Big blow for non filers of GSTR 1

Big blow for non filers of GSTR 1

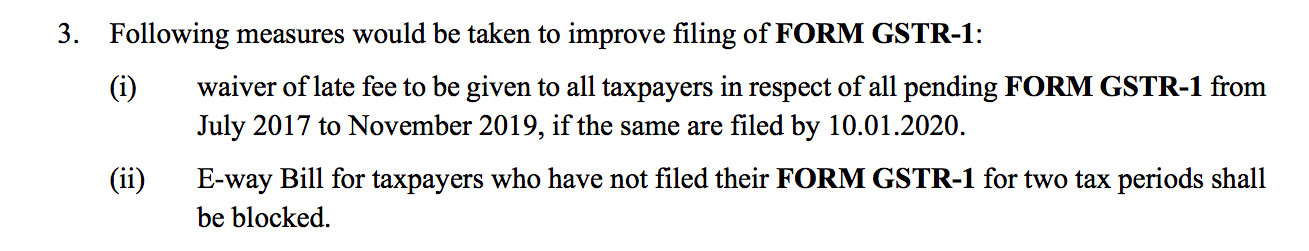

GST council meeting ended with relaxation. But it results in pain to non filers of GSTR 1. GSTN portal was not asking for late fees on GSTR 1. Although there is a provision for the same in section 37 of the CGST Act. But with this statement now late fees is payable if GSTR 1 gets delayed. Taxpayers were not paying any late fees until now. Now with this relaxation actually the government has announced that now on late fees is there. It is also important to note that now the portal will allow filing all GST returns from beginning to date. See the exact text of the release.

Also in case of non filing of GSTR 1 for 2 months will block E-way bill. This will stop the movement of articles from the defaulter. This will again result in a big blow.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.