Enablement of SMS For Filing GSTR-3B on portal

Table of Contents

Enablement of SMS For Filing GSTR-3B

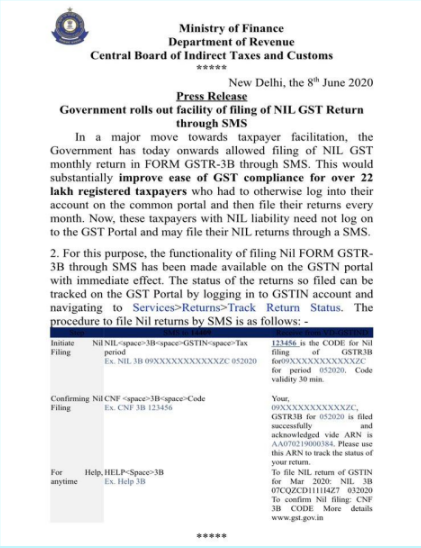

- To make the compliance easier for taxpayers, the Government on today i.e. 08.06.2020 allowed the filing of Nil GST monthly return in FORM GSTR-3B through SMS.

- This would give substantially benefit over 22 lakh registered taxpayers who had to otherwise log into their account on the common portal and then file their returns every month. Now, these taxpayers with NIL liability need not log on to the GST Portal and may file their NIL returns through an SMS. Read step by step process to file GSTR 3b using SMS facility.

1. Brief History

- At the 28th GST Council meeting, The Goods and Services Tax (GST) Council has approved the new and simplified returns filing format, in which the SMS system has been enabled to ease the filing process for nil taxpayers.

- Later on in October 2019, Prakash Kumar, CEO of GST Network (GSTN) said, “Under the new system, assessees with nil turnover will just need to send an SMS and they will receive an OTP (one-time-password) and based on the confirmation, filing of returns can be completed.” GSTN provides shared IT infrastructure and service for the indirect tax regime to both central and state governments including taxpayers and other stakeholders.

2. Introduction of Rule 67A

People have run away within the era of technology, hence to bring such an enormous relief by exercising of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council introduced Rule 67A of the CGST Rules 2017 vide NOTIFICATION No. 38/2020–Central Tax dated the 5th May 2020.

3. Bare text of Rule 67A

67A. Manner of furnishing of return by short messaging service facility:-

Notwithstanding anything contained in this Chapter, for a registered person who is required to furnish a Nil return under section 39 in FORM GSTR-3B for a tax period, any reference to electronic furnishing shall include the furnishing of the said return through a short messaging service using the registered mobile number and the said return shall be verified by a registered mobile number based One Time Password facility.

Explanation. – For the purpose of this rule, a Nil return shall mean a return under section 39 for a tax period that has nil or no entry in all the Tables in FORM GSTR-3B.

4. However, even after the introduction of such facility vide aforementioned Rule, it was still not available on the GST Portal. However, CBIC vide its official twitter handle introduced below mentioned clarification in such respect:-

1. As for paying taxes, India’s score has risen somewhat to 115th. But we can, and need to, further simply the indirect goods and services tax (GST) regime, and make taxes, both on income and consumption, easy and taxpayer-friendly. The average time for filing taxes can be significantly higher in lower-middle-income economies like India.

2. Though, the GST eliminates challenges and bottlenecks that regularly occurred under the old tax regime. Greater transparency and easiness in compliances under GST makes more people want to try their hand at entrepreneurship. The incentive to start a business has grown immeasurably since the introduction of the Goods and Services Tax. Entrepreneurs who commence a business today have a much easier time getting their venture off the ground. They also stand to gain much more financially by starting their enterprise.

Read the copy:

Enablement of SMS For Filing GSTR-3B