Intellectual Property Rights Taxability Under GST Laws

Table of Contents

- Intellectual Property Rights Taxability Under GST Laws

- Factual Matrix:

- FAQ OF CBIC 15.12.2018

- JUDGMENT ON PRE-GST REGIME – TAXABILITY OF IPR.

- (A) Whether Royalty being paid on the Merchanting Trade Activity would be a Non-GST Supply and not amenable to RCM. i.e no GST on RCM basis needs to be paid on Rs. 5,500/- as per example taken.

- (B) Whether this Royalty under the present Agreement is covered by SAC 9973 i.e Temporary or Permanent Transfer or Permitting the use or enjoyment of Intellectual Property (IP) rights in respect of goods other than Information technology Transfer.

- (C) Whether this should be treated as Import of Service and whether GST is payable on the RCM basis.

- (D). Whether there are any provisions under GST Laws which can make the place of supply as deemed to be in India as the recipient of Services is in India and thereby applying RCM?

- Import of service

- IMPORT OF SERVICE AND PLACE OF SUPPLY DEFINED.

- WHETHER GST IS PAYABLE ON RCM BASIS:

- Place of Supply in case of Import of Service

- RECIPIENT OF SERVICE DEFINED

- POSITION IN PRE-GST REGIME

- ADVANCE RULING AUTHORITY

- FACTS:

- FINDINGS:

- (E). Whether RCM will be payable on import of Services by SEZ. i.e on Rs. 600 as per example.

- (F). If RCM is at all applicable then whether the applicable rate is 12% or 18% as per SAC 9973.

- DIFFERENCE BETWEEN LICENCE AND ASSIGNMENT

- GST Rates of IPR:

- Read the copy:

Intellectual Property Rights Taxability Under GST Laws

In this article, an attempt has been made to explain the taxability of Intellectual Property Rights (hereinafter called IPR) on the touchstone of Goods & Service Tax Act, 2017 (hereinafter called the Act), with the help of cases of Hon’ble High Courts and Hon’ble Tribunal both pertaining to pre-GST and post GST regime. The Articles are in parts – Part I deals with taxability of IPR – Part –II deals Forward Charge or RCM and Part III deal with rates of Tax.

Factual Matrix:

2: This could be illustrated by way of an example. An Indian Company is availing the Intellectual Property Rights (hereinafter called IPR) related services provided by a Foreign Entity based outside India, who is holding License for Patents for the manufacture of Automobile Parts and who does not have any place of establishment in India.

3. Under Agreement, Indian Company has been granted License by the Foreign Company to make, produce, procure and sell the products outside India, without bringing the same into India and would directly sell the products outside India on High Sea Sales basis. Towards consideration, Indian Company shall have to pay a Royalty to Foreign Company based on the value sale of licensed products outside India.

4: During the pre-GST regime, the Finance Act, 1994 had defined “intellectual property right” to mean “any right to intangible property, namely, trademarks, designs, patents or any other similar intangible property, under any law for the time being in force, but does not include copyright”.

5: Now the question arises as to whether, the grant of patents rights for the manufacture of “goods” for which royalty is being paid by the Indian Co to Foreign Co, would be the supply of “goods” within the meaning of Section 2(52) of CGST Act or supply of “Services” within the meaning of Section 2(108)?. This brings us to the question of whether patents are ‘goods’ as defined in the Sale of Goods Act, 1930. Section 2 (7) of the Sale of Goods Act, 1930 defines ‘goods’ as under:

“(7) “goods” means every kind of movable property other than actionable claims and money; and includes stock and shares, growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale;”

6: The Supreme Court in Vikas Sales Corporation v. Comm. MANU/SC/0519/1996 observed that ‘property’ would include things such as patents, copyrights, and trademarks.

7: The Delhi High Court in the case of Telefonaktiebolaget LM Ericsson Vs. Competition Commission of India: MANU/DE/0762/2016 has held as under-

The issue, whether patents are goods, is no longer res Integra.

8: We will have to understand the meaning of the word “Supply” as per under Section 7 of the CGST Act as it is only supplied which is taxable by virtue of Section 9 of the CGST Act. We may cursory look at the provision of Section 7 of the GST Act, 2017, which reads as under:- Section 7. (1) For the purposes of this Act, the expression “supply” includes–

(a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

(b)…………………..

(c)……………………………………..

(d)……………………………………..

9: Further, Para 5 of Schedule II says that the following shall be treated as supply of service and more particularly Clause 5 (c) of Schedule II attached to the CGST Act may please be seen.

5(c) temporary transfer or permitting the use or enjoyment of any intellectual property right;

10: Hence, in my view, transfer of right in goods is a supply of service and I am supported by following judgments of Hon’ble High Courts, Appellate Authority of Advance Ruling Authority, and FAQs.

11: The Board also issued a FAQ on GST and question No.15, as is relevant for our purpose, is reproduced below:-

FAQ OF CBIC 15.12.2018

15. Whether the transfer of right to use goods will be treated as a supply of goods or supply of service? Why?

Ans. Transfer of right to use goods shall be treated as supply of service because there is no transfer of title in such supplies. Such transactions are specifically treated as supply of service in Schedule-II of CGST/SGST Act.

12: In S.P.S. Jayam and Co. v. Registrar, Tamil Nadu Taxation Special Tribunal and Others, MANU/TN/0420/2004:(2004) 137 STC 117 (MAD), the High Court held that the Royalty received as consideration for use of trademark is the consideration of the transfer of right to use a movable asset and upheld its taxation under the sales tax laws.

JUDGMENT ON PRE-GST REGIME – TAXABILITY OF IPR.

13: Messrs Inductotherm Pvt. Ltd Vs Comm. The decision on 5 July 2019 – Appeal No.595/2010-DB. (PRE GST REGIME)

Section 65(55a) of the Act defines “Intellectual Property Right” to mean as under:

“Intellectual Property Right” means any right to intangible property, namely, trademarks, designs, patents, or any other similar intangible property, under any law for the time being in force, but does not include copyright.”

14: The Appellate Authority of Advance Ruling Authority of Karnataka in, In Re: United Breweries Limited (23.10.2018 – AAAR – Karnataka): MANU/AI/0010/2018, has observed as under:-

In terms of Section 7(1) of the CGST Act, ‘supply’ also includes within its scope, the activities referred to in Schedule II of the Act which has been categorized as either a supply of goods or a supply of service. Clause 5(c) of the said Schedule II, refers to “temporary transfer or permitting the use or enjoyment of any intellectual property right” as a supply of service.

The phrase “intellectual property rights” has not been defined under the GST law. In a general sense, the term intellectual property right would include the following:-

(a) Copyright

(b) Patents

(c) Trademarks

(d) Designs

(e)Any other similar right to intangible property.

15: In view of the above discussions, there is absolutely no doubt that the “user of the patent granted under the Agreement” is the supply of “service” and is taxable under Section 9 of the CGST Act, 2017. The issue about the rate of tax, forward charge, or reverse charge is being discussed in Part-II.

(A) Whether Royalty being paid on the Merchanting Trade Activity would be a Non-GST Supply and not amenable to RCM. i.e no GST on RCM basis needs to be paid on Rs. 5,500/- as per example taken.

20: First of all, let us understand and appreciate the scope of the NonGST supply. We may have to examine the provision as appearing in Schedule III attached to the Goods & Service Tax Act, 2017 and more particularly Clause 7, which is reproduced below for easy reference:-

Clause 7: Supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods entering into India.

21: The above Clause 7 has been inserted by way of amendment carried out w.e.f. 1.2.2019. The question arises as to whether Clause covers goods or services or both. From the language of Clause 7, it is manifestly clear that Clause 7 specifically talks of only “goods”.

(B) Whether this Royalty under the present Agreement is covered by SAC 9973 i.e Temporary or Permanent Transfer or Permitting the use or enjoyment of Intellectual Property (IP) rights in respect of goods other than Information technology Transfer.

22: Under Section 9 CGST Act, the rate of GST may be notified by the Government. The Notification 11/2017 – Central Tax (Rate) dated 28.06.2017 deals with the supply of services. In terms of the Table in the Notification, under Heading 9973, the ‘Temporary or permanent transfer or permitting the use or enjoyment of Intellectual Property (IP) right in respect of goods other than Information and Technology software’ is taxed at 6% whereas, ‘Temporary or permanent transfer or permitting the use or enjoyment of Intellectual Property (IP) right in respect of Information and Technology software’ is taxed at 9%. There is no doubt royalty on the patent is covered by Heading 9973.

(C) Whether this should be treated as Import of Service and whether GST is payable on the RCM basis.

(D). Whether there are any provisions under GST Laws which can make the place of supply as deemed to be in India as the recipient of Services is in India and thereby applying RCM?

23 The Service Tax on Intellectual Property Rights as levied prior to 1.7.2017. Intellectual Property Rights were defined in Section 65(55a) of the Finance Act, 1994 (i.e. Service Tax Law) to mean any right to intangible property namely, trademarks, designs, patents or any other similar intangible property, under any law for the time being in force, but does not include copyright.

24: Under the present GST Law, the expression “Intellectual Property Right” has not been defined. It has to be understood as in normal trade parlance as per which intellectual property right includes the following:-

a) Copyright viz. …………………………

b) Patents viz. A document granting an inventor sole rights to an invention;

c) Trademarks viz. A formally registered symbol identifying the manufacturer or distributor of a product;

d) Designs viz. The act of working out the form of something (as by making a sketch, outline or plan)

e) Design viz: The act of working out the form of some things (as by making a sketch, outline or plan)

25: If the supplier of service is located in a non-taxable territory and at the same time, the recipient of services is located in the taxable territory (i.e. in India), GST is liable to be paid under reverse charge. Notification Nos. 13/2017-CT (Rates) and 10/2017-IT (Rates) dated 28- 6-2017

26: IGST is not payable on import of services under reverse charge if the value of royalty and license fee was included in the customs value of goods imported – (Notification No. 6/2018-IT (Rate) dated 25-1-2018 and FAQ issued by CBI&C on 15-12-2018. )

Import of service

27: As per Section 2(11) of IGST Act, import of service means the supply of service, where,

a) Supplier of service is located outside India

b) Recipient of Service is located in India

c) The place of supply of service is in India.

Taxability of Import of Service under GST includes the following: –

a) Import of service for a consideration whether or not in the course or furtherance of business [Section 7]

b) Import of service without consideration by a taxable person from a related person or from any of his establishment outside India, in the course or furtherance of business [ Schedule I to CGST Act].

28: The Division Bench of Hon’ble Gujarat High Court in the case of Mohit Minerals Pvt. Ltd. vs. Union of India (23.01.2020 – GUJHC): MANU/GJ/0046/2020, has interpreted what is meant by the import of service:_

Sub-section (11) of Section 2 of the IGST Act defines the term ‘import of services’. The relevant extract of the said section is reproduced as under: Section 2(11) ‘import of services’ means the supply of any service, where(i) the supplier of service is located outside India; (ii) the recipient of service Is located in India; and (iii) the place of supply of service is in India;”

28.1: Thus, the import of services means the supply of service where the supplier of service is located outside India, the recipient of services is located in India; and the place of supply of service is in India.

29: The CESTAT Delhi Bench in the case of Bharat Oman Refineries Ltd. vs. CCE and ST (21.03.2017 – CESTAT – Delhi): MANU/CE/0206/2017 had observed and noted as under:-

The Tribunal had occasioned to examine similar issues involving technical collaboration and transfer of the intellectual property right from foreign companies to Indian recipients. It was held that when the agreement is for transfer of exclusive/non-exclusive technical knowhow the consideration received cannot be taxed under consultancy service.

IMPORT OF SERVICE AND PLACE OF SUPPLY DEFINED.

30: As per Section 2(11) of IGST Act, import of service means the supply of service, where,

a) Supplier of service is located outside India

b) Recipient of Service is located in India

c) The place of supply of service is in India.

31: In view of the above discussions, there is absolutely no doubt that there is an import of service and the place of supply of service in India and GST is payable on Reverse Charge Basis.

WHETHER GST IS PAYABLE ON RCM BASIS:

32: In terms of Notification no.10/2017-IT(R) dtd 28.06.2017, one of the notified categories on which GST is applicable under RCM is “any service supplied by any person who is located in non-taxable territory to any person other than non-taxable online recipient”.

33: IGST liability under RCM in case of Import of service has to be paid in cash/bank. GST ITC to the extent of IGST paid can be availed and utilized in the same month subject to ITC eligibility.

Place of Supply in case of Import of Service

34: In case of import of service, if the nature of service does not fall under the one specified under Section 13(3) to 13(13) of IGST Act, then the place of supply shall be the location of the recipient of service. Undisputedly, the import of service from a person outside India to a person located in India does not fall under any of the sub-sections 13(3) to 13(13) of the IGST Act. Therefore, there is no doubt, IGST is to be discharged under RCM when the recipient is in India.

13.4 RCM would generally be applicable in the cases wherein the place of supply would be that of the recipient of service (generally located in India).

RECIPIENT OF SERVICE DEFINED

13.5 The term ‘recipient’ is not defined in the IGST Act. However, subsection (24) of Section 2 of the IGST Act states that the words and expression not defined in the IGST Act but defined in the Central Goods and Services Act, 2017 (CGST Act), the Union Territory Goods and Services Tax Act, 2017 and the Goods and Services Tax (Compensation to States) Act, 2017, shall have the same meaning as assigned to them in the said Acts.

13.6 The Sub-section (93) of Section 2 of the CGST Act defines the term ‘recipient’ as under:

“(93) ‘recipient’ of supply of goods or services or both, means

(a) where a consideration is payable for the supply of goods or services or both, the person who is liable to pay that consideration;

(b) where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available; and

(c) where no consideration is payable for the supply of a service, the person to whom the service is rendered.

In view of the above, there is no doubt that the Licensee Company is a recipient of service.

POSITION IN PRE-GST REGIME

13.7 In the pre-GST regime, the import of IPR Service was also subject to payment of Service Tax. In support of which, referring to a judgment of Division Bench of Delhi High Court in the case of Mccann Erickson (India) Ltd. vs. CST (19.09.2019 – DELHI HC): MANU/DE/3963/2019 wherein it has been observed as under:

Section 66A of the Finance Act, 1994 makes the recipient of any service, specified in Section 65(105) of the Finance Act, 1994 – which would cover all “taxable services” – received by a person located in India, from a service provider located outside India, liable to pay Service Tax thereon as if he had himself provided the service in India. This, in taxing parlance, is known as payment on a “reverse charge basis”. In the Service Tax universe, Service Tax is payable, on reverse charge basis in various circumstances, chiefly in cases of “import of service”, i.e. where the Service Tax provider is located outside India and the Service Tax recipient is located in India, and where the service provider is a Goods Transport Agency (GTA)

ADVANCE RULING AUTHORITY

13.8 In Re: Udayan Cinema Pvt. Ltd. (26.02.2019 – Authority For Advance Rulings West Bengal): MANU/AR/0050/2019

FACTS:

The Applicant intends to produce a feature film, a portion of which is planned to be shot at locations outside India. For this purpose, he is in the process of appointing CDI Virtual Films Inc. (hereinafter the CDIVF) as a Line Producer in Brazil. He seeks a ruling on whether he is liable to pay IGST on the reverse charge on the payments to be made to CDIVF and, if so, what should be the rate depending upon the classification of the service of a Line Producer. He also wants to know whether the reimbursements made on an actual cost basis will also be subject to IGST.

FINDINGS:

The service being supplied is not, therefore, classifiable as the one specified in sub-sections (3) to (13) of section 13 of the IGST Act, 2017. The transaction between CDIVF and the Applicant is, therefore, import of service and constitutes an inter-State supply within the meaning of section 7(4) of the IGST Act, 2017.

13.9 In terms of Notification no.10/2017-IT(R) dated 28.06.2017, one of the notified categories on which GST is applicable under RCM is “any service supplied by any person who is located in non-taxable territory to any person other than non-taxable online recipient”. IGST liability under RCM in case of Import of service has to be paid in cash/bank. GST ITC to the extent of IGST paid can be availed and utilized in the same month subject to ITC eligibility.

(E). Whether RCM will be payable on import of Services by SEZ. i.e on Rs. 600 as per example.

14. For answering the above query, it would be necessary to understand the implications of provisions of the SEZ Act and Section 26 of this Act, as is relevant for our purpose, is reproduced below:

Section 26(1): Subject to the provisions of sub-section (2), every developer and entrepreneur shall be entitled to the following exemptions, drawbacks, and concessions namely:-

(a): exemption from any duty of Customs, under the Customs Act, 1962, or the Customs Tariff Act, 1975 or any other law for the time being in force, on goods imported into, services provided in, in Special Economic Zone or a Unit, to carry on the authorized operations by the developer or entrepreneur.

(b)………………………….

14.1 The Ministry of Finance has issued an Exemption Notification No.18/2017 Integrated Tax (Rate) dated 5.7.2017 which exempts services imported by a unit or a developer in the Special Economic Zone for authorized operations, from the whole of the integrated tax leviable thereon. In other words, if SEZ Unit or an SEZ Developer imports any service, GST is not payable by SEZ Unit or Developer.

14.2 In the pre-GST regime, the import of services was also exempt from the levy of Service Tax. The CESTAT in the case of Societe Generale Global Solutions Centre Pvt. Ltd. vs. Comm. (31.01.2020 – CESTAT – Bangalore) : MANU/CB/0031/2020, has observed as under:-

I find that the appellant is an SEZ unit and as per Section 26 read with Rule 31 of SEZ Rules, 2006 along with Section 51 of SEZ Act, the SEZ Act has an overriding impact over other laws and other SEZ units are exempt from payment of service tax for any service which is used for authorized operations.

14.3 The Hon’ble Tribunal has held that by virtue of provisions of Section 26 read with Section 51 of SEZ Act, no levy of duty or tax shall be payable, inter-alia, on the import of services. The CESTAT in the case of M/s. Intas Pharma Limited vs. Comm.: MANU/CS/0128/2013, while dealing with the exemption as provided under Section 26 of SEZ Act, has observed as under:-

The immunity to service tax provided under Section 7 or 26 of the 2005 Act cannot be eclipsed by the procedural prescriptions of Notification Nos. 9/2009 or 15/2009. These notifications are calibrated to enable recipients of taxable services which are exempt from the liability to tax under the provisions of the 2005 Act, to claim a refund of the service tax, wherever whether assessed and collected by Revenue or remitted by the service provider inadvertently

14.4 Further Section 51 of the SEZ Act has an overriding effect on other laws. Section 51 is reproduced below:-

The provisions of this Act shall have effect notwithstanding anything inconsistent therewith contained in any other law for the time being in force or in any instrument having effect by virtue of any law, other than this Act.

14.5 The Hon’ble CESTAT in the case of Lanco Solar Pvt. Limited vs. Comm. of Customs,- 26.02.2020 – MANU/CE/0072/2020 Tri, has observed as under:-

I hold that the ab initio exemption provided under the SEZ provisions, having an overriding effect on the Service Tax provision. Under such a position of law, a notification under service tax cannot restrict or provide a time limit for a grant of the refund to the SEZ unit and developer. Accordingly, impugned orders are set aside and appeals are allowed.

14.6 In view of the elaborate discussions, there is absolutely no doubt that no GST is payable on the import of services by SEZ Unit or SEZ Developer.

(F). If RCM is at all applicable then whether the applicable rate is 12% or 18% as per SAC 9973.

15. Under Section 9 CGST Act, the rate of GST may be notified by the Government. Notification 11/2017 – Central Tax (Rate) dated 28.06.2017 deals with the supply of services. In terms of the Table in the Notification, under Heading 9973, the ‘Temporary or Permanent Transfer” or permitting the use or enjoyment of Intellectual Property (IP) right in respect of goods other than Information and Technology software’ is taxed at 6% whereas, ‘Temporary or permanent transfer or permitting the use or enjoyment of Intellectual Property (IP) right in respect of Information and Technology software’ is taxed at 9%.

15.1 However, in terms of the Explanation Clause of the Notification (clause 4), a reference to ‘Chapter’, ‘Section’ or ‘Heading’, wherever they occur, unless the context otherwise requires, shall mean respectively as ‘Chapter’, ‘Section’ and ‘Heading’ in the annexed scheme of classification of services (Annexure). In such Annexure, it is only ‘Licensing services for the right to use the intellectual property and similar products’ that have been mentioned under Heading 9973 and Group 99733.

15.2 Notification No. 1/2017 – Central Tax (Rate) dated 28.06.2017 deals with the rates on the supply of goods. Now, as we have discussed above, copyrights and patents are not moveable properties, and therefore, this notification cannot be applied to copyrights and patents at all. While trademarks are not covered anywhere in the entry, there is a residuary entry under which all supplies not mentioned are taxed at 9%.

15.3 On the other hand, Notification No. 11/2017, which deals with services has no residuary entry. Hence, if no rate is mentioned, then there is no GST on such supplies at all. Since assignments of intellectual property are not mentioned in the Annexure to Notification No. 11/2017, there can be no GST on the same. However, in the present, there is no doubt that there is no assignment but rather “License has been given”. Therefore, GST shall be payable at the rate of 12%.

DIFFERENCE BETWEEN LICENCE AND ASSIGNMENT

15.4 Now let us try to understand the difference between the “License” and “Assignment”. License, under common law, is a permission given to a person to do or enjoy something that he otherwise does not have the legal right to do or enjoy. In simple words, it “merely makes lawful which would otherwise [but for the license] be unlawful”. Therefore, a license does not transfer any proprietary interest in the object over which it is given. For instance, if a person is given the license to project a film in his theatre, he only has the license to use the copyright in the film to that extent. He does not own anything in the copyright of the film. Similarly, a distributor of some trademarked goods may have the permission to use the trademark on promotional material or on the packaging. This will not give him any interest in the trademark itself.

15.5 On the other hand, an “assignment” is a transfer of the right in question. When a patent, trademark, or copyright is assigned, the assignee acquires the right – he becomes the owner of that right. Of course, it is not necessary that the entire right is assigned. Just as a part of a property can be sold, a part of the rights in a trademark, copyright, or patent may be assigned. For instance, a person could assign only the DVD publishing rights of a film to another person. A person could assign the right to use a trademark in a particular State in India, or a person could assign the right to make a particular kind of product using a patent. Under Sec. 19 of the Copyright Act, 1957, the assignee, for the part of the copyright assigned, is treated as the “owner” of the copyright. Similarly, under Sec. 45 of the Trademarks Act, 1999, the assignee is treated as the “proprietor” of the part of the trademark assigned to him.

15.6 Therefore, the crucial difference between a “license” and an “assignment” is that the licensee only gets the right to do some act that he cannot otherwise do. A further concomitant of a license is that it is held only at the pleasure of the licensor. A licensor can, at any time, revoke his license, and the licensee will no longer have that right. Even an irrevocable, perpetual license can be revoked, subject only to damages or specific performance of the license agreement.

15.7 An assignee, on the other hand, becomes the owner of the right assigned to him. He can do as he pleases with the right. An assignment cannot be revoked, it is akin to a sale of those rights. This would mean, therefore, that an assignment is a “transfer” of the IP in question, whereas a license, whatever the terms of it may be, is only permission given for consideration, and not a “transfer”.

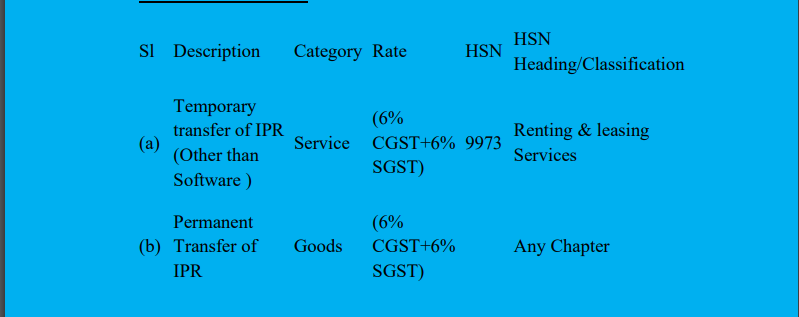

GST Rates of IPR:

To summarize, the CGST liability of the various transactions is as per the below table. An equal amount of SGST will be applicable.

| License | Assignment | |

| Copyright | 6% or 9% (if in relation to computer software) | Nil |

| Patent | 6% | Nil |

| Trademark | 6% | 9% |

Therefore the applicable IGST Rate shall be 12%.

4. However recently the Indian Company has stopped manufacturing these in the Domestic Unit and only manufacturing in the SEZ unit and from there, exporting to Taiwan. On this sale also, Royalty is being paid with respect to sale amount.

Read the copy:

Advocate Pradeep Kumar

Advocate Pradeep Kumar

PK Mittal BCom Delhi university 1975 LLB Delhi University 1978 FCS Fellow Member of ICSI 1992 1982 to 1992 as CS in Corporate Head Legal Apollo Tyres Ltd 1986 to 1992 1993 onwards Advocate in Delhi High Court CESTAT NCLT = Practcising Indirect Tax and Corporate laws 1993 to till date. Written more than 100 Article on Company Law and Corporate laws Indirect Tax Speaker on Indirect Tax Co Law and IBC in various Seminars Workshop organised by ICAI ICSI and ICMA and other organisations Convenor Core Group on GST of ICSI