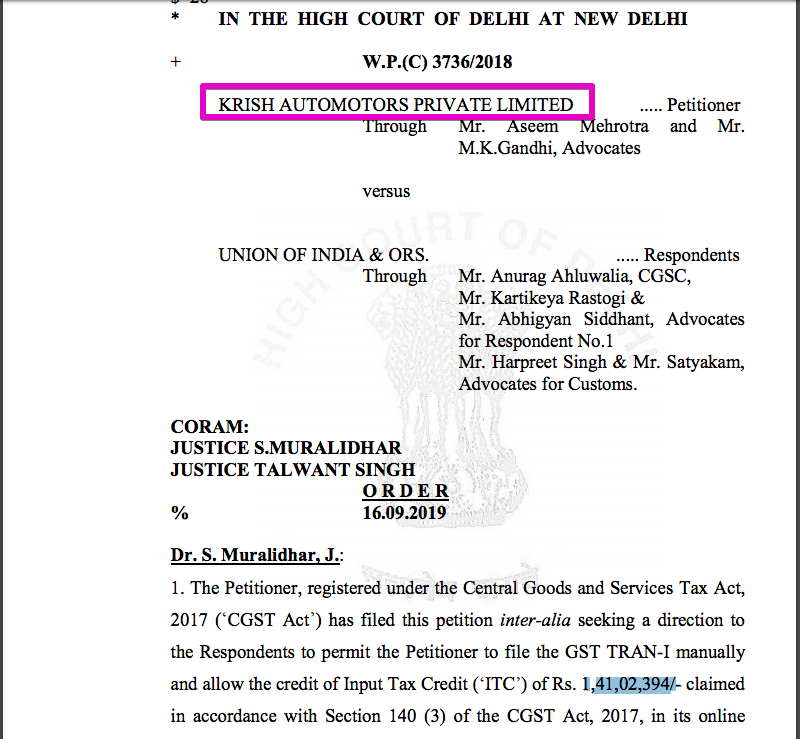

ITC of Rs. 1,41,02,394/- allowed by Delhi HC on manual filing of Tran 1

Manual filing of Tran 1 :

In case of KRISH AUTOMOTORS PRIVATE LIMITED Delhi HC allowed the filing of tran 1 manually. Delhi high court also allowed the applicant to take the ITC of Rs. 1,41,02,394/- Again manual filing of Tran 1 was allowed by the honourable high court.The Petitioner states that in view of the maze of compliance due dates, with the time extended time for filing the form GSTR-1 ending on 31st December, 2017, the accountant of the Petitioner is said to have missed noticing that the time for filing GST TRAN-1 was extended only till 27th December, 2017.

The Petitioner was accordingly not able to file the GST TRAN-1 declaration online within time and claim the ITC of the eligible amounts. Thereafter, in order to be permitted to manually file the GST TRAN-1, the Petitioner made two representations dated 8th March and 19th March, 2018 to the jurisdictional GST Authorities, as well as representations dated 20th March, 2018 and 21st March, 2018 to the Ministry of Finance, Union of India and the GST Council respectively. With no response having been received from any of the aforesaid authorities, the Petitioner filed the present petition claiming the above relief.

The recent case of Gujrat high court M/s. Siddharth Enterprises v. The Nodal Officer was also considered. In that case, it was observed that ITC is a vested right. The taxpayer is eligible for it, even if they fail to file Tran 1. A procedural provision cant snatches a right given by substantive law.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.