The Blocking/Unblocking of E-Way Bill generation

Table of Contents

Introduction:

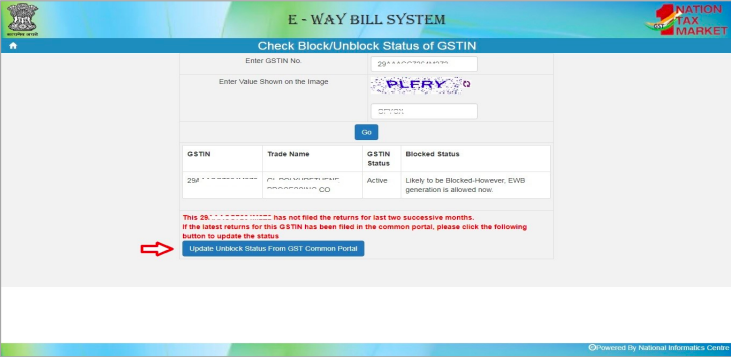

E-Way Bill system will have a new feature of blocking/unblocking of E-way bill for the taxpayers from next month, as per the rule. That is, if the GST taxpayer has not filed Return 3B for the last two successive months in GST Common portal, then that GSTIN will be blocked for generation of e-way bill either as consignor or consignee. Now, this month, the tax payer will be alerted with a cautionary message while generating the eWaybills, in case Return 3B for the past 2 successive months of the consignor/consignee GSTIN has not been filed. However, from next month onwards, such GSTINs will be blocked. On Filing of the Return-3B in the GST Common Portal, the GSTIN will get automatically updated as ‘Unblock’ within a day in the e-Waybill system and the tax payer can continue with e-way bill generation without any cautionary message. However, if the status is not updated in e-waybill system, then the taxpayer can do it by going to the e-Waybill portal and clicking on option Search-> Update Block Status. Enter the GSTIN, followed by the CAPTCHA and click on GO.

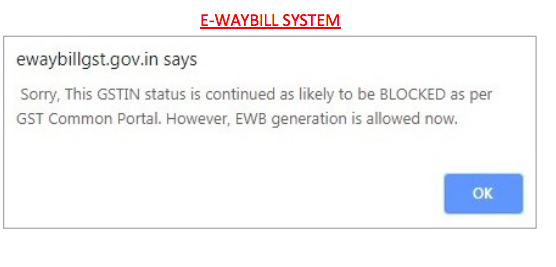

As shown in the above figure, the GSTIN and the blocked status will be displayed. The user must now click on the button: ‘Update Unblock Status from GST Common Portal’. This will fetch the status of filing from the GST Common Portal and if filed, the status in e-Waybill system will subsequently get updated. In case the user hasn’t filed the Returns for the last two successive months and clicked on the update button, a pop-up message as shown below will appear.

Blocking of e-way bill is going to be started for the taxpayers who haven’t file their GSTR returns. This will make it difficult for non-compliant to continue in business.

Blocking/Unblocking of E-way Bills Generation :Frequently Asked Questions

1. What is Blocking and Unblocking of E-waybill generation?

Ans: Blocking of e-waybill generation means not allowing the taxpayer to generate e-waybills if he /she has not filed GST Return for latest two successive months or quarters. The blocked GSTIN cannot be used to generate the e-way bills either as Consignor or Consignee. Unblocking means allowing the generation of e-way bills for the GSTIN (if blocked) after the filing of the Return.

2. How does blocking take place in the e-waybill system?

Ans: If the tax payers have not filed the latest two successive month returns on the GST Common Portal, then these tax payers will be blocked for the generation of the e-way bills as per the rule. The E-way Bill system will communicate with the GST Common Portal to find out the filing details of the taxpayers.

3. How does unblocking take place in e-waybill system?

Ans: If the blocked tax payer has filed the Return on the GST Common Portal, then next day morning his GSTIN is unblocked on the e-way Bill system and allow him to generate the e-way bills. If the tax payer wants to generate the e-way bills immediately after filing the Return, then he can go to the e-way bill portal and select the option ‘Search Update Block Status ‘ and then enter his/her GSTIN and see the status. If it is blocked then he/she can use update option to get the latest filing status from the GST Common Portal and get unblocked. Still if the system is not unblocking the GSTIN for e-way bill generation, then he can contact the Help Desk of the GST and raise the complaint to get his/her case resolved.

4. In spite of filing latest Returns, I have been blocked from e-waybill generation. What should I do?

Ans: If the tax payer wants to generate the e-way bills immediately after filing the returns, then he can go to the e-way bill portal and select the option ‘Search Update Block Status ‘ and then enter his/her GSTIN and see the status. If it is blocked then he/she can use update option to get the latest filing status from the GST Common Portal and get unblocked. Still the system is not unblocking the GSTIN for e-way bill generation, then he can contact the Help Desk of the GST and raise the complaint to get his/her case resolved.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.