Proposed GST related relaxations announced by the Finance Minister due to COVID-19 outbreak

Table of Contents

- Following are the proposed GST related relaxations announced by the Finance Minister due to COVID-19 outbreak:

- Extension of time limit for filing GSTR-3B

- Extension of time limit for filing GSTR-1

- Extension of time limit for filing GSTR-9 and 9C for 2018-19

- Extension of time limit for Composite taxpayers

- Extension of various other due dates

- Sabka Vishwas Scheme

- Download the copy:

Following are the proposed GST related relaxations announced by the Finance Minister due to COVID-19 outbreak:

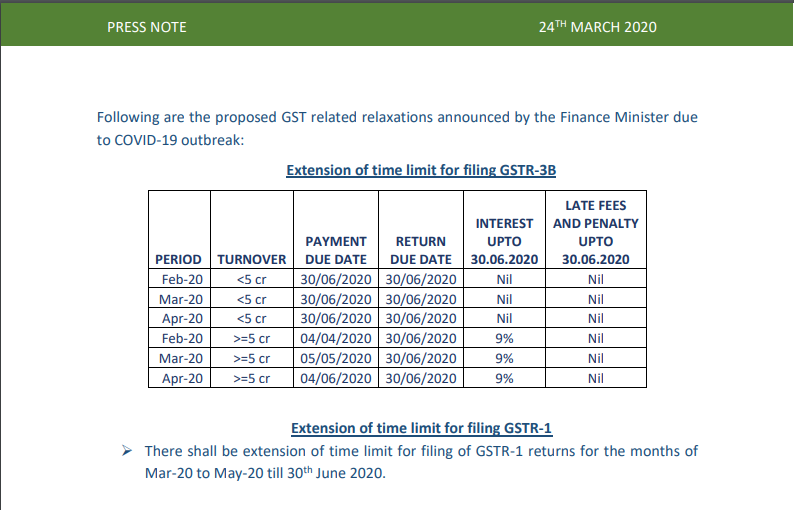

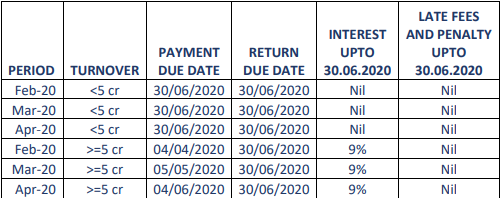

Extension of time limit for filing GSTR-3B

Extension of time limit for filing GSTR-1

There shall be an extension of the time limit for filing of GSTR-1 returns for the months of Mar-20 to May-20 till 30th June 2020.

Extension of time limit for filing GSTR-9 and 9C for 2018-19

GSTR 9 and 9C for 2018-19 which was due till 31st March 2020 has been extended to 30th June 2020

Extension of time limit for Composite taxpayers

- The last day for opting for composition scheme has been extended from 31st March 2020 to last week of June 2020

- All return and payment for the quarter ending 31st March 2020 have been extended to last week of June 2020.

Extension of various other due dates

Due date for issue of notice, notification, approval order, sanction order, filing of an appeal, furnishing of return, statements, applications, reports, any other documents, the time limit for any compliance under the GST laws where the time limit is expiring between 20 March 2020 to 29th June 2020 shall be extended to 30th June 2020.

Sabka Vishwas Scheme

The payment date under Sabka Vishwas Scheme shall be extended to 30th June 2020. No interest for this period shall be charged if paid by 30th June 2020.

Download the copy:

Shubham Khaitan

Shubham Khaitan

Kolkata, India