10 Major Changes in CARO, 2020 vs CARO, 2016 in Fastrack Summary Mode

Table of Contents

- 10 Major Changes in CARO, 2020 vs CARO, 2016 in Fastrack Summary Mode

- 1) Fixed Asset Rejig

- 2) Inventory Physical Verification & Bank Limit Rejig

- 3) Loans & Advances Rejig

- 4) Default in Loan Repayment Rejig (Most Changed Clause 9 of CARO, 2020)

- 5) Fraud Reporting Rejig

- 6) Managerial Remuneration Clause Deletion

- 7) Five New Clauses (Clause 17 to 21)

- 8) NBFC Companies Compliance Reporting Rejig

- 9) Internal Audit Rejig

- 10) Income Tax Transactions not in Books

- Conclusion:-

- Download the copy:

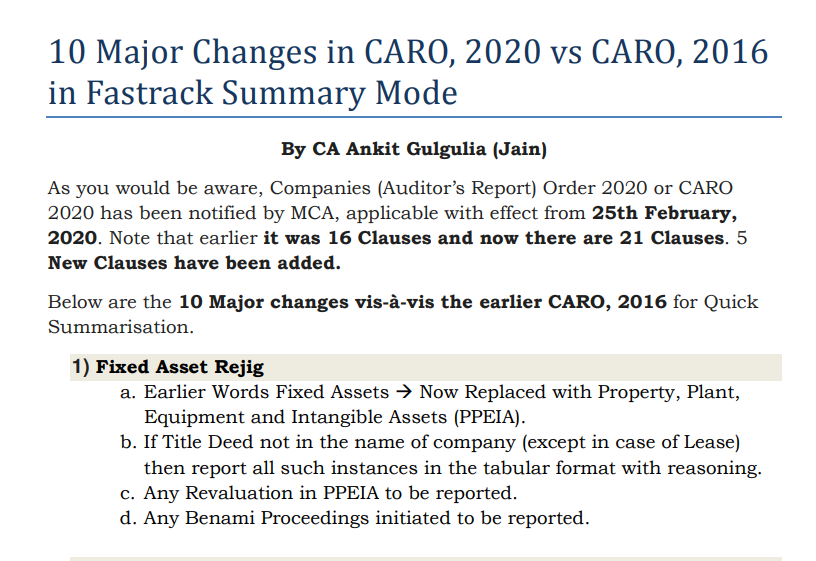

10 Major Changes in CARO, 2020 vs CARO, 2016 in Fastrack Summary Mode

As you would be aware, Companies (Auditor’s Report) Order 2020 or CARO 2020 has been notified by MCA, applicable with effect from 25th February 2020. Note that earlier it was 16 Clauses and now there are 21 Clauses. 5 New Clauses have been added.

Below are the 10 Major changes vis-à-vis the earlier CARO, 2016 for Quick Summarisation.

1) Fixed Asset Rejig

a. Earlier Words Fixed Assets→ Now Replaced with Property, Plant, Equipment and Intangible Assets (PPEIA).

b. If Title Deed not in the name of the company (except in case of Lease) then report all such instances in the tabular format with reasoning.

c. Any Revaluation in PPEIA to be reported.

d. Any Benami Proceedings initiated to be reported.

2) Inventory Physical Verification & Bank Limit Rejig

a. Inventory verification coverage and procedure to be disclosed.

b. Any Discrepancy beyond 10% to be disclosed

c. Any Working capital limit above 5 Cr on the collateral of Current Assets to be disclosed and returns filed with Bank in consonance with Books.

3) Loans & Advances Rejig

a. Earlier dues settled by extension, renew or fresh loans to be now reported

b. Any Loans on-demand basis to be separately disclosed.

4) Default in Loan Repayment Rejig (Most Changed Clause 9 of CARO, 2020)

a. Specified Table for reporting default

b. Disclosure if declared willful defaulter by Financial Institutions.

c. Terms loans applied for the right purpose or not

d. Short term loans whether applied for long term purposes.

e. Funds obtained to service obligation of Subsy, JV or Associate Companies

f. Funds obtained on pledging of shares of Subsy, JV or Associate Companies.

Related Topic:

CARO 2003, 2015, 2016 and 2020 comparison table

5) Fraud Reporting Rejig

a. ADT-4 Filed by Auditor’s if any to be reported.

b. Any whistleblower complaint referred to during audit

6) Managerial Remuneration Clause Deletion

a. Payment of Managerial Remuneration in accordance with Sch V has been deleted

7) Five New Clauses (Clause 17 to 21)

a. 17 – Cash Losses – Cash Losses to be reported for an FY if any

b. 18 – Resignation of Auditor – The Issues raised by him whether considered or not if any.

c. 19 – Company’s ability to meet its current liabilities in auditor’s opinion based on ratios, realizations, and aging.

d. 20 – CSR Compliance – Ongoing project whether unspent amount transferred to fund within 6 months / Special account

e. 21 – Companies in Consolidation – All negative CARO remarks whether of any subsidy, JV or Associate company as consolidated has to be reported in the Holding Company Clause 21 CARO.

8) NBFC Companies Compliance Reporting Rejig

a. Whether NBFC has a valid certificate from RBI

b. Whether it is CIC, whether the group has more than 1 CIC and compliance.

Related Topic:

CARO:Companies (Auditor’s Report) Order, 2016

9) Internal Audit Rejig

a. Whether the Internal Audit System exists or not as per the company’s size?

b. Whether any Internal audit report has been considered by the auditors

10) Income Tax Transactions not in Books

a. Whether any transactions offered in income tax but not recorded in Books.

Conclusion:-

Welcome Changes, these will improve the reporting specially after ILFS, DHFL Fiasco

Download the copy:

CA Ankit Gulgulia

CA Ankit Gulgulia

Chartered Account and Financial Services Provider

New Delhi, India