Representation on issues being faced by taxpayers and tax professionals related to GST Act, GST portal, network and glitches thereof.

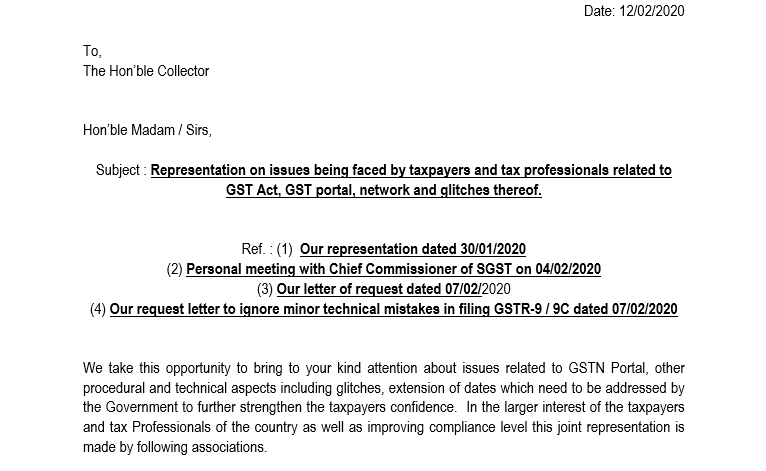

To,

The Hon’ble Collector

Hon’ble Madam / Sirs,

Subject: Representation on issues being faced by taxpayers and tax professionals related to GST Act, GST portal, network and glitches thereof.

Ref. : (1) Our representation dated 30/01/2020

(2) Personal meeting with Chief Commissioner of SGST on 04/02/2020

(3) Our letter of request dated 07/02/2020

(4) Our request letter to ignore minor technical mistakes in filing GSTR-9 / 9C dated 07/02/2020

We take this opportunity to bring to your kind attention about issues related to GSTN Portal, other procedural and technical aspects including glitches, the extension of dates that need to be addressed by the Government to further strengthen the taxpayers’ confidence. In the larger interest of the taxpayers and tax professionals of the country as well as improving compliance level this joint representation is made by following associations.

- The Gujarat Sales Tax Bar Association (GSTBA)

- The All Gujarat Federation of Tax Consultants (AGFTC)

- National Action Committee of Tax Professionals (NAC)

- All India Federation of Tax Practitioners-West Zone (AIFTP-WZ)

- Income Tax Bar Association (IT Bar)

- Tax Advocates Association Gujarat (TAAG)

- Chartered Accountant Association Ahmedabad. (CAA)

The Professional Associations seeking measures to resolve the technical glitches in the GST Portal.

India’s largest tax reforms, the Goods and Services Tax, were launched on July 1, 2017, but are yet to be fully put in place due to patchy technical implementation. GST is a complete overhaul of the taxation system in India powered by the GSTN Network. However, it has been almost 31 months since its introduction and the GST regime had its fair share of roadblocks. Even today also GST is not error or glitch-free. The road ahead promises a bumpy ride for the taxpayers. It gives the impression that the Government is still riding on the learning curve.

Any new reform, particularly a tax reform, is bound to have initial resistance. However, tax-paying businessmen were so frustrated by multiple taxes and compliances under earlier laws that they welcome GST wholehearted hoping it will solve all their problems and GST will be easy to understand and implement.

The government also trumpeted GST from top of the roof, in spite of the fact that the Government was ill-prepared for it. It believed that it has taken so long that the drafting personnel has made it full proof. On paper and conceptually GST is very good but practically not easy to understand and implement.

World Bank calling Indian GST a very complex taxation system. The regime is not tax-friendly. Frequent technical glitches in the GSTN website have been a big cause of inconvenience for businesses. The Comptroller and Auditor General of India (CAG) has pointed out the lacuna in the goods and service tax (GST) regime, saying that system-validated input tax credit through invoice matching is not in place and a non-intrusive e-tax system still remains elusive after two years of its rollout.

It pulled up the department of revenue, the Central Board of Indirect Taxes and Customs (CBIC), both under the finance ministry and GST Network (GSTN) for their failure to try out the GST System adequately before rolling it out on July 1, 2017.

The implementation of GST and thereafter functioning of GSTN Portal has to lead to a situation wherein the taxpayers, tax professionals, and national interest get jeopardized and all are suffering which would not be in the interest of the nation and its overall growth.

Since the inception of goods and services tax, the register persons are facing many problems and challenges in complying with the provision of the Act and the Rules made thereunder. The GST portal is the main source of the problems caused to the registered person. The glitches in the system prevent the registered persons from filing the returns in regular time for which the due dates for various returns have been postponed now and then. Major taxpayers reported difficulties in logging in to the portal and filing their returns. There are many technical issues in the network. Design bugs in GST Software have added to problems.

There is a lot of technical changes in the area of Indirect Taxation, especially in GST. We all are aware of the problems and difficulties faced by the taxpayers related to GSTN Network. The compliance, requirement under the GST has increased many folds.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.