European court case over single and multiple supply.

Table of Contents

Case Covered:

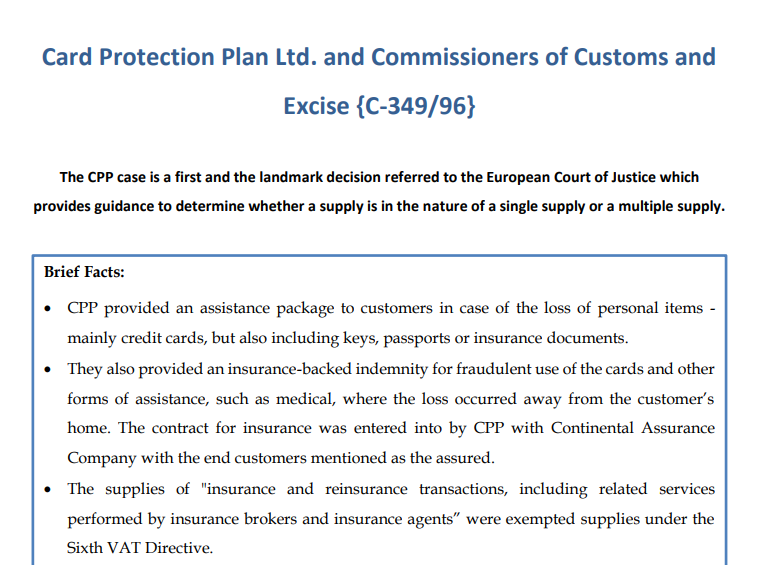

Card Protection Plan Ltd. and Commissioners of Customs and Excise

The CPP case is a first and the landmark decision referred to the European Court of Justice which provides guidance to determine whether a supply is in the nature of a single supply or multiple supply.

Brief Facts:

• CPP provided an assistance package to customers in case of the loss of personal items – mainly credit cards, but also including keys, passports or insurance documents.

• They also provided an insurance-backed indemnity for fraudulent use of the cards and other forms of assistance, such as medical, where the loss occurred away from the customer’s home. The contract for insurance was entered into by CPP with Continental Assurance Company with the end customers mentioned as the assured.

• The supplies of “insurance and reinsurance transactions, including related services performed by insurance brokers and insurance agents” were exempted supplies under the Sixth VAT Directive.

• CPP argued that the services it supplies are wholly or – as multiple supplies – largely tax-exempt as insurance services. However, the UK authorities took the view that the activity of CPP can be regarded as a taxable activity since the maintenance of a register of card numbers and the services related to loss of cards constitute a package of services where the dominant part of the services comprises a card registration service, which is a taxable service.

Issue:

• The question raised by the House of Lords before the ECJ was whether this was a single or multiple supply and whether the package was an exempt supply of insurance or a taxable supply of ‘convenience’ since the customers would be paying for someone else to cancel their cards/order new cards etc.

Observations & Ruling:

• The ECJ could not give definitive guidelines and stated that the final decision on whether a transaction was a single or multiple supplies was the responsibility of the national court.

• However, the ECJ did give useful guidance on what to use as a basis for these decisions. They were:

✓ Since it is not possible to give guidance that would cover all cases of single/multiple supplies when you are considering a transaction that consists of a number of components regard must be given to all the circumstances in which that transaction takes place.

✓ Each supply of service must normally be regarded as distinct and independent.

✓ A supply that comprises a single service from an economic point of view should not be artificially split – the essential features of the transaction must be ascertained to decide if the supply to a typical customer comprises several distinct principal services or a single service

✓ There is a single supply in cases where one or elements are to be regarded as ancillary services. An ancillary service is defined as something that does not constitute for customers an aim in itself but as a means of better enjoying the principal service supplied

✓ The fact that a single price is charged is not decisive. If the circumstances indicate that customers intend to purchase two or more distinct services a single price will not prevent these being treated as separate supplies with different liabilities applying, if appropriate, to those services.

• Following the recommendations from the ECJ, Lord Slynn held that:

“If anyone asks what is the essential feature of the scheme or its dominant purpose, perhaps why objectively people are likely to want to join it, I have no doubt it is to obtain insurance cover against loss arising from the misuse of credit cards or other documents. The other features of the scheme, such as card registration and obtaining replacement cards, were found to be ancillary to the main objective of the scheme i.e. the financial protection against loss of the card.”

• Accordingly, services provided by Card Protection Plan were ultimately held to be in the nature of ‘insurance transactions’ and thus, were deemed to be a single supply of exempt services.

Download the copy:

CA Tushar Aggarwal

CA Tushar Aggarwal