Apply for LUT for FY 2020-21

Who is required to apply for LUT?

All taxpayers engaged in the export of goods and/or services can apply for LUT. There are two options for making an export. Section 16 of IGST provide for:

- Export on payment of IGST and claim refund.

- Export on LUT, without payment of tax and apply for a refund of ITC.

Exporters who want to export without payment of tax can apply for LUT. It is for one financial year. So even if you applied for LUT in last year. You can apply for a fresh one for FY 2020-21.

How to apply for LUT?

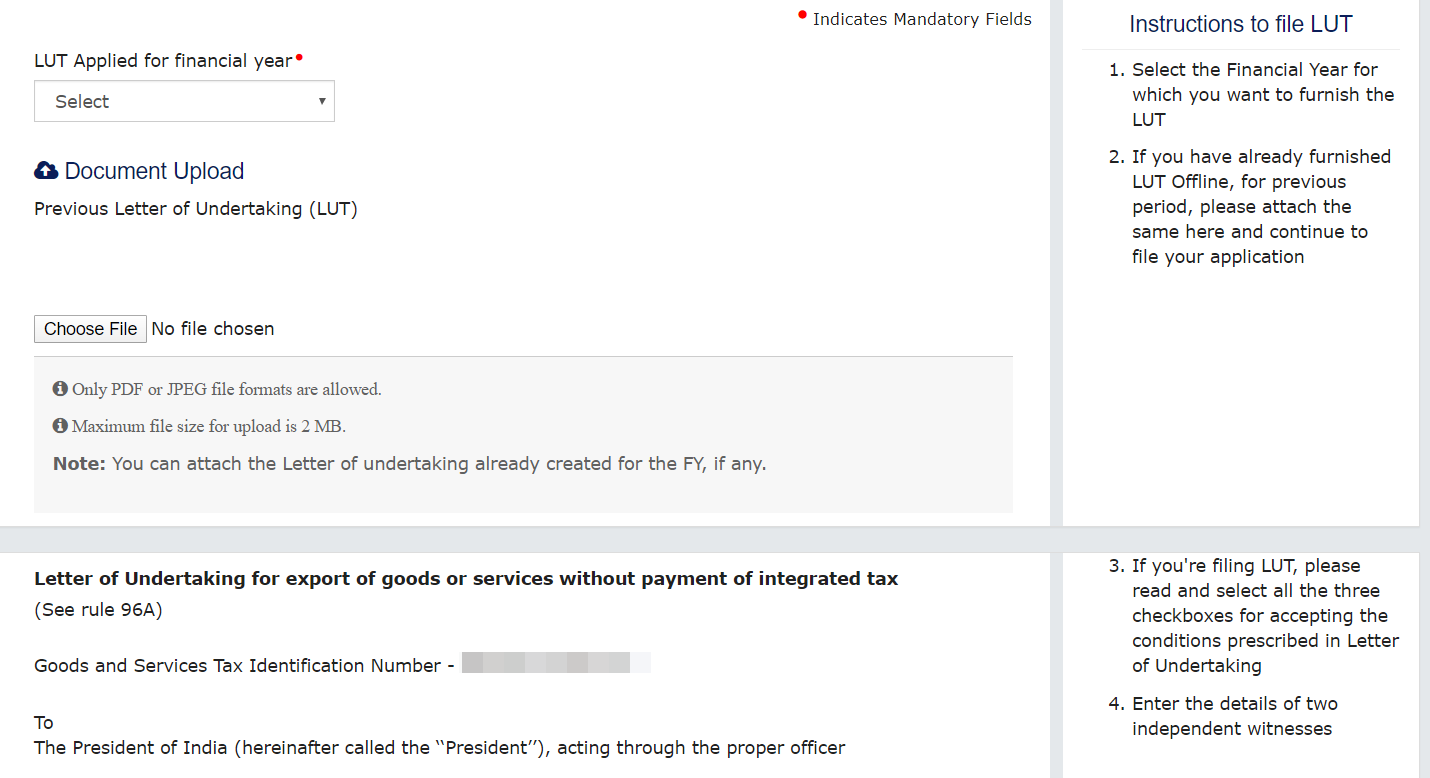

Login at GSTN and go to user services. Here you will see the “letter of undertaking” tab. Click on it and a window will open as shown in the image below.

- Here you will see a box to upload your LUT of the previous year. It is not mandatory. Move ahead if it is the first year.

- Then there is a declaration. Three checkboxes are there. You need to tick on all these three boxes.

- Fill the details of witnesses. Two witnesses are required to file LUT. The name and address of witnesses will be required.

- Then click on save.

- Select the authorized signatory

- click on the “file”. You can file it with EVC if you are an individual or HUF or partnership.

- For other entities, DSC is required.

Your LUT is filed. It is simple and easy. Remember that it is valid only for one year. Its validity is from the date of filing to next 31st March.

Now you can export without payment of IGST for one year. Next year you need to apply for it again. Remember that it is not mandatory to export on LUT even if you have it. You may still export on payment of tax. You can do both also. like some export with LUT and some with IGST payment.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.