Renting/ Leasing/ Licensing/ Transfer of Right to Use of Goods, Immovable Property and Intellectual Property Rights

- Renting/ Leasing/ Licensing/ Transfer of Right to Use of Goods, Immovable Property and Intellectual Property Rights

- RESIDENTIAL PROPERTY FOR RESIDENTIAL USE

- RENTING OF VACANT LAND FOR CULTIVATION AND REARING ANIMALS

- RENTING OF MOVABLE PROPERTY

- Renting of Apparatus/Equipment

- Renting of Transport Vehicles with Operator

- Renting of Agro-Machinery

- Renting and Hiring are Synonym

- Rental Services in case of Mines

- INTELLECTUAL PROPERTY RIGHTS

- Download the copy:

Renting/ Leasing/ Licensing/ Transfer of Right to Use of Goods, Immovable Property and Intellectual Property Rights

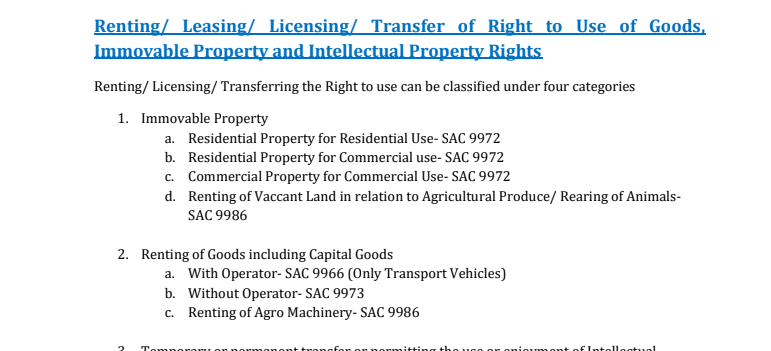

Renting/ Licensing/ Transferring the Right to use can be classified under four categories

1. Immovable Property

a. Residential Property for Residential Use- SAC 9972

b. Residential Property for Commercial use- SAC 9972

c. Commercial Property for Commercial Use- SAC 9972

d. Renting of Vacant Land in relation to Agricultural Produce/ Rearing of Animals- SAC 9986

2. Renting of Goods including Capital Goods

a. With Operator- SAC 9966 (Only Transport Vehicles)

b. Without Operator- SAC 9973

c. Renting of Agro Machinery- SAC 9986

3. Temporary or permanent transfer or permitting the use or enjoyment of Intellectual Property (IP) right- SAC 9973

a. Other than Information Technology

b. Information Technology

4. Transfer of the right to use any goods for any purpose being provided by Financial Institution- SAC 9971 (Finance Lease)

Related Topic:

Movable and Immovable Property

RENTING OF IMMOVABLE PROPERTY

Renting as the word denotes is not limited to rent. Renting in relation to immovable property means allowing, permitting or granting access, entry, occupation, use or any such facility, wholly or partly, in immovable property, with or without the transfer of possession or control of the said immovable property and includes letting, leasing, licensing or other similar arrangements in respect of the immovable property;

The word Immovable Property has not been defined in the CGST Act, 2017 however the same term has been defined in General Clauses Act, 1977 u/s 2(19)- “Immovable Property” shall include land, benefits to arise out of the land, and things attached to the earth, or permanently fastened to anything attached to the earth.

Rent- As per Section 105 of the Transfer of Property Act, 1882- The transferor is called the lessor, the transferee is called the lessee, the price is called the premium, and the money, share, service or another thing to be so rendered is called the rent.

Renting has the inclusive definition to include letting, leasing or other similar arrangements

However, the word similar arrangement would be limited in the context of letting and leasing.

It is well settled that when particular words pertaining to a class, category, or genus are followed by general words, the general words are construed as limited to things of the same kind as those specified. This principle of interpretation is known as “ejusdem generis”. The preconditions for application of the said principle was laid down by Hon. Supreme Court in the case of Amar Chandra Chakraborty v/s Collector of Central Excise AIR 1972 SC 1863 = 1972 (5) TMI 59 –

SUPREME COURT as follows:

“The ejusdem generis rule strives to reconcile the incompatibility between specific and general words.

This doctrine applies when

(i) the statute contains an enumeration of specific words;

(ii) the subjects of the enumeration constitute a class or category;

(iii) that class or category is not exhausted by the enumeration;

(iv) the general term follows the enumeration and

(v) there is no indication of a different legislative intent.”

Renting of Immovable Property is taxable at a central tax rate of 9% under Serial No- 16(iii) of Notification No- 11/ 2017 Central Tax Rate dated 28.06.2017.

RESIDENTIAL PROPERTY FOR RESIDENTIAL USE

Services by way of renting of residential dwelling for use as residence is exempt under Serial No- 12 of Notification No- 12 Central Tax Rated dated 28.06.2017.

2019 (27-1) G.S.T.L 54 (AAR-GST). An application filed before AAR under GST, West Bengal by Borbheta Estate Pvt Ltd. The Applicant owns the residential units in the South City complex and has given the units on rent to individuals and companies. The residential units are meant only for residential use only. Flats cannot be used for any purpose other than a residence. Held that such rent receipt is exempted from GST under Sr. No 12 of Notification No- 12/2017- C.T (Rate) dated 28.06.2017

Residential Dwelling cannot be equated with the hostel or lodge. The same to be treated as non- residential property.

In an application filed before AAR under GST, Karnataka by Sri DMS Hospitality Pvt Ltd [2019 (30) G.S.T.L. 673 (A.A.R. – GST)]. Agreement between the assessee and subsequent lessee showing 31 rooms with 31 washrooms indicating that building constructed as hotel or lodge. Held it appears that the premises are a non-residential property. Considering the number of washrooms and toilets mentioned in the agreement it appears that the building was constructed as a hotel or a lodge. The supply of services, in the facts and circumstances of the case, are classifiable as ‘Rental or leasing services involving own or leased non-residential property’ is liable for GST at the rate of 18 percent

In an Application filed before AAR under GST, Karnataka by Taghar Vasudeva Amrbish [2020 (4) TMI 692]- Applicant has let out a Residential complex to M/s. D. Twelve Spaces Pvt. Ltd which is engaged in the business of providing affordable residential accommodation to students on a long term basis. M/s. D TweIve Spaces Pvt. Ltd. Has entered into sublease agreement students for providing residential accommodations with living amenities, security, entertainment facilities for a long stay for a period varying from 3 months to Il months. Held they are like hotel rooms and the entire leased premises have 42 rooms, which can by no imagination be termed as a residential dwelling. Even if the same is given for residential purposes, the services provided are not for use as a residence by the lessee

RENTING OF VACANT LAND FOR CULTIVATION AND REARING ANIMALS

Services relating to the cultivation of plants and rearing of all life forms of animals, except the rearing of horses, for food, fiber, fuel, raw material or other similar products or agricultural produce by way of renting or leasing of agro machinery or vacant land with or without a structure incidental to its use is exempted under Serial No 54 of the Notification No- 12/2017 Central Tax Rate dated 28.06.2017

RENTING OF MOVABLE PROPERTY

Renting or Leasing of Goods without Operator Leasing or Renting of Goods without operator are taxable at a tax rate under Serial No 17 of the Notification No- 11/2017 dated 28.06.2017. Such services are taxable at the Same rate of Central tax as applicable on supply of like goods involving the transfer of title in goods. In this case, the possession and

the control of the goods pass to the recipient of the services. Operation and Maintenance services are borne by the recipient of the service. Renting or Leasing as the term denotes means the amount earned is fixed in nature.

Section 2(28) of Motor Vehicle Act, 1988 “motor vehicle” or “vehicle” means any mechanically propelled vehicle adapted for use upon roads whether the power of propulsion is transmitted thereto from an external or internal source and includes a chassis to which a body has not been attached and a trailer, but does not include a vehicle running upon fixed rails or a vehicle of a special type adapted for use only in a factory or in any other enclosed premises or a vehicle having

less than four wheels fitted with engine capacity of not exceeding4 [twenty-five cubic centimeters];

In an application filed before AAR under GST, West Bengal by Ishan Resins & Paints Limited [2020 (1) TMI 881]. The applicant intends to lease out vehicles like trucks, tankers, etc. that are designed to transport goods to GTA without an operator. The control and possession of the vehicle will be transferred to the lessee and bear the cost of repair, insurance, etc. It amounts to the transfer of the right to use the goods and taxable under Sl No. 17(iii) of the Rate Notification.

Renting of Apparatus/Equipment

Renting of Apparatus and Equipment will be taxable at a tax rate under Serial No- 17 of the Notification NO- 11/2017 Central Tax Rate dated 28.06.2017. Leasing or Renting of Goods Same rate of Central tax as applicable on supply of like goods involving the transfer of title in goods.

In an application filed AAR under GST, Karnataka by New Space India Limited [2020 (4) TMI 694]- Applicant enables satellite communication service providers with necessary transponder capacity and also acquire the transponders from foreign satellite operators on lease and provide the leasing services of the same to the service providers. In the instant case, satellite transponders had been leased out. Therefore the rate of tax applicable to the service of leasing of the satellite transponders shall be the same as the rate of tax as applicable on the supply of the satellite transponders. Service of Leasing of Satellite Transponders is taxable to GST at the rate of 5% IGST.

Renting of Transport Vehicles with Operator

In this case, renting of the transport vehicle to carry passengers are taxable at a rate of 5% with no credit of input tax. Transportation of Passengers is the prime objective of renting. If the taxable person does not do the transportation of passengers, the same would not be taxable @ 5% but at 18%.

In an Application filed before AAR under GST, Maharasthra by SST Sustainable Transport Solutions India Pvt. Ltd [2019 (20) G.S.T.L. 317 (A.A.R. – GST)]- Applicant providing the Buses along with Driver, Fuel & Maintenance for use of General Public at Large. The applicant merely hiring out buses whereas Bus routes, Bus Fares decided by Nagpur Municipal Corporation (NMC). A transaction between applicant and NMC being of the nature of leasing/renting supply would be regarded as a supply of services as per Clause 5(f) of Schedule II appended to both, Central Goods and

Services Tax Act, 2017 and Maharashtra Goods and Services Tax Act, 2017. Such renting of Buses by applicant squarely falls under Sr. No. 10(ii), Heading No. 9966 of Notification No. 11/2017-C.T. (Rate), dated 28-6-2017 as rental Service of transport vehicles, in this case with operators and therefore attracts CGST and SGST @ 9% each on the remuneration received for such services rendered by the applicant.

Further renting of transport vehicle other than engaged in the transportation of passengers are taxable @ 18%. Renting of transport vehicles is done with an operator. Hence the possession of the vehicle is retained with the supplier of the services.

In an application filed before AAR under GST, Karnataka by Sharma Transports [2020 (32) G.S.T.L. 74 (A.A.R. – GST – Kar.)]- The applicant engaged in the business of transportation of passengers. The applicant is responsible for not only providing the buses but also maintaining them and running the same towards Employee Commutation. Towards the same, the applicant is paid a minimum fixed cost and a variable cost, depending on the number of kilometers run. The applicant is the owner of the buses but permits in the name of M/s. Volvo (Private Service Vehicle. The applicant is

responsible for the maintenance of the buses. Said services would not be renting as the renting services are not dependent on the distance covered. Service Accounting Code 9964, specifically Code 9964 11 covering local land transport services of passengers by bus covered under Serial No. 8(vii) of Notification No. 11/2017-C.T. (Rate) and taxable at 9% CGST and 9% KGST.

Renting of Agro-Machinery

Services relating to the cultivation of plants and rearing of all life forms of animals, except the rearing of horses, for food, fiber, fuel, raw material or other similar products or agricultural produce by way of renting or leasing of agro machinery or vacant land with or without a structure incidental to its use is exempted under Serial No 54 of the Notification No- 12/2017 Central Tax Rate dated 28.06.2017

Renting and Hiring are Synonym

Allahabad High Court in case of Anil Kumar Agnihotri vs C.C.E Kanpur [2018 (10) G.S.T.L. 288 (All.)]- Renting or hiring the two terms has not been specifically defined under the Act and as such, they have to be assigned the meaning which is acceptable in common parlance. Ordinarily, in common usage, there is hardly any distinction between ‘renting’ or ‘hiring’, and both the terms are usually used as a synonym. Irrespective of whether he retains possession and control of the vehicle or passes it to the consumer, the service so rendered by him would fall within the taxable service as defined under Section 65(105)(o) of the Act and is chargeable to tax under Section 66 of the Act. Any person providing service of renting a motor cab would be amenable to service tax under the Act.

Rental Services in case of Mines

Renting or Leasing of Goods will be taxable at a tax rate under Serial No- 17 of the Notification NO- 11/2017 Central Tax Rate dated 28.06.2017. Leasing or Renting of Goods Same rate of Central tax as applicable on supply of like goods involving the transfer of title in goods. In the case where the mining lease is assigned with the right to extract the minerals being the goods and royalty is paid thereon. Such payment of royalty cannot be equated with “renting or leasing of goods”. The same will fall under Serial No- 17(viii) of the above Notification “Leasing or rental services, without an operator, other than (i), (ii), (iii), (iv), (vi), and (viia) above” and hence taxable at a rate of 18%.

In an Appeal filed before Appellate AAR, GST Oridha by Penguin Trading and Agencies Limited- Licensing services for Right to use Minerals including its exploration and evaluation being Lease by The government not being lease of any goods. Conditional rate of tax applicable to the sale of like goods cannot be imported for prescribing the rate of GST applicable to the leasing of the Mining Area. Impugned service to be covered under revised Entry No (viii) of Notification No. 11/2017 C.T Rate attract GST @ 18%.

INTELLECTUAL PROPERTY RIGHTS

Intellectual property (IP) is a term referring to a brand, invention, design or other kinds of creation, which a person or business has legal rights over. Almost all businesses own some form of IP, which could be a business asset.

Common types of IP include:

i. Copyright – this protects written or published works such as books, songs, films, web content and artistic works;

ii. Patents – this protects commercial inventions, for example, a new business product or process;

iii. Designs – this protects designs, such as drawings or computer models;

iv. Trademarks – this protects signs, symbols, logos, words, or sounds that distinguish your products and services from those of your competitors.

Copyright Act, 1957, Trade Marks Act, 1999, India’s Patents Act of 1970, Designs Act 2000

IP can be either registered or unregistered.

The regulatory authority for patents is the Controller General of Patents, Designs and Trade Marks under the Department of Industrial Policy and Promotion. The police now have more robust powers in enforcing trademark law

Temporary or permanent transfer or permitting the use or enjoyment of Intellectual Property (IP) right in respect of goods other than Information Technology software is taxable @ 12% of GST and Temporary or permanent transfer or permitting the use or enjoyment of Intellectual Property (IP) right in respect of Information Technology software are taxable @ 18% under Serial No- 17(i) and 17(ii) respectively of the Notification No- 11/2017 Central Tax Rate dated 28.06.2017

Appellate AAR in case of United Breweries Ltd vs AAR [2018 (18) G.S.T.L. 855 (App. A.A.R. – GST)]- CBUs (Contract Bottling Units)making and supply alcoholic liquor (beer) for human consumption and excluded from the purview of GST. Brand owners (Applicant) give CBUs the right to use their process for the manufacture of their branded beer under their supervision and control by deputing process executives and commercial executives to the brewer at their cost. “Surplus Profit” over and above brand fee transferred by CBUs to brand owner in lieu of permission granted to utilize their brand. The activity of the brand owner in terms of agreements permitting the use of the intellectual property right squarely covered under Clause 5(c) of Schedule II of Central Goods and Services Tax Act, 2017.

Download the copy:

If you already have a premium membership, Sign In.

CA Rachit Agarwal

CA Rachit Agarwal