Tax and penalty on Cash Deposit due to Demonetization

The Union Finance Minister Arun Jaitley yesterday introduced the Taxation Laws (Second Amendment) Bill, 2016 with a view to tax unaccounted black money deposited in bank accounts pursuant to demonetisation. The government has introduced Chapter IXA: ‘Taxation and Investment Regime for Pradhan Mantri Garib Kalyan Yojana, 2016′ (PMGKY) consisting of Section 199A to 199R .The salient terms of the proposal to tax the unaccounted cash are as follows:

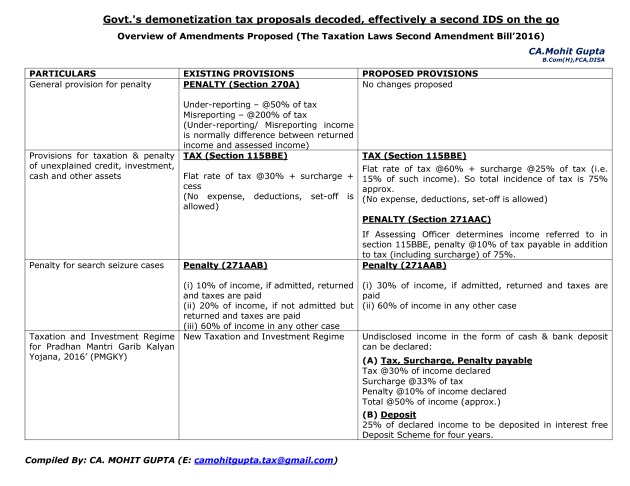

(i) 30 per cent tax on undisclosed income plus 10 per cent penalty as also a 33 per cent surcharge ( Total Tax incidence of around 49.9% of the amount declared );

(ii) 25 per cent of undisclosed income post demonetisation has to be deposited in the Pradhan Mantri Garib Kalyan Deposit Scheme for a lock in period of 4 years (non-interest bearing) ;

The money from the Pradhan Mantri Garib Kalyan Deposit scheme would be used for projects in irrigation, housing, toilets, infrastructure, primary education, primary health and livelihood so that there is justice and equality, states the Statement of Objects and Reasons of the Bill

(iii) In other cases, wherein this opportunity is not availed, undisclosed wealth deposited post demonetisation which is detected by the income-tax authorities will attract 75 per cent tax and 10 per cent penalty.

The copy of the Taxation Laws (Second Amendment ) Bill, 2016 along with a tax rate/penalty analysis sheet is enclosed herewith. Tax and penalty on cash deposit will be calculated accordingly.

Download PDF for the chart

|

PARTICULARS |

EXISTING PROVISIONS |

PROPOSED PROVISIONS |

|

|

General provision for penalty |

PENALTY (Section 270A) |

No changes proposed |

|

|

|

Under-reporting – @50% of tax |

|

|

|

|

Misreporting – @200% of tax |

|

|

|

|

(Under-reporting/ Misreporting income |

|

|

|

|

is normally difference between returned |

|

|

|

|

income and assessed income) |

|

|

|

Provisions for taxation & penalty |

TAX (Section 115BBE) |

TAX (Section 115BBE) |

|

|

of unexplained credit, investment, |

|

Flat rate of tax @60% + surcharge @25% of tax (i.e. |

|

|

cash and other assets |

Flat rate of tax @30% + surcharge + |

|

|

|

15% of such income). So total incidence of tax is 75% |

|

||

|

|

cess |

approx. |

|

|

|

(No expense, deductions, set-off is |

|

|

|

|

(No expense, deductions, set-off is allowed) |

|

|

|

|

allowed) |

|

|

|

|

|

PENALTY (Section 271AAC) |

|

|

|

|

If Assessing Officer determines income referred to in |

|

|

|

|

section 115BBE, penalty @10% of tax payable in addition |

|

|

|

|

to tax (including surcharge) of 75%. |

|

|

Penalty for search seizure cases |

Penalty (271AAB) |

Penalty (271AAB) |

|

|

|

(i) 10% of income, if admitted, returned |

(i) 30% of income, if admitted, returned and taxes are |

|

|

|

and taxes are paid |

paid |

|

|

|

(ii) 20% of income, if not admitted but |

(ii) 60% of income in any other case |

|

|

|

returned and taxes are paid |

|

|

|

|

(iii) 60% of income in any other case |

|

|

|

Taxation and Investment Regime |

New Taxation and Investment Regime |

Undisclosed income in the form of cash & bank deposit |

|

|

for Pradhan Mantri Garib Kalyan |

|

can be declared: |

|

|

Yojana, 2016’ (PMGKY) |

|

(A) Tax, Surcharge, Penalty payable |

|

|

|

|

|

|

|

|

|

Tax @30% of income declared |

|

|

|

|

Surcharge @33% of tax |

|

|

|

|

Penalty @10% of income declared |

|

|

|

|

Total @50% of income (approx.) |

|

|

|

|

(B) Deposit |

|

|

|

|

25% of declared income to be deposited in interest free |

|

|

|

|

Deposit Scheme for four years. |

CA Mohit Gupta

CA Mohit Gupta

Delhi, India

Mr. Mohit Gupta is a Fellow Member of the Institute of Chartered Accountants of India, a commerce graduate from prestigious Ramjas College, Delhi University, and alumni of St. Xavier’s School, New Delhi. He is practicing as a Chartered Accountant for more than 15 years and managing the Direct Tax Advisory and Litigation practice of M/s. Dhanesh Gupta & Co., Chartered Accountants, New Delhi a renowned Chartered Accountancy firm in the core domain of direct taxation established in 1978. He forte is handing Income Tax Search and Seizure matters, matters before the Income Tax Settlement Commission and other direct tax litigation matters. As of today, he has wide experience in handling Income Tax Search and Seizure Cases, representing matters before the Income Tax Settlement Commission, ITAT, and other appellate tribunals. He has been contributing articles in various professional magazines/journals and addressing various seminars on topics relating to Income Tax Search and Seizure, Income Tax Settlement Commission, and other allied tax matters. He has to his credit plethora of well-researched articles out of which many have appeared in leading journals. In Addition to the above, Mr. Mohit Gupta is a Special Auditor of the Income Tax Department and has carried out numerous Special Audits across the country on being appointed by the Income Tax Department which have plugged tax evasions, tax base erosion, and other tax manipulative practices and in turn, facilitated the Income Tax Department to collect huge tax revenues. Mr. Mohit Gupta has also been appointed as Special Auditor under other tax statutes and by other Investigation Agencies of the Government of India. Mr. Mohit Gupta, authored the periodical Newsletter on Income Tax Search and Seizure. The said newsletter contained well-researched write-ups/articles and judicial developments on the matters of Direct Taxation. The newsletter was circulated both electronically and otherwise. Recently, in the year 2016, Mr. Mohit Gupta has authored two comprehensive books on the Income Declaration Scheme’2016, titled as “Law Relating to Income Declaration Scheme’2016”. His books provided at one place the entire gamut of the Law relating the Income Declaration Scheme ‘2016 and set to rest all the queries that arose before, during, and after the course of making the declaration under the Income Declaration Scheme’2016. The books received an extremely overwhelming response from the readers including the proposed taxpayers, tax administration, tax professionals, corporate houses, and academicians. The said books were released by erstwhile Hon’ble Union Finance Minister, Shri. Arun Jaitley, Shri.Arjun Ram Meghwal, Minister of State for Finance and the Chairman of Central Board of Direct Taxes and many other dignitaries. Due to his continuous desire to always rise on the learning curve, he always has a quest and quenches to read more, learn more, and perform even more.