Doctrine of Estoppel on retrospective change in the exemption notification

Table of Contents

- The doctrine of estoppel:

- The principal of Estoppel on the retrospective change in the exemption notification

- The principal of Estoppel on prospective change in the exemption notification

- Case of Union of India Versus M/s V.V.F Limited by Supreme Court?

- Observation of Supreme Court in UOI V. V.V.F. Private Ltd. for application of the principle of estoppel retrospective change in the exemption notification:

- Download the judgment:

The doctrine of estoppel:

The Word ‘Promissory Estoppel” means that a party is prevented by his own acts from claiming a right to detriment of the other party who was entitled to rely on such conduct and has acted accordingly. In simple words, when you promise some benefits based on an act from another party. you can’t deny that benefit once that party has acted upon. In statute, it will be binding on promisor. This is a very important concept for taxation statutes. When the statute promises for a benefit based on a condition. Is it possible to deny it once the condition is fulfilled? It is more relevant in the case of exemption notifications. When some exemption or refund is promised based on some action by the taxpayer. Whether the government is bound from its promise. Any notification issued in the future to change or deny that benefit will be invalid?. Here we will discuss the principle of Estoppel on retrospective change in the exemption notification.

The principal of Estoppel on the retrospective change in the exemption notification

It is important to analyze, whether the change is clarificatory or not If it altogether changes the benefit and puts the taxpayer in a detriment. It may be bind from the principle of estoppel. While applying this principle in taxation statute public interest should also be considered. If a notification is just clarificatory. It doesn’t deny any benefit promised in the past. It just clarifies the conditions related to it. In that case it will not get hit by promissory estoppel. It will be applied retrospectively.

In the case of Kanishka Trading it was observed that:

Once a benefit is provided government will be bound by it.

In the case of Union of India V. M/S V.V.F. Limited, it was held that where the change in conditions of taking a refund is changed. The principle of estoppel will not apply. We will discuss this case in detail next to the next para.

You can also read this case’s synopsis in this article.

The principal of Estoppel on prospective change in the exemption notification

When a benefit is withdrawn or amended prospectively. The principle of estoppel still applies? A scheme framed for public welfare may lose its need. In case there is a lack of resources to provide some benefits promised earlier. The government has the right to amend or altogether cancel the benefit under any scheme perspectively.

In the case of Mahaveer Oil Industries (supra), after considering the decision of this Court in the case of Kasinka Trading (supra), a similar view has been taken and it has been observed that public interest requires that the State be held bound by the promise held out by it in such a situation. But this does not preclude the State from withdrawing the benefit prospectively even during the period of the Scheme if the public interest so requires. Even in a case where a party has acted on the promise if there is any supervening public interest which requires that the benefit be withdrawn or the scheme is modified, that supervening public interest would prevail over any promissory estoppel. (Para 11.4 of UoI Vs. V.V.F. Limited)

Case of Union of India Versus M/s V.V.F Limited by Supreme Court?

In this landmark case, orders of high courts were set aside (in various similar petitions). The notifications which were quashed by high court orders were restored.

Let us discuss this case in detail.

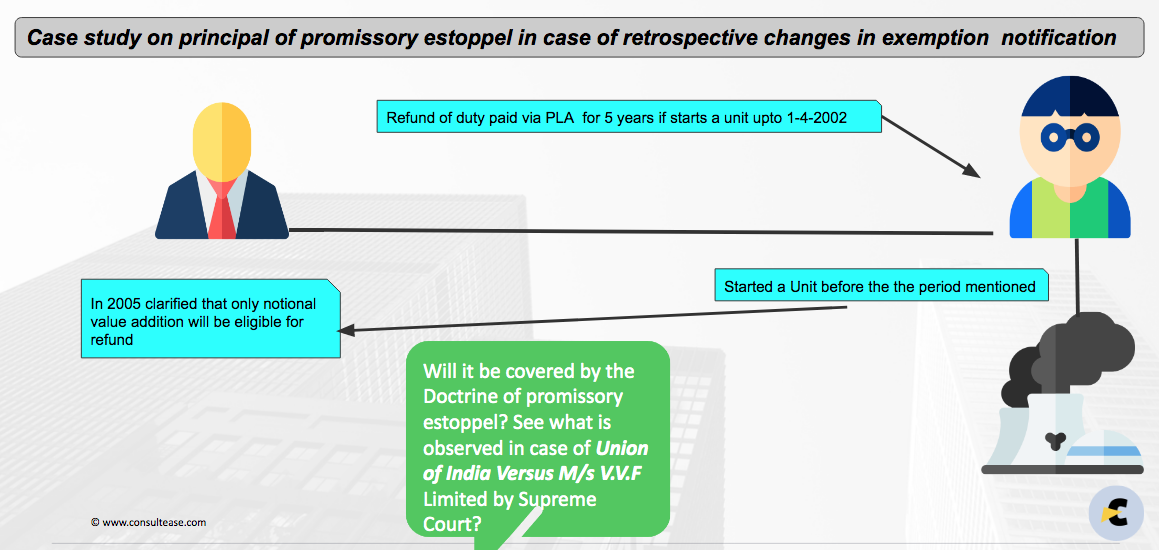

As you can see in the image above. After the earth quake in Kuchh district industrial incentives were announced. The generation of employment was a priority. Tax incentives for setting up new industry is a tested method for the industrial growth of any area. This was made applicable to the Kuchh district also. A refund of excise duty paid via PLA has announced is an industry was set up by the specified date.

Then some manufacturers started to misuse the provision. They started to pay more duty via PLA. They also started to forge their production to claim more refunds. This puts the basic purpose of benefit in danger. Also, it failed the noble objective of the scheme. When the department realized the groud situation. They issued a notification and restricted the refund to a national figure of value added by the manufacturer. It amended the base notification and inserted the condition into it. As a result of the said amendment which resulted in their entitlement for a refund being reduced from nearly 100% of the duty paid to only 34% of such duty amount.

Now the question before the court was, whether this amendment will get hit by the principle of promissory estoppel. Revenue was of the view that it will not as it is clarification. It is retrospective and not retroactive. If it is clarificatory, retrospective change in the exemption notification is valid.

Whereas the petitioner pleaded that it restricted its refund amount to a percentage. Whereas in the original scheme it was allowed 100%. They also said that the inputs are natural products, not liable to tax That is the reason for excessive payment via PLA.

This was also pleaded that the Department has the right to take action against the fraudulent units trying to mis utilized the scheme. But for fraudulent intentions of some businesses entire benefit cant be changed. Now the honorable supreme court was required to decide upon a retrospective change in the exemption notification.

Observation of Supreme Court in UOI V. V.V.F. Private Ltd. for application of the principle of estoppel retrospective change in the exemption notification:

After listening to both of the parties the SC observed that:

“As observed hereinabove, the subsequent notifications/industrial policies do not take away any vested right conferred under the earlier notifications/industrial policies. Under the subsequent notifications/industrial policies, the persons who establish the new undertakings shall be continue to get the refund of the excise duty. However, it is clarified by the subsequent notifications that the refund of the excise duty shall be on the actual excise duty paid on actual value addition made by the manufacturers undertaking manufacturing activities. Therefore, it cannot be said that subsequent notifications/industrial policies are hit by the doctrine of promissory estoppel. The respective High Courts have committed grave error in holding that the subsequent notifications/industrial policies impugned before the respective High Courts were hit by the doctrine of promissory estoppel.” (Para 14.3)

Download the judgment:

You can download a copy of this judgment here.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.