Section 10 – Composition Scheme

Table of Contents

- Section 10 – Composition Scheme

- GST Composition Scheme-An Introduction

- Intimation for composition levy [Rule 3 of CGST rules]

- Who cannot opt for Composition Scheme?

- Validity of the composition levy is covered by Rule 6 of the CGST Rules.

- GST payment be made by a composition dealer

- Returns to be filed by a composition dealer

- Conclusion

- Declaimer:

- Download the copy:

Section 10 – Composition Scheme

GST Composition Scheme-An Introduction

The composition levy is an alternative method of levy of tax designed for small taxpayers whose turnover is up to Rs. 1.5 Crores (Rs. 75 lakhs in case of an In case of North-Eastern states and Himachal Pradesh) [N.N 14/2019-CT(Rate) dt. 07-03-2019]

From the 1st of April,2019, the composition scheme will also be available to services and mixed goods and services suppliers if they had an annual turnover of Rs 50 lakh in the preceding financial year. [N.N- 14/2019-C.T(rate) Dt. 07/03/2019] Small taxpayers can get rid of tedious GST formalities and pay GST at a fixed rate of turnover.

The aim of the article is to understand the nature, objective and purpose of the composition scheme under the GST taxation system regime. The article will be focusing on needs to introduce, criteria, eligibility, conditions, merits and demerits of the composition scheme for the small taxpayers to opt for it.

Please note – “Taxable Turnover” means the Taxable value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess.

The Composition Dealer shall not collect any tax from the recipient on supplies made by him nor shall he be entitled to any credit of input tax as notified u/s 10(4),

Composition scheme can apply only if all units eligible for composition scheme – It is clarified that where any place of business of a registered person that has been granted a separate registration becomes ineligible to pay tax under section 10 (composition scheme), all other registered places of business of the said person shall become ineligible to pay tax under the said section [Explanation to Rule 11(1) of CGST Rules, inserted w.e.f. 1-2-2019].

Related Topic:

Composition Scheme for Real-estate

Intimation for composition levy [Rule 3 of CGST rules]

Any Unregistered Person who wants to opt for a Composition scheme needs to electronically file an intimation in FORM GST CMP-01, duly signed or verified. He also needs to file FORM GST CMP-03, having details of stock, including the inward supply of goods received from unregistered persons as on date, held by him within a period of ninety days from the date on which the option for composition levy is exercised.

Any existing registered person who wants to opt to pay tax under the scheme shall file an intimation in FORM GST CMP-02, prior to the commencement of the financial year for which the option to pay tax under the aforesaid section is exercised and shall file FORM GST ITC-03 [Rule 44(4)] within a period of sixty days from the commencement of the relevant financial year.

Once opted for, The Composition dealer needs to issue a bill of supply and not Tax Invoice.

As per the CGST (Amendment) Act, 2018 and CGST (Removal of Difficulties) Order, 2019, a composition dealer can also supply services to an extent of ten percent of turnover, or Rs.5 lakhs, whichever is higher. This amendment will be applicable from the 1st of Feb, 2019.

Turnover of all businesses registered with the same PAN should be taken into consideration to calculate turnover. Also as Inserted by the Finance (No. 2) Act, 2019, w.e.f. 1-1-2020, The value of exempt supply of services provided by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount shall not be taken into account for determining the value of turnover in a State or Union territory.

Related Topic:

Composition Scheme (Section-10 of CGST Act, 2017)

Who cannot opt for Composition Scheme?

As per section 10(2), the following people cannot opt for the scheme-

- Manufacturer of o Ice cream and other edible ice[Notification No. 14/2019-Central Tax]

- pan masala[Notification No. 14/2019-Central Tax]

- Aerated water[Notification No. 43/2019-Central Tax]

- All Tobacco and manufactured tobacco substitutes. [Notification No. 14/2019-Central Tax]

- A person making inter-state supplies.

- A casual taxable person or a non-resident taxable person

- Businesses which supply goods through an e-commerce operator

The following conditions, as prescribed under Rule 5(1), must be satisfied in order to opt for composition scheme:

- No Input Tax Credit can be claimed by a dealer opting for composition scheme

- He shall not be involved in the manufacture of items as mentioned in the above para.

- The dealer cannot supply goods which are not leviable to tax under the GST Act.

- The goods held in stock by him on the appointed day have not been purchased in the course of inter-State trade or imported or received from his branch situated outside the State or from his agent or principal outside the State.

- The goods held in stock by him have not been purchased from an URD and where purchased, he pays the tax under sub-section (4) of section 9

- The taxpayer has to pay tax at normal rates for transactions u/s 9(3) & 9(4) i.e. RCM

- If a taxable person has different segments of businesses (such as textile, electronic accessories, groceries, etc.) under the same PAN, they must register all such businesses under the scheme collectively or opt out of the scheme.

- The taxpayer has to mention the words ‘composition taxable person’ on every notice or signboard displayed prominently at their place of business.

- The taxpayer has to mention the words ‘composition taxable person not eligible to collect tax on supplies’ on every bill of supply issued by him.

Related Topic:

Steps to Resolve The Error “Invalid Summary Payload” in GSTR-10.

Validity of the composition levy is covered by Rule 6 of the CGST Rules.

- The validity of the Composition scheme shall be as long as the dealer satisfies all the conditions mentioned in the Section 10 and under the prescribed Rules thereto.

- If the dealer wants to withdraw from the composition scheme shall, before the date of such withdrawal, file an application in FORM GST CMP-04. [Rule 6(3)]

- The day he ceases to satisfy any condition u/s 10, he shall issue a tax invoice for every taxable supply made thereafter and shall File FORM GST CMP-04 within seven days of the occurrence of such event. [Rule 6(2)]

- Where the proper officer has reasons to believe that the Dealer was not eligible to pay tax under section 10 or has contravened the provisions of the Act or of this Chapter, the officer may issue FORM GST CMP-05 to be replied within fifteen days of the receipt in FORM GST CMP-06 upon which the officer shall accept or deny the reply in FORM GST CMP-07.

- FORM GST ITC-01 containing details of the stock of inputs and inputs contained in semi-finished or finished goods held in stock by him on the date on which the option is withdrawn, within a period of thirty days from any of the event occurring above, is to be filled.

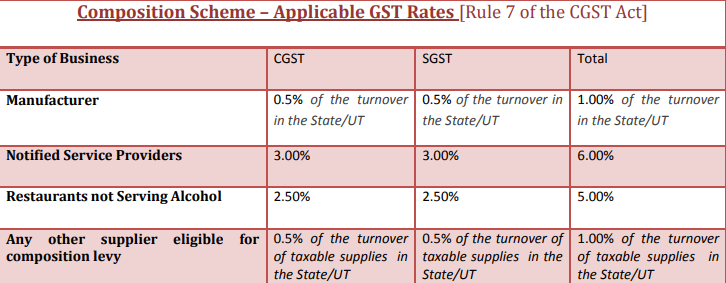

Following chart explains the rate of tax on turnover applicable for composition dealers:

GST payment be made by a composition dealer

For a Composition Dealer,GST Payment has to be made out of pocket for the supplies made. The GST payment to be made by a composition dealer comprises of the following:

- GST on supplies made.

- Tax on reverse charge

- Tax on purchase from an unregistered dealer[Only on the specified categories of goods and services and well as the notified class of registered persons [as explained in our Article of RCM under GST]]

Returns to be filed by a composition dealer

Originally, Form GSTR-4 was a quarterly return form for those taxpayers who have opted to go for the GST Composition Scheme in the new indirect tax regime.

From FY 2019-20,the periodicity of GSTR-4 is changed to annually, and it should be filed by 30th April for every financial year.

All business who have opted for composition scheme will now have to file Form GST CMP-08 applicable from April 2019 for the financial year 2019-20 onwards, that needs to be filed by 18th of the month after the end of the quarter.

- Due to COVID 19 Outbreak, the following relaxations has been provided –

- Annual Return in GSTR 4 for the FY ending 31st March, 2020,has been extended till the 15th July, 2020 [N.N. 34/2020 C.T(rate) dt. 23-03-2020]

- CMP 08 [vide N.N 34/2020 C.T(rate) dt. 23-03-2020] for the quarter ending March 2020, has been extended to 7th of July,2020.

Conclusion

- The introduction of composition scheme by the government under GST is for benefit in favour of the small traders, manufacturers and restaurants etc. Who stand to benefit as it will simplify the compliance burden (returns, maintaining books of record, issuance of invoices) on them and creates more liquidity due to limited tax Liability.

- But still as a coin has two side, there are problems’ being faced by the taxpayer under GST such as a holder under the composition scheme is not entitled to take credit of input tax credit on purchases made and also A limited territory of business (barred from carrying out inter-state transactions and not allowed to supply exempt goods or goods through an e-commerce portal. Thus it depends on the type of supply that the dealer is involved in to take a informed decision as to whether the composition scheme is beneficial or not even if it’s a Small Sized Dealer.

Declaimer:

The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. The author does not accept any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in Reliance thereon. No part of this document should be distributed or copied without express written permission of the author.

Download the copy:

CA Suraj Goyal

CA Suraj Goyal

SME & Speaker, Business Advisor on Indian GST Add profile section

Kolkata, India

SME & Speaker, Business Advisor on Indian GST