Refund under Mistake of Law which is Time Bared under the Provisions of the Act

- Refund under Mistake of Law which is Time Bared under the Provisions of the Act

- Supreme Court in case of Mafatlal Industries Ltd vs Union of India

- Principles of Claiming such Refund

- Commissioner of Sales Tax, U.P vs Auriaya Chamber of Commerce [1986 (25) E.L.T. 867 (S.C.)]

- Factual Summary of the Case

- Reference to Other Laws

- Court Verdict

- Supreme Court in case of Porcelain Electrical Mfg Co vs Collector Central Excise, New Delhi [1998 (98) E.L.T. 583 (S.C.)]

- Download the copy:

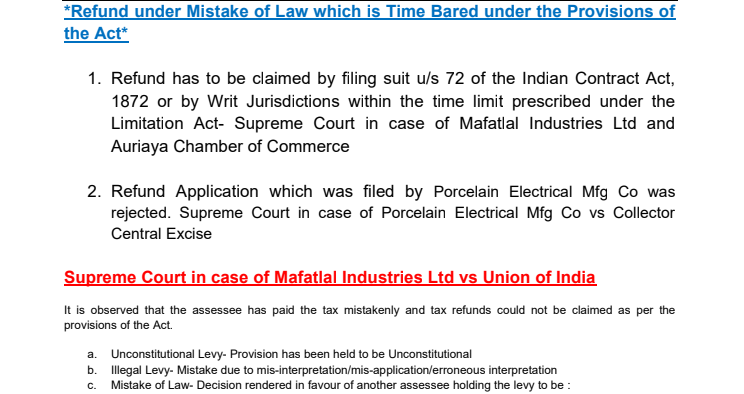

Refund under Mistake of Law which is Time Bared under the Provisions of the Act

1. The refund has to be claimed by filing suit u/s 72 of the Indian Contract Act, 1872 or by Writ Jurisdictions within the time limit prescribed under the Limitation Act- Supreme Court in case of Mafatlal Industries Ltd and Auriaya Chamber of Commerce

2. Refund Application which was filed by Porcelain Electrical Mfg Co was rejected. Supreme Court in case of Porcelain Electrical Mfg Co vs Collector Central Excise

Supreme Court in case of Mafatlal Industries Ltd vs Union of India

It is observed that the assessee has paid the tax mistakenly and tax refunds could not be claimed as per the provisions of the Act.

a. Unconstitutional Levy- Provision has been held to be Unconstitutional

b. Illegal Levy- Mistake due to misinterpretation/misapplication/erroneous interpretation

c. Mistake of Law- Decision rendered in favor of another assessee holding the levy to be :

(1) unconstitutional; or

(2) without inherent jurisdiction

Related Topic:

Delay in refund – Right of assessee to claim interest from department

Principles of Claiming such Refund

1. Right to refund or restitution neither automatic nor unconditional. Refund claimable either by filing civil suit under Section 72 of the Contract Act or by filing writ petition under Article 32 or 226 of the Constitution of India.

2. Civil court jurisdiction barred to the extent pointed out in Section 11B of the Central Excise Act, 1944. However where the levy is unconstitutional or outside the provisions of the Act or not contemplated by the Act, the jurisdiction of the civil courts is not barred.

3. Tax not to be imposed except by authority of law – Article 265. Hence Refund will be granted for the tax collected, retained or not refunded without the authority of Law.

4. If Article 265 of the Constitution is allowed to be destroyed it would be a dangerous precedence for demolition of the Constitution, article by article. Constitutional guarantee under Article 265 of the Constitution of India. Denial of right to recover unlawfully collected tax is denial of the protection given to a citizen by Article 265 of the Constitution. Levy and collection of taxes, both to be lawful under Article 265 of the Constitution.

5. Such Petition/ Claim to be filed within the limitation period of 3 years as per Section 17(1)(c) of the Limitation Act, 1963

6. Period of 3 years shall commence from the date when the Order has been pronounced in other assessee case or the date when the provision has been held as unconstitutional.

7. Writ Court can refuse to grant relief where burden of duty has been passed on to third party. Writ jurisdiction not to be exercised to unjustly enrich a person. Hence Refund not to be ordered unless claimant establishes that the burden of duty has not been passed on to others. One not to be compensated for what he has not lost

8. Person ultimately bearing the burden of duty can legitimately claim its refund otherwise amount to be retained by the State.

Commissioner of Sales Tax, U.P vs Auriaya Chamber of Commerce [1986 (25) E.L.T. 867 (S.C.)]

Factual Summary of the Case

1. Favourable Order was passed by this Court in Budh Prakash Jai Prakash’s case on 3rd May, 1954

2. Appellant Filed the Revision application for quashing the order of his case in 1955 before Sales Tax Officer

3. Revision Application dismissed the Revision Application in 1958 on reason that application has been filed after long delay

4. Assessee filed for Refund application on 24.05.1959 before Sales Tax Officer

5. Refund Application was dismissed considering Article 96 of Limitation Act, 1908

6. Revision was filed before the High Court upon Rejection by Sales Tax Officer

7. High Court Held that judgment came to be known in May 1954, then in our opinion, when the assessee had made an application in 1955, it was not beyond the time

Reference to Other Laws

Article 96 of Limitation Act, 1908- For relief on the ground of mistake- Limitation Period shall be three years from the date when the mistake becomes known to the plaintiff.

Section 72 of the Indian Contract Act, 1872 recognized that a person to whom money has been paid, or anything delivered, by mistake or under coercion, must repay or return it. In this case it is not disputed that mistake of law is also a mistake covered by the provisions of section 72 of the Indian Contract Act

Court Verdict

The rules or procedures are hand-maids of justice not its mistress. It is apparent in the scheme of the Act that sales tax is leviable only on valid transaction. If excess amount is realised, refund is also contemplated by the scheme of the Act. In this case undoubtedly sales tax on forward contracts have been illegally recovered on a mistaken view of law. The same is lying with the Government. The assessee or the dealer has claimed for the refund in the revision. In certain circumstances refund specifically has been mentioned. There is no prohibition against refund except the prohibition of two years under the proviso of Section 29- Para 29

Where indubitably there is in the dealer legal title to get the money refunded and where the dealer is not guilty of any latches and where there is no specific prohibition against refund, one should not get entangled in the cobweb of procedures but do substantial justice. The above requirements in this case, in our opinion, have been satisfied and therefore we affirm the direction of the Additional Judge (Revisions), Sales Tax for refund of the amount to the dealer and affirm the High Court’s judgment on this basis. Para 31

Supreme Court in case of Porcelain Electrical Mfg Co vs Collector Central Excise, New Delhi [1998 (98) E.L.T. 583 (S.C.)]

1. Madras High Court held that various items of porcelain manufactured by the appellant were not dutiable under Item 23B.

2. The appellant, therefore, on 12th and 16th June 1978 filed two applications for refund of duty paid by it

3. The Collector did not dispute the claim of the appellant that the insulators were not dutiable but the claim for refund was rejected as, according to the Collector, it was beyond six months, the period of limitation provided under Rule 11.

4. In appeal before the Tribunal, it was claimed that since duty had been paid under mistake of law, the claim for refund was not governed by the provisions of Rule 11 of the Central Excise Rules, 1944, and the period applicable was three years from the date of knowledge of the mistake under Limitation Act.

5. Since the appellant had filed an application under Rule 11 read with Rule 173J and sought its remedy under the Statute it was bound by the limitation provided under the Act and the Rules

6. It was not open to the appellant to claim that even though the period of limitation was provided under the Statute for refund the application filed by it should be processed and considered under the general law of limitation.

Download the copy:

If you already have a premium membership, Sign In.

CA Rachit Agarwal

CA Rachit Agarwal