GST notified amendments and relaxations provided as COVID-19 relief measure

Table of Contents

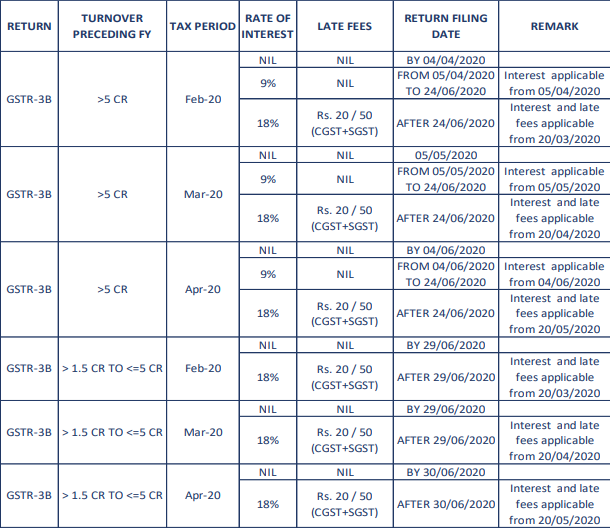

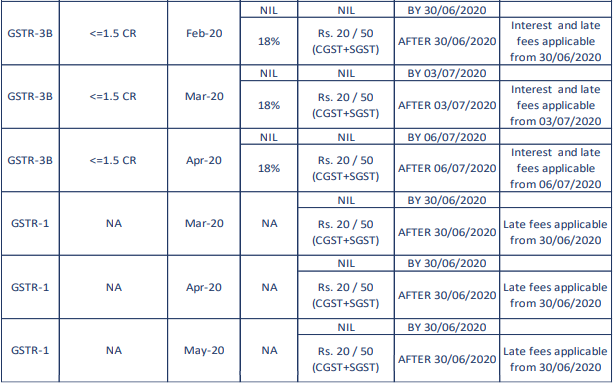

Waiver of Interest and Late fees for GSTR-3B and GSTR-1

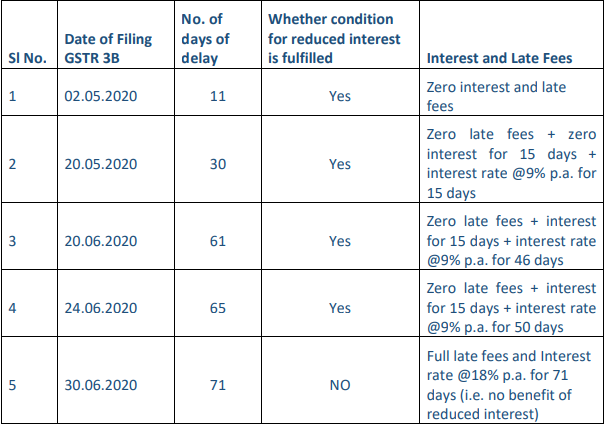

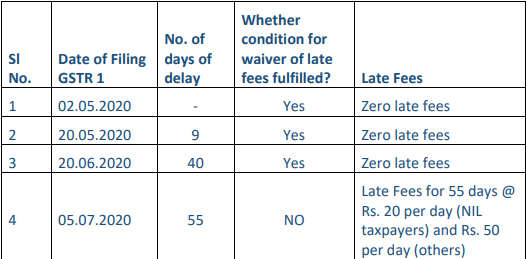

Illustration: Calculation of interest and late fees for delayed filing of return for the month of March 2020 (due date of filing being 20.04.2020) may be illustrated as per the below Table:

Illustration: Calculation of interest and late fees for delayed filing of return for the month of April 2020 (due date of filing being 11.05.2020) may be illustrated as per the below Table:

(Notification No. 31/2020 -CT dt. 03.04.2020)

(Notification No. 32/2020 -CT dt. 03.04.2020)

(Notification No. 33/2020 -CT dt. 03.04.2020)

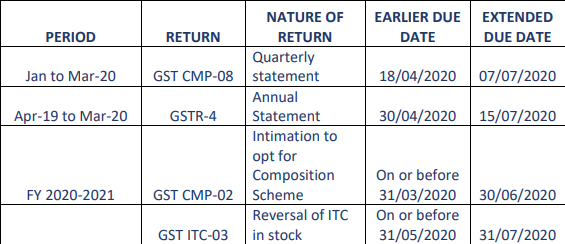

Extension of time limit for filing the various return for Composition dealers

(Notification No. 30/2020 -CT dt. 03.04.2020)

(Notification No. 34/2020 -CT dt. 03.04.2020)

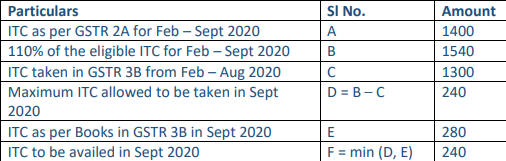

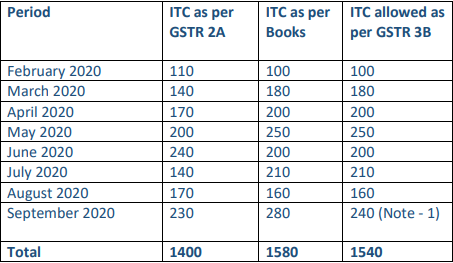

Cumulative Application of condition specified in Rule 36 (4)

➢ Rule 36(4) of the CGST Act, 2017, restricts availment of ITC to 110% of the ITC reflected in GSTR-2A. With the extensions in GSTR-1 dates, the government has provided that the said restriction shall apply cumulatively for the period February ’20 to August ’20 in GSTR-3B of September 20.

Example:

Download the copy:

(Notification No. 30/2020 -CT dt. 03.04.2020)

Due date of other compliances extended to 30th June 2020

Where the time limit of any of the following actions falls between 20th March 2020 to 29th June 2020, the due date of the same would get extended to 30th June 2020:

➢ The due date for completion of any proceeding or passing of any order or issuance of any notice, intimation, notification, sanction or approval or such other action by any authority, commission or tribunal, under the provisions of the Acts

➢ Filing of any appeal, reply or application or furnishing of any report, document, return, statement or such other record, by whatever name called, under the provisions of the Acts stated above;

The above extension includes but is not limited to:

➢ Filing of refund claims and other refund-related compliances which fall due between 20th March 2020 to 29th June 2020

➢ Intimation for withdrawal from Composition Scheme under CMP-04

➢ Amendment, Cancellation, and Revocation of Cancellation of Registration

➢ Filing of Form ITC-01 (Exemption / Composition to Normal Scheme/ITC upon new registration), Form ITC-02 (Transfer of ITC upon transfer of business) and Form ITC03 (Normal to Exemption Scheme)

➢ Filing of Form ITC-04 (Intimation by the principal for job work) for the period January – March 2020

➢ Assessment related forms including the issuance of the notice, furnishing of reply, passing of an order

➢ Departmental audit and Special Audit related compliances

➢ Advance ruling compliances

➢ Appeal provisions including the filing of an appeal, cross objection, etc.

➢ Search and seizure forms including an order of seizure, bond for the release of seized goods, order for the release of seized goods, etc.

➢ Demand and recovery forms including the issuance of show cause notice, reply to show cause notice, the passing of the order, payment of demand under the order, etc.

Shubham Khaitan

Shubham Khaitan

Kolkata, India