Write up on SVLDRS by Alwar CGST commissionerate

Write up on SVLDRS

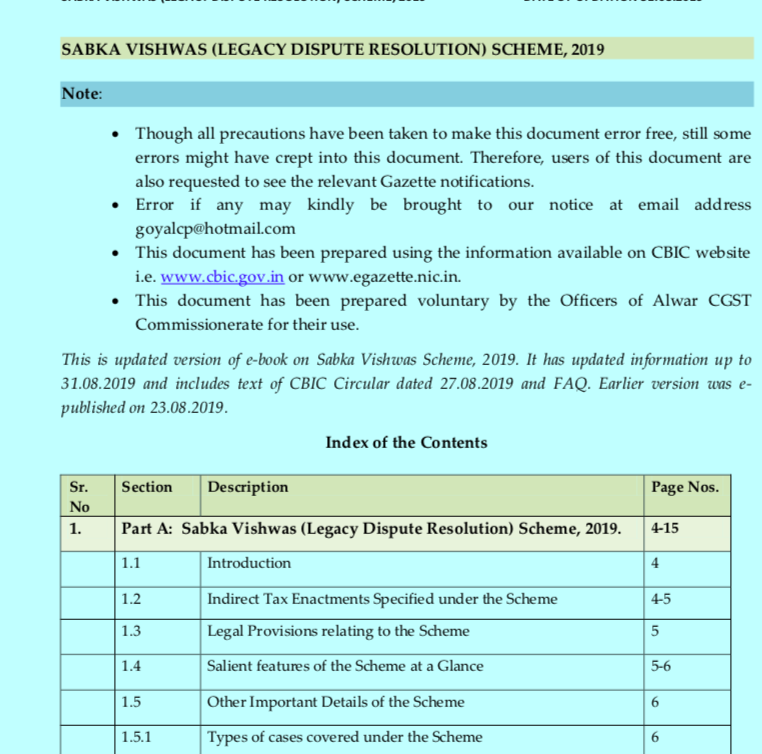

Note:

-

Though all precautions have been taken to make this document error free, still some errors might have crept into this document. Therefore, users of this document are also requested to see the relevant Gazette notifications.

-

Error if any may kindly be brought to our notice at email address goyalcp@hotmail.com

-

This document has been prepared using the information available on CBIC website i.e. www.cbic.gov.in or www.egazette.nic.in.

-

This document has been prepared voluntary by the Officers of Alwar CGST Commissionerate for their use.

This is updated version of e-book on Sabka Vishwas Scheme, 2019. It has updated information up to 31.08.2019 and includes text of CBIC Circular dated 27.08.2019 and FAQ. Earlier version was e- published on 23.08.2019.

|

Sr. No |

Section |

Description |

Page Nos. |

||||||||

|

1. |

Part A: Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019. |

4-15 |

|||||||||

|

1.1 |

Introduction |

4 |

|||||||||

|

1.2 |

Indirect Tax Enactments Specified under the Scheme |

4-5 |

|||||||||

|

1.3 |

Legal Provisions relating to the Scheme |

5 |

|||||||||

|

1.4 |

Salient features of the Scheme at a Glance |

5-6 |

|||||||||

|

1.5 |

Other Important Details of the Scheme |

6 |

|||||||||

|

1.5.1 |

Types of cases covered under the Scheme |

6 |

|||||||||

|

1.5.2. |

Persons /Cases Not Eligible to File Declaration under the Scheme |

7 |

|||||||||

|

1.5.3. |

Definition of Term “Person” |

8 |

|||||||||

|

1.5.4. |

Meaning of term “Tax Dues” |

8-9 |

|||||||||

|

1.5.5. |

Tax Relief Available under the Scheme (under various categories of Declarant) |

9-10 |

|||||||||

|

1.5.6 |

Timelines Prescribed for Resolution of Dispute under the Scheme |

10-12 |

|||||||||

|

1.5.7 |

Forms and Formats Prescribed under the Scheme |

12 |

|||||||||

|

Rule 4 |

Auto acknowledgement |

28 |

|||||||

|

Rule 5 |

Constitution of designated committee |

28-29 |

|||||||

|

Rule 6 |

Verification by designated committee and issue of estimates, etc. |

29-30 |

|||||||

|

Rule 7 |

Form and manner of making the payment |

30 |

|||||||

|

Rule 8 |

Proof of withdrawal of appeal from High Court or Supreme Court. |

30 |

|||||||

|

Rule 9 |

Issue of discharge certificate |

30 |

|||||||

|

2.4 |

CBIC Circular No. 1071/4/2019-CX.8 [on Sabka Vishwas scheme, 2019] |

31-37 |

|||||||

|

2.5 |

Frequently Asked Questions [ Issued by CBIC] |

37-43 |

|||||||

|

3. |

Part C: Forms and Formats Prescribed under the Scheme |

44-56 |

|||||||

|

Form SVLDRS-1 |

Declaration under Section 125 of the Finance Act (No. 2), 2019 |

44-49 |

|||||||

|

Form SVLDRS-2 |

Estimate under Section 127 of the Finance Act (No. 2), 2019. |

50-51 |

|||||||

|

Form SVLDRS-2A |

Written submissions, waiver of personal hearing and adjournment under Section 127 of the Finance Act (No. 2), 2019. |

52 |

|||||||

|

Form SVLDRS-2B |

Intimation of Personal Hearing under Section 127 of the Finance Act (No. 2), 2019. |

53 |

|||||||

|

Form SVLDRS-3 |

Statement under Section 127 of the Finance Act (No. 2), 2019 to be issued by the Designated Committee. |

54 |

|||||||

|

Form SVLDRS-4 |

Discharge Certificate for full and final settlement of Tax Dues under Section 127 of the Finance Act (No. 2), 2019. |

55-56 |

|||||||

|

4 |

Part D: Reference Material and Relevant Websites |

57 |

|||||||

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.