Trans ITC can be claimed in 3b of 2020 jan: Hans Raj Sons v. Union of India PDF attached

Table of Contents

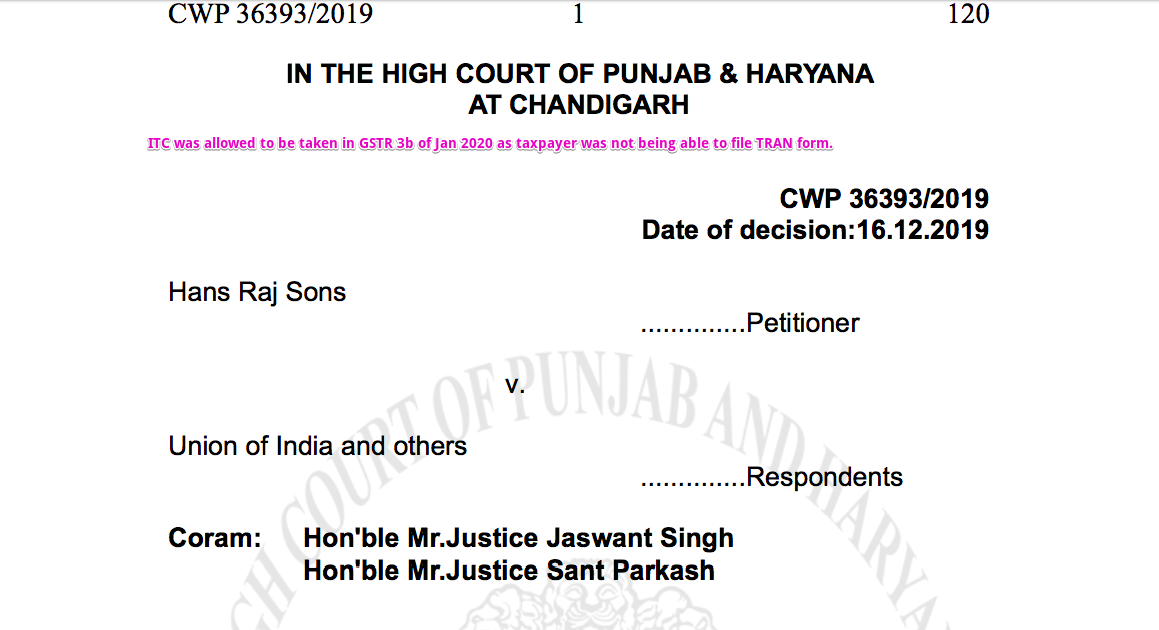

Case: Hans Raj Sons v. Union of India and others: Trans ITC can be claimed in 3b of 2020 jan

Facts of the Case: The taxpayer was not being able to take the transitional ITC as they were unable to fill form TRAN1. In a recent case of Adfert Technologies Pvt.Ltd. Versus Union of India and others a favourable decision is there. In this case also the Punjab and Haryana court allowed the ITC to taxpayer.

But in this case they were unable to take it as portal didnt allowed Tran 1 form. The court permit them to take the ITC in GSTR 3b of jan 2020.

The verdict of the court:

“It is clarified that in case the petitioner is hampered in any manner from availing the benefit of aforesaid judgment, due to non opening of the Portal by the Respondents, then the petitioner shall be permitted, in the alternative to claim the benefit of unutilized credit in their GST-3B Forms to be filed for the month of January,2020 either electronically or manually”

You can download the full copy of judgement here.

CWP_36393_2019_16_12_2019_FINAL_ORDER

Download Copy of order:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.