Whether service tax is levied on services received indirectly from intermediary foreign banks on furnishing guarantee to its foreign customer

Table of Contents

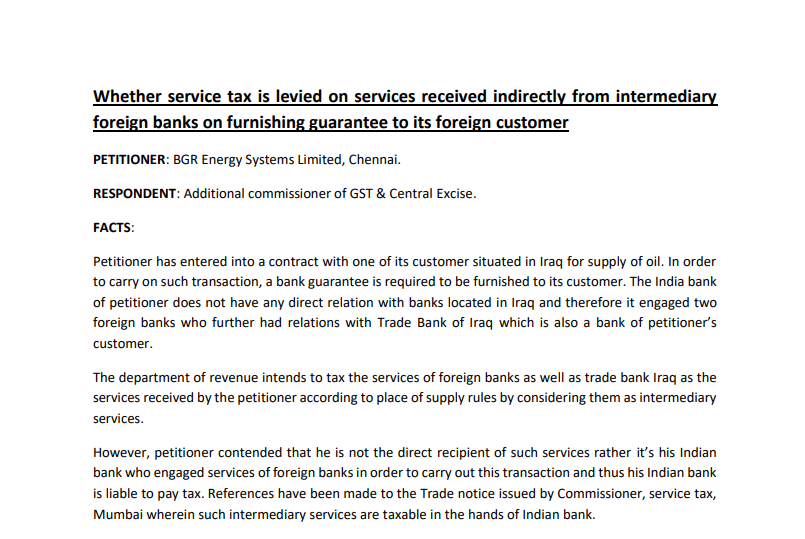

Whether service tax is levied on services received indirectly from intermediary foreign banks on furnishing guarantee to its foreign customer

PETITIONER: BGR Energy Systems Limited, Chennai.

RESPONDENT: Additional Commissioner of GST & Central Excise.

Read the full text of the case here.

FACTS:

Petitioner has entered into a contract with one of its customers situated in Iraq for the supply of oil. In order to carry on such a transaction, a bank guarantee is required to be furnished to its customer. The India bank of the petitioner does not have any direct relation with banks located in Iraq and therefore it engaged two foreign banks who further had relations with Trade Bank of Iraq which is also a bank of petitioner’s customer. The department of revenue intends to tax the services of foreign banks as well as trade bank Iraq as the services received by the petitioner according to the place of supply rules by considering them as intermediary services. However, the petitioner contended that he is not the direct recipient of such services rather it’s his Indian bank who engaged services of foreign banks in order to carry out this transaction, and thus his Indian bank is liable to pay tax. References have been made to the Trade notice issued by Commissioner, service tax, Mumbai wherein such intermediary services are taxable in the hands of Indian bank.

HELD:

Although the flow of payment routed through the Indian bank of the petitioner it’s the account of petitioner which has been debited for service charges paid to intermediaries. Moreover, for receipt of payment against goods supplied, it will be the ultimate petitioner whose account will be credited. Thus petitioner cannot deny that he is the ultimate recipient of services. Also, a justification given by petitioner related to trade notice is not acceptable as neither adjudicating officer nor courts are bound to follow such trade notices. Thus, the petitioner is liable to pay service tax.