Notice inviting comments for amending the existing provisions for auditor independence and accountability

- NOTICE INVITING COMMENTS ON THE CONSULTATION PAPER TO EXAMINE THE EXISTING PROVISIONS OF LAW AND MAKE SUITABLE AMENDMENTS THEREIN TO ENHANCE AUDIT INDEPENDENCE AND ACCOUNTABILITY

- A. Objective

- B. Background and rationale for the review

- C. Current regulatory Provisions:

- (D) Suggestions to overcome the aforesaid situations which worsened the independence of the Auditors

- (A)To remove the self-interest threat:-

- (B)To remove the self-review threat:-

- (C) To remove the advocacy threat:-

- (D) To remove the familiarity threat:-

- (E) To remove the intimidation threat:-

- Download the copy:-

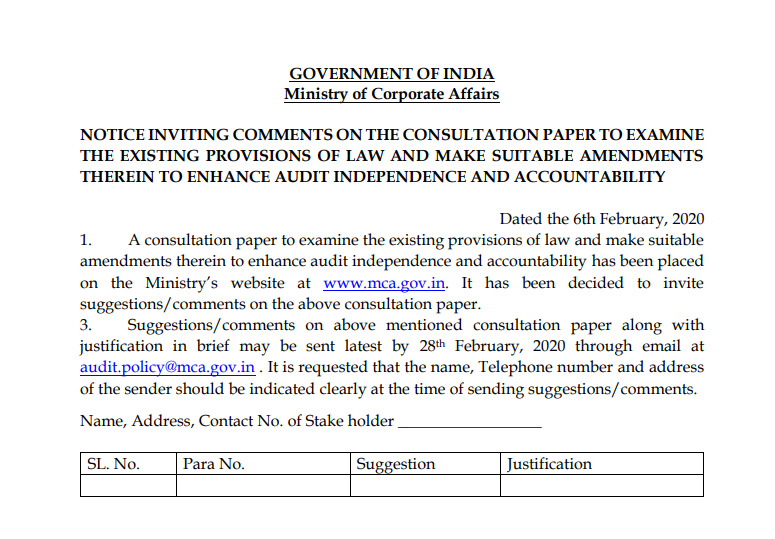

NOTICE INVITING COMMENTS ON THE CONSULTATION PAPER TO EXAMINE THE EXISTING PROVISIONS OF LAW AND MAKE SUITABLE AMENDMENTS THEREIN TO ENHANCE AUDIT INDEPENDENCE AND ACCOUNTABILITY

Government of India

Ministry of Corporate Affairs

Consultation Paper to examine the existing provisions of law and make suitable amendments therein to enhance audit independence and accountability

A. Objective

To solicit the views/ comments of other Government Departments and Regulatory Agencies on suggestions relating to amendment in existing law to enhance audit independence and accountability.

B. Background and rationale for the review

The concept of Auditor independence requires the auditor to carry out his or her work freely, with integrity and in an objective manner. Though the auditor is appointed by the shareholders, the effective power of their appointment and dismissal lies with the management. Hence, time and again, audit independence has been questioned, as to whether the auditor really doing justice to the interest of shareholders and is staying true to the audit profession. Also, the auditor’s responsibility is not limited to shareholders, as audit report is a public document relied on to by various stakeholders, including Financial Institutions, Government and the general public.

2. Broadly, the auditor’s financial or other interest in the client’s business inappropriately influences his judgment or behavior and a conflict of interest always exists, which may result in the auditor turning a blind eye to potential risk or at the extreme ignore an impending/occurred fraud.

2.1 There is a self-interest threat due to the reliance of auditors on the fee from the client. This is manifested in various ways and results in various negative consequences.

2.1.1 In order to sign clients, it is observed that audit firms quote competitive prices, not commensurate with the amount necessary to undertake the quality audits.

This may result in auditors/audit firms deploying lesser resources than needed for the audit, limiting the scope of their work, etc, all resulting in a sub-par audit.

2.1.2 Auditors and audit firms want to hold on to clients after the completion of auditing assignments, in order to provide other services (like management consulting, bookkeeping, etc), this also affects the independence of the auditor.

2.1.3 Income from other services provided by the auditor (other than ones disallowed by the Act) also affects how far the auditor may be influenced by the management.

2.2 Sometimes, the self-review affects the independence of the auditor if the auditor is auditing his or her own work or work that is done by others in the same firm. For example, The auditor prepares the financial statements for ABC Company while also serving as the auditor for ABC Company. Even if the auditor has previously provided other services to the company, his independence may be effected as his work may now need to be scrutinized by him/his firm.

2.3 Many times, the auditors involved in promoting the client to the point in which their objectivity is potentially compromised, resulting in an advocacy threat. For example: Promoting shares in an audit client; Acting as an advocate on behalf of the client in resolving disputes with third parties.

2.4 Sometimes, due to a long or close relationship with a client or employer, auditors are too sympathetic to their interests or too accepting of their work. A familiarity threat exists if the auditor is either too familiar with employees, officers, and directors, or keeps a long-standing relationship with the client. For example, Auditing the same client for numerous years; Having a close relationship with the director, officer, or employee in a position of influence over engagement subject; Previously having worked with or held office in engagement client.

2.4 An intimidation threat to independence also exists if the auditor is intimidated by management or its directors to the point that they are deterred from acting objectively. The threat that an auditor will be deterred from acting objectively because of actual or perceived pressures, including attempts by the client to exercise undue influence over the auditor. For example: Being threatened with dismissal as auditor of client; Being threatened with litigation; Being pressured to reduce the extent of work below what is required in an attempt to reduce fees.

3. Recently various instances of failure of auditors have been noticed such as IL&FS case etc., and it is also seen that the quality of audit reports has been compromised. In most cases, the auditor appears to be hand in glove with the management and therefore the question on their independence and accountability have arisen. In order to pluck the aforesaid scenarios/instances, the Ministry is of the view that the existing regulatory provisions relating to Audit and Auditors in Companies Act, 2013 and its Rules along with Standard of Auditing need to be reviewed.

C. Current regulatory Provisions:

(1) Chapter X (Section 139 to 148) of the Companies Act, 2013 deals with the Audit and Auditors. Section 139 relates to the appointment of auditors and section 140 deals with Removal and resignation of Auditor, giving special notice. Section 141 provides for eligibility, qualifications, and disqualifications of auditors. Section 142 deals with the Remuneration of auditors. Section 143 provides for the Powers and duties of auditors and auditing standards & Section 144 prohibits the auditors to render certain services other than an audit.

(2) In order to properly implement the aforesaid provisions relating to Auditors, the Central Government has notified the Companies (Audit and Auditors) Rules, 2014 and made amendments in the rules from time to time.

(3) Standards of Auditing (SAs) issued by the ICAI are mandatory to follow by the auditors in view of Section 143(9) of the Companies Act, 2013. The auditors are expected to ensure compliance with SAs in their audit engagements to ensure quality audits.

(D) Suggestions to overcome the aforesaid situations which worsened the independence of the Auditors

In order to overcome the aforesaid situations which worsened the independence of the Auditors following suggestions have been noted:

(A)To remove the self-interest threat:-

➢ Prohibition of providing non-audit services;

➢ Fees based on reasonable estimates of time and expertise required;

➢ Stringent independence guidelines and monitoring by firms;

➢ Disclosure of previous business relationship with the company in audit report;

➢ Legislative restrictions on auditors regarding independence

(B)To remove the self-review threat:-

➢ Stringent quality review procedures within firms;

➢ Prohibition of retired partners joining clients within the cooling period;

➢ Confidentiality of information;

➢ Prohibition of personal relationships with clients;

➢ Prohibition of providing certain assurance engagements for client

(C) To remove the advocacy threat:-

➢ Prohibition of business relationships;

➢ Strict rules on promoting clients;

➢ Rotation of audit partners

(D) To remove the familiarity threat:-

➢ Restriction of personal relationships;

➢ Rotation of audit partners and possibly senior auditors;

➢ Disclosure of commission and other relationships.

(E) To remove the intimidation threat:-

➢ Appointment of auditors by external authorities like CAG

The above suggestions are not exhaustive but inclusive and the proposals are invited to give more suggestions to enhance the independence and accountability of auditors.

Apart from the above, the Ministry has observed the following further points which require the thorough examination and proper inclusion in the existing law i.e. either in Companies Act, 2013 and its Rules or in the standard of auditing (SAs).

Download the copy:-

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.