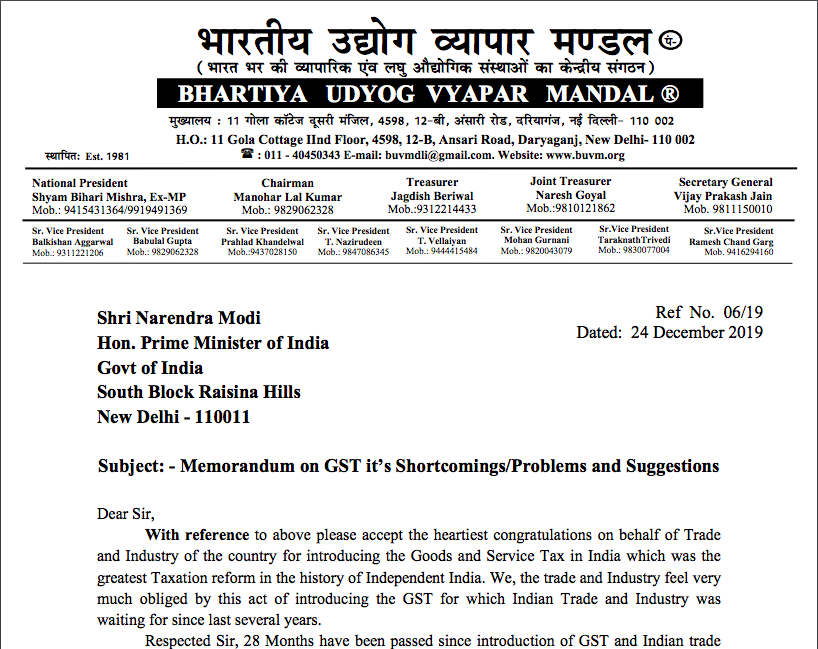

Letter to PM on shortcomings/suggestions on GST by BHARTIYA UDYOG VYAPAR MANDAL

A Letter to PM on shortcomings/suggestions on GST by Bhartiya Udyog Vyapar Mandal. In this letter issues in GST are discussed. Some suggestions to make it better are also covered.

Memorandum on GST it’s Shortcomings/Problems and Suggestions

Dear Sir,

With reference to above please accept the heartiest congratulations on behalf of Trade and Industry of the country for introducing the Goods and Service Tax in India which was the greatest Taxation reform in the history of Independent India. We, the trade and Industry feel very much obliged by this act of introducing the GST for which Indian Trade and Industry was waiting for since last several years.

Respected Sir, 28 Months have been passed since introduction of GST and Indian trade and Industry has given its full cooperation in implementation of Goods and Service Tax and we have received some of the shortcomings and need of simplification of the GST and request your good self to consider the same so the Indian Trade and Industry will give their full capacity cooperation for the betterment of the Economy of India. The matters are being enlisted hereunder:-

1. Sir, the provision of 10% Input credit provision should be postponed and it should be reframed with proper preparation. The time limit given in the provision is very impractical and the dealers should be given 3 to 6 Months time for clearing the Mismatch of the input credit. We are not supporting the tax evasion or nonpayment of tax but if the tax is paid by the dealer to the seller then it should not be collected from him again on the ground that there is delay on part of the seller in filing his returns. There may be several reasons for delay in filing of the returns and if in the same month the ITC – Input tax credit is withheld and purchaser is asked to deposit the same is not a practical solution.

In any case the tax will be paid by the purchaser if it is not paid by the selling dealer with interest but he should be given a time of 3 to 6 Months to control the transactions of the seller and compel him to file the returns.

2. Sir, As per GST Act, there is a provision of rectifying the mistake in the returns filed by dealers but such a provision is not given in respect of GSTR-3B which was the stopgap arrangement at the time of introduction of GST in July 2018 and still the form is there and Now this is the main return for payment of tax.

There should be a facility to rectify the mistakes done in the GSTR-3B otherwise for every assessment there will be a Notice from the Department and this will not be a standard situation and further the Department does not have the manpower to attend these large number of cases.

Please make a provision for rectifying the mistakes made in Form 3B filed by the dealers since July 2017 i.e. from the inception of GST.

Letter Prime Minister Narendra Modi (E)

3. Sir, the provision of RCM is a very impractical provision especially in the cases where the paying dealer is getting the instant credit of the same. It has Zero revenue effect in most of the cases.

GST is a new tax and RCM is a very innovative provision hence in most of the cases dealers has made default in paying the same though they have paid the full tax as per their tax liability and in these type of cases the RCM is just a technical formality.

Sir, please consider the dealer who defaulted in paying the RCM and taking credit of the same due to complications attached of this provision though they have otherwise paid their full tax liability and abolish the same since inception to give relief to these dealers.

Sir, we are giving herewith an example how RCM has no financial effect on the revenue. Let us assume a dealer has to pay tax amounting to Rs. 5.00 out of which RCM is Rs. 50000.00, the dealer failed to pay RCM but paid tax Rs. 5.00 Lakhs.

The same dealer has paid Rs.50000.00 as RCM and paid the normal tax as Rs.4.50 Lakhs since he is eligible to get ITC of Rs. 50000.00 paid by him as RCM. Hence in this case also total tax deposited is Rs. 5.00 Lakhs. Rs.50000.00 is paid as RCM and Rs. 4.50 Lakhs paid as Normal Tax.

In these types of cases the RCM is just a technical formality and having no financial effect so please scrap it since inception of GST i.e. 1st, July 2017.

4. Respect Sir, the dealers who have surrendered their RC and does not have any tax liability and having no stock have to file a final return GSTR-10 and in most of the cases these returns are NIL but if forget they have to pay a late fess amounting to Rs. 200.00 per day subject to maximum of Rs. 10000.00 . The form GSTR-10 in most of the cases have NIL information hence this late fees is a harassment and big burden on the dealers who have already surrendered their registration certificates.

This GSTR-10 has to be filed after order of the cancellation of the RC and it is a big problem. Sometimes it is ordered within 15 days of applying the surrender and insome cases it took 6 Months so the dealers who surrendered their Registration to keep in touch with this formality.

Please consider the problem associated with this form GSTR-10 and practically this form should be taken with the application of surrender of RC and in NIL cases if the return is not filed please waive the late fees further the NIL GSTR-10 has no purpose hence it should be made optional for the dealers who has something to file in it.

5. Sir, ITC-04 is a form which was postponed several times and after several postponements it was scrapped for initial two years. Here please see sir, the problems associated with this form are still there hence it is requested to please scrap this form forever to give the relief to the affected dealers.

6. Respected sir, GST late fees is very big problem for the dealers and this one more point is attached with the late fees. At one point of time the Government has waived the late fees for the dealers who did not file their returns but in that case most of the dealers filed their return before that time with late fees and if a late fee is waived for the defaulters, the Late fees collected from these dealers should be refunded to them. But this is not done hence dealers have regrets due to this discrimination. Sir, Please make a provision for refund of late fees to these dealers and further introduce an amnesty scheme for rest of the dealers so that they can file their returns. Further Late fees on GSTR-1 is waived till 10th JAN 2020 and general perception is that after that there will be late fees on this form also which will create more problems for Taxpaying dealers. Please sir, please stop this at this initial stage. Sir, GST itself is at experimental stage hence provisions like late fees should be avoided to make the dealers to understand the system.

7. Sir, GSTN is creating problems since inception of the GST. It is not well equipped with required capacity hence filing of return is always a problem. The GSTN always crashed before one or two days before the due date of every return. Recently it is advised to file the returns 3 days before the due dates but sir, this is not the solution but it is acceptance of the shortcoming of the GST Network. Recently on 20th Dec. 2019 at last date of filing of GSTR-3B GST network was working perfectly when internet was blocked for security reason in some part of the county and it shows that GSTN can work smoothly but the capacity is the problem. Dear Sir, Please order for the enhancement of the GSTN capacity so that it can work smoothly,

8. Respected sir, GST is “One nation One Tax” and it was introduced as a tax with threshold limit of Rs.20.00 Lakhs both for Goods and Services but later when threshold was enhanced, it was enhanced only for Goods and not for services. Small service provider should also be given benefit of the same and for them also the Limit should be extended to a certain level to make it “One Nation One Tax”.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.