

- In the prototype, some sample data are pre-populated for view and familiarization.

- Some of the features of the actual tool will not be available to users in this prototype, such as the feature of saving data, downloading/uploading JSON to GST Portal and related error rectification, etc.

- Users can provide their feedback on the prototype, by filling in the (a special sheet that has been provided) and mailing the same.

Instructions for using Prototype of New Return

A. General

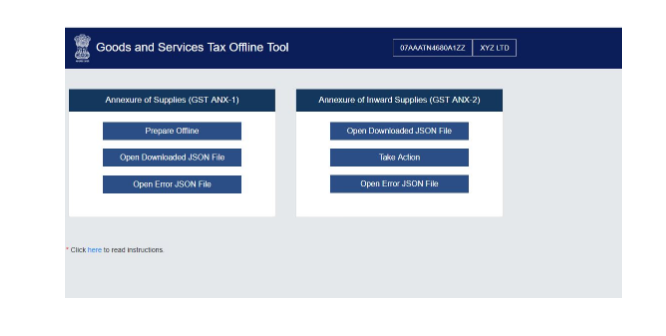

1. This prototype shows working of following features of Offline Tool of new return:

- Annexure of Supplies (GST ANX-1) contains features for uploading the details of outward supplies, imports (goods and services), and inward supplies attracting reverse charge, etc.

- Annexure of Inward Supplies (GST ANX-2) is the form in which the user can take action on the auto-drafted documents uploaded by the supplier which will be made available to them on a real-time basis.

- The matching tool can be used by the recipient to match the auto-drafted details of GST ANX-2 with their own purchase register.

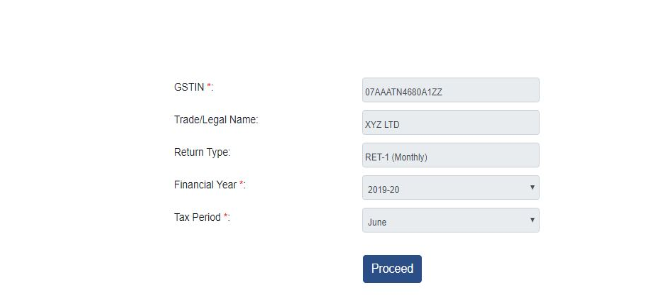

2. In this prototype, screens starting from the login page to fill up the details in Form GST ANX-1 and taking action in Form GST ANX-2 have been provided for a specimen taxpayer who is filing his return on a monthly basis. The features for taxpayers filing the quarterly returns will be ‘similar’.

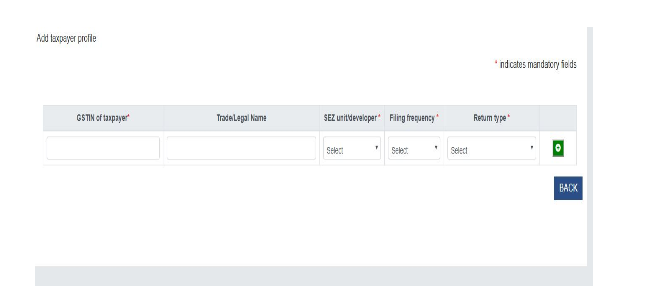

3. Users can fill in details in the ‘Manage Profile’ section of various taxpayers whose returns will be prepared by them using this offline tool. However, in this prototype, this data cannot be saved or edited by the user.

4. On the Login page, the user can select a particular GSTIN and tax period from the dropdown to proceed further. Since, it is a prototype, profile and GSTIN details have been pre-selected. Thereafter, the user may directly click on the ‘Proceed’ button which will

take him to the next screen to fill details in Form GST ANX-1 and Form GST ANX-2.

B. Form GST ANX-1: Annexure of Outward Supplies, Imports & Inward supplies attracting reverse charge

1. Users may click on ‘Prepare Offline’ under ‘GST ANX-1: Annexure of supplies’ to fill in the details. On this screen details of the functionalities which will be available in the Offline Tool are shown. Tabs namely ‘IMPORT EXCEL/CSV FILE’, ‘OPEN DOWNLOADED JSON FILE’, ‘ REMOVE DATA IN ALL TABLES’, ‘ GENERATE JSON FILE TO UPLOAD’ and ‘EXPORT TO EXCEL’ are not available for use in Prototype.

2. The different tables can also be selected by users one by one from the dropdown to view the prefilled details. The summary can be viewed as taxpayer wise or document wise.

3. ‘VIEW SUMMARY’ tab provides a table-wise summary of ANX-1 on pre-populated sample data. Entries in the tables of the screen are for view only and no new entry can be made in the screens in the prototype and the summary will not be updated as new data is not saved.

4. After filling up details in applicable tables, the user has to create a JSON file to upload the same on the portal. This feature will be available after the actual deployment.

C. GST ANX-2: Annexure of Inward Supplies

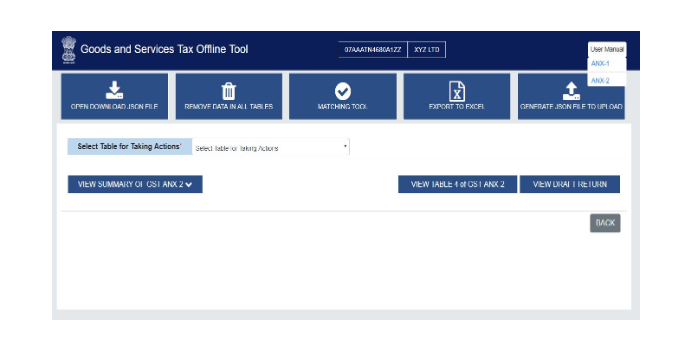

1. Click on ‘TAKE ACTION’ under ‘ANNEXURE OF INWARD SUPPLIES (GST ANX-2)’ to take action on the details. On this screen, details of the functionalities which will be available in the Offline Tool is shown. Tabs namely ‘OPEN DOWNLOADED JSON FILE’,

‘REMOVE DATA IN ALL TABLES’, ‘EXPORT TO EXCEL’ AND ‘GENERATE JSON FILE TO UPLOAD’ is not available for use in Prototype. Working on ‘MATCHING TOOLS’ can be seen in the prototype with pre-filled data provided.

2. The taxpayer can open the downloaded JSON file from the GST Portal by importing the same in the Offline Tool. This feature is not available for use in Prototype. For the convenience of the user, a specimen file has already been pre-populated in the prototype.

3. Purchase Register is to be imported in Excel File format to compare it with the data downloaded from the portal. However, this feature will be available after the actual deployment. Working on ‘MATCHING TOOLS’ can be seen in the prototype with pre-filled data provided. Click on ‘REFINE MATCHING RESULT’ to further refine criteria for matching by selecting the tolerance limit (to be selected in Rupees) and approximation in the document number. The matching result will change after refinement. The taxpayer can take action (Accept/ Reject/ Pending) after matching.

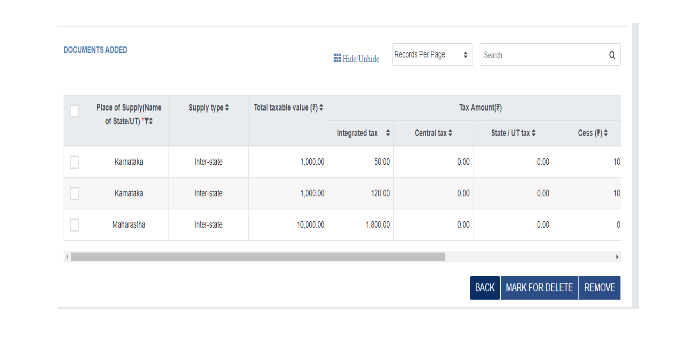

4. The facility to view table-wise summary will be available based on action already taken by the user. Individual tables can also be selected to take action and view summary. The facility to view supplier wise and document wise details will be available on clicking of the relevant tabs for each table.

5. The different tables can also be selected by users one by one from the dropdown to view the prefilled details. Users can select Accept, Reject, and Pending button under the ‘Take Action’ column on the documents uploaded by their suppliers.

6. A consolidated summary of ITC available after taking action will be available in table 4. To view the same, the user has to click on ‘View Table 4 of ANX-2’. This table is non-editable. Offline Tool will auto-fill the details in this table.

7. Credit received from ISD can be viewed by selecting table 5. It is for view only. No action is required to be taken in this table.

D. Functionalities not available in this prototype:

1. Users cannot save any data on click of ‘Save Document’ button and Action was taken in ANX-2 will not be saved.

2. The JSON file can neither be created nor downloaded from the portal.

3. The functionalities like – IMPORT EXCEL/CSV FILE, OPEN DOWNLOADED JSON FILE, REMOVE DATA IN ALL TABLES, GENERATE JSON FILE TO UPLOAD, EXPORT TO EXCEL, VIEW DRAFT RETURN, HIDE/UNHIDE OF COLUMNS, RECORDS PER PAGE, SEARCH, SORTING, FILTER, AND ADD/DELETE will not be available.

4. Add to Masters Facility to add supplier/buyer and items will not be available.

5. VIEW DRAFT RETURN Button can be used to view draft Return FORM GST RET- 1/2/3. Offline Tool will auto-fill the details in the draft return page based on the data in various tables. This feature is not available in the prototype.

The following functionalities as per screenshot are:

Read the copy:

CS Shashank Kothiyal

CS Shashank Kothiyal

Honesty Speaks Itself.

East Delhi, India

Company Secretary (Certfied GST Professional) with more than 2.5 years of experience in GST Related Work.